Tesla's Decline in California Might Indicate a Larger EV Crisis | Carscoops

While the electric vehicle market in California increased by over 7 percent in Q1 2025, Tesla experienced a more than 15 percent decline in its sales during the same timeframe.

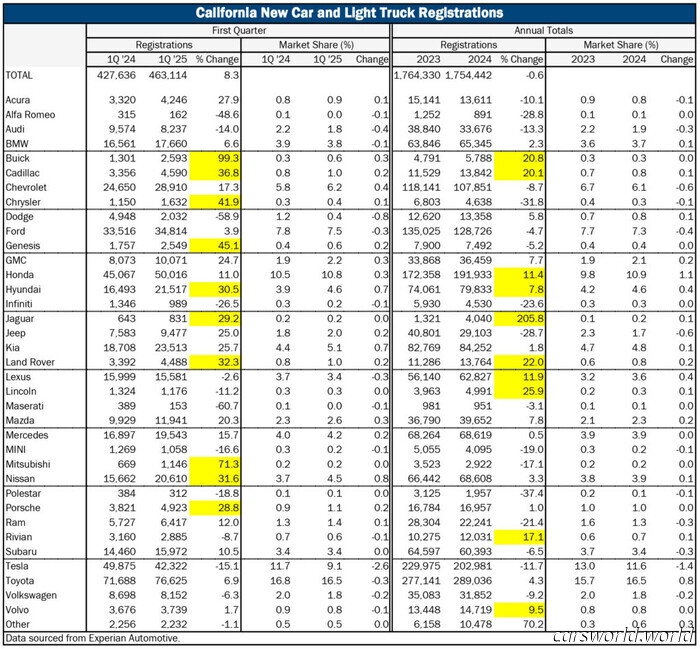

Tesla's share of the EV market in California decreased to 43% in Q1 2025. Overall, electric vehicle sales in the state rose by 7.3%, while Tesla's sales fell 15.1%. Major growth in EV sales was noted among GMC, Jaguar, Porsche, and Subaru, all of which saw triple-digit increases.

Despite being a pioneer in electric vehicles, Tesla is losing its grip on California's market, as evidenced by the Q1 2025 figures.

The California New Car Dealers Association (CNCDA) revealed that Tesla's sales fell sharply by 15.1% in Q1, from 49,875 units last year to 42,322 this year. The company’s market share in the EV segment dropped from 55.5% in Q1 2024 to below 50%, now at 43%.

In contrast, total EV sales in California increased by 7.3% over the same period, rising from 89,821 units last year to 96,146 in Q1 2025.

Several automakers made notable gains: GMC saw a 318% increase to 1,041 units, while Jaguar nearly doubled its sales from 485 to 861 units. Porsche experienced a 139% rise from 572 to 1,367 units, and Subaru had a remarkable 177.8% increase from 333 to 925 units. On the downside, Audi's EV sales decreased by 20%, and Lexus suffered a more significant drop of 43.7%, falling to just 485 units, down from 861.

Tesla maintained its position with the top two best-selling EVs in California: the Model Y at 23,314 units and the Model 3 at 13,992 units. The Honda Prologue followed with 4,493 units, and Hyundai's Ioniq 5 achieved 3,762 units. However, Tesla's declining performance negatively impacted the overall zero-emission vehicle (ZEV) market, leading to a second consecutive quarterly decline in ZEV sales and a market share decrease to 20.8%, down from 22% in Q1 2024.

Achieving the California Air Resources Board's goal of 35% ZEV sales for 2026 model year vehicles will necessitate a 14.2 percentage point increase from current levels, which is a significant challenge, especially since some 2026 models, like the Tesla Model Y, are already available for sale.

Robb Hernandez, CNCDA Chairman and President of Camino Real Chevrolet, commented, “Dealers sell what customers want to buy. No mandate can force consumers to choose otherwise.” He noted that although manufacturers are increasing EV sales in California, Tesla’s substantial sales decline means overall EV market penetration remains flat, falling short of this year's sales mandates.

In terms of the overall vehicle market in California, sales grew by 8.3% in Q1, totaling 463,114 units. Hybrids had a particularly strong performance, now representing 17.9% of the market, nearing EV sales levels. However, the CNCDA warned that this momentum might slow due to potential trade policy changes and tariffs that could raise prices and dampen demand. They observed that a surge in buying in March and April, likely in anticipation of tariffs, may be short-lived if vehicle prices increase.

