Consider Tesla's 43% decline to be severe? Just wait until you observe this Stellantis brand's sales in Europe. | Carscoops

Despite introducing its first all-new model in 13 years and venturing beyond Italy, Lancia is finding it challenging to attract customers.

Lancia experienced a 73% decline in European sales during January and February compared to 2024.

Similarly, Tesla, Smart, and Jaguar have all reported significant decreases in sales as 2025 begins.

Sales of gasoline and diesel vehicles continue to decline, while electric and hybrid vehicle sales are increasing.

Tesla has recently been in the spotlight, primarily due to its steep decline in sales across Europe and other global markets. However, it's not just Elon Musk's electric company facing issues; Lancia is also encountering difficulties, with European sales dropping an astonishing 73% thus far in 2025. This substantial decrease indicates that the anticipated revival of the Italian brand is far from smooth.

According to sales figures from the ACEA (European Automobile Manufacturers’ Association) for the EU, EFTA, and UK, Lancia managed to sell only 2,208 units in January and February 2025, a significant reduction from 8,098 units sold during the same timeframe last year. This drop is particularly notable given the introduction of a new generation of the Lancia Ypsilon supermini and the brand’s first expansion beyond Italy in many years.

To provide some context, the previous Lancia Ypsilon, which was discontinued after 13 years, sold nearly four times as many units in the initial two months of last year compared to the new model. Additionally, the older model was available only in Italy, while the new Ypsilon has already entered markets like France, Spain, Belgium, and the Netherlands. Such a drastic decline raises considerable questions.

Lancia’s Pricing Challenge

So, what has led to this sharp decline in sales? One significant factor is likely the increased pricing of the new Ypsilon’s mild-hybrid and electric versions compared to the non-hybrid predecessor, which mirrors trends observed with Stellantis brands in North America as well.

Given the brand's long absence from many European markets, it’s understandable that potential buyers might be hesitant to spend more on a vehicle that appears somewhat overlooked. Competing against established supermini brands doesn’t help Lancia's situation either.

The Lancia Ypsilon has achieved sales of over 3 million units since its original launch in 1985.

To reverse its fortunes, Lancia plans to open 70 new showrooms across Europe by the end of 2025. Whether this strategy will prove effective for the brand remains uncertain. The Ypsilon will eventually be complemented by the Gamma flagship crossover in 2026, followed by a new Delta hatchback in 2028.

Other Winners and Losers

Lancia is not alone in having a tough start to 2025. Along with Lancia’s 72.7% sales drop, Tesla is experiencing a significant decrease of 42.6% as well. Other brands facing notable declines include Smart (-55.4%), Jaguar (-53.4%), and Mitsubishi (-35.4%). Stellantis brands like DS (-30.3%), Opel/Vauxhall (-27.2%), and Fiat (-26.9%) are also struggling, while Porsche is down by 23.2% this year.

Conversely, some brands are thriving. For instance, Alpine has recorded a remarkable 137.8% increase in sales, largely due to the launch of the A290 GT hot hatch. Cupra is also enjoying a successful year, with a 42.3% increase, selling 40,869 units, just shy of Seat's 42,212 sales during the same period.

For Stellantis, Alfa Romeo stands out with a 29.6% increase in sales, primarily due to the Junior subcompact SUV, which contributed 9,788 sales in just two months. Other companies showing positive results include Lexus (+32.2%), SAIC (+21.2%), and Renault (+18.5%). Volkswagen also reported a healthy 12% sales increase, totaling 216,565 units, making it the only brand with a double-digit market share in the EU, EFTA, and UK regions, maintaining an 11.1% share.

Overall, the VW Group leads in Europe with 525,346 units sold, reflecting a 4.3% increase. Stellantis follows with 310,091 sales, reflecting a 16.1% decrease, while Renault Group (205,005 sales / +8.2%), Hyundai Group (156,526 sales / -5.5%), and Toyota Group (151,589 sales / -4.9%) complete the top five.

Europeans Are Embracing Hybrids and BEVs

On the powertrain side, there's a clear shift towards electrification among European consumers. In the first two months of 2025, hybrid vehicle sales increased significantly, with 687,709 units sold, marking a 17.6% rise

Other articles

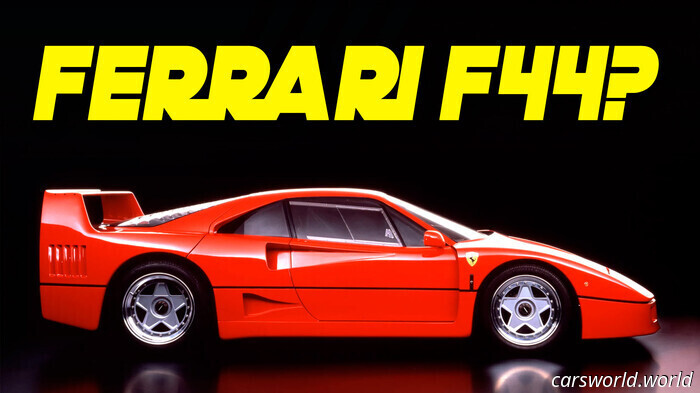

Lewis Hamilton Aims to Create a New Ferrari F40 Featuring a Manual Transmission | Carscoops

Restoring the F40 with a manual gearbox and Hamilton's autograph would result in the complete allocation being sold out in just seconds.

Lewis Hamilton Aims to Create a New Ferrari F40 Featuring a Manual Transmission | Carscoops

Restoring the F40 with a manual gearbox and Hamilton's autograph would result in the complete allocation being sold out in just seconds.

These Supermassive Car Hauler Semis Are Essential for China's Automotive Industry Operations

A quick calculation shows that this semi-truck is transporting roughly 120,000 pounds in cars, in addition to the large trailer, which features two rows of cars on its upper deck.

These Supermassive Car Hauler Semis Are Essential for China's Automotive Industry Operations

A quick calculation shows that this semi-truck is transporting roughly 120,000 pounds in cars, in addition to the large trailer, which features two rows of cars on its upper deck.

Purists May Disapprove of This Electric Porsche 911, But Its Speed Is Unmatched | Carscoops

The electric 964 from Everatti can accelerate to 60 mph in less than 4 seconds and is said to have a range of up to 200 miles on a full charge.

Purists May Disapprove of This Electric Porsche 911, But Its Speed Is Unmatched | Carscoops

The electric 964 from Everatti can accelerate to 60 mph in less than 4 seconds and is said to have a range of up to 200 miles on a full charge.