Toyota led the sales in California with 76,625 registrations, securing 16.5% of the market. Honda ranked second with 10.8%, while Tesla fell to third place with 9.1%, down from 11.7% the previous year. Toyota also dominated the light truck segment, followed by Ford and Honda in the top three spots.

Other brands that recorded strong growth of 30% or more in year-to-date Q1 registrations include Buick, Mitsubishi, Genesis, Chrysler, Cadillac, Land Rover, Nissan, and Hyundai. Meanwhile, Tesla was not the only brand facing difficulties; Maserati's sales plummeted by 60% to just 153 units, Alfa Romeo fell by 48.6%, Audi experienced a 14% drop, and Dodge saw a nearly 59% decline.

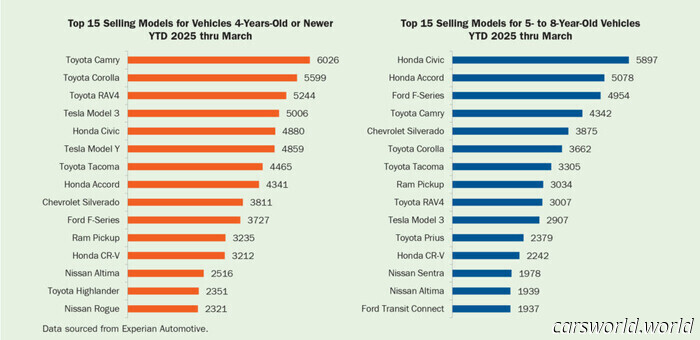

The Tesla Model Y remained the best-selling vehicle overall in California with 23,314 units, followed by the Toyota RAV4 with 16,719, the Tesla Model 3 with 13,992, and the Toyota Camry with 13,792. In the used car market, the Camry led among vehicles four years old or newer with 6,026 units sold, while the Honda Civic topped the list for cars aged five to eight years with 5,897 units.

Other articles

For Sale: Tesla Cybertruck Featuring a Unique One-of-One Color Design | Carscoops

This damaged Tesla endured fire, paint, violence, and additional acts of vandalism.

For Sale: Tesla Cybertruck Featuring a Unique One-of-One Color Design | Carscoops

This damaged Tesla endured fire, paint, violence, and additional acts of vandalism.

VW Tiguan SEL R-Line Turbo Seems Just One Plaid Seat Short of a GTI | Carscoops

From everything we're hearing, this could have been named the Tiguan GTI; it simply didn't come with plaid seats.

VW Tiguan SEL R-Line Turbo Seems Just One Plaid Seat Short of a GTI | Carscoops

From everything we're hearing, this could have been named the Tiguan GTI; it simply didn't come with plaid seats.

Genesis GMR-001 Hypercar Engulfed in Le Mans Magma Excitement | Carscoops

The hybrid powertrain of the racing beast incorporates a Frankenstein twin-turbo V8 constructed from two WRC engines.

Genesis GMR-001 Hypercar Engulfed in Le Mans Magma Excitement | Carscoops

The hybrid powertrain of the racing beast incorporates a Frankenstein twin-turbo V8 constructed from two WRC engines.

Mazda Halts CX-50 Exports to Canada Amid Increasing Tariff Conflict | Carscoops

Mazda manufactures all North American CX-50 models at its Alabama plant, which is operated in conjunction with Toyota.

Mazda Halts CX-50 Exports to Canada Amid Increasing Tariff Conflict | Carscoops

Mazda manufactures all North American CX-50 models at its Alabama plant, which is operated in conjunction with Toyota.

Kia's Nightfall EV9: A Unique Special Edition That Truly Increases Speed | Carscoops

The electric SUV receives black styling accents and unique interior finishes, along with an increase of 73 lb-ft in torque thanks to its dual-motor system.

Kia's Nightfall EV9: A Unique Special Edition That Truly Increases Speed | Carscoops

The electric SUV receives black styling accents and unique interior finishes, along with an increase of 73 lb-ft in torque thanks to its dual-motor system.

The New Subaru Outback Finally Launches as an SUV | Carscoops

Beneath a completely redesigned exterior, much of the 2026 Outback's drivetrain remains unchanged from its predecessor.

The New Subaru Outback Finally Launches as an SUV | Carscoops

Beneath a completely redesigned exterior, much of the 2026 Outback's drivetrain remains unchanged from its predecessor.

Tesla's Decline in California Might Indicate a Larger EV Crisis | Carscoops

Although the electric vehicle market increased by more than 7 percent in the first quarter, Tesla experienced a sales decline of over 15 percent in that same timeframe within the state.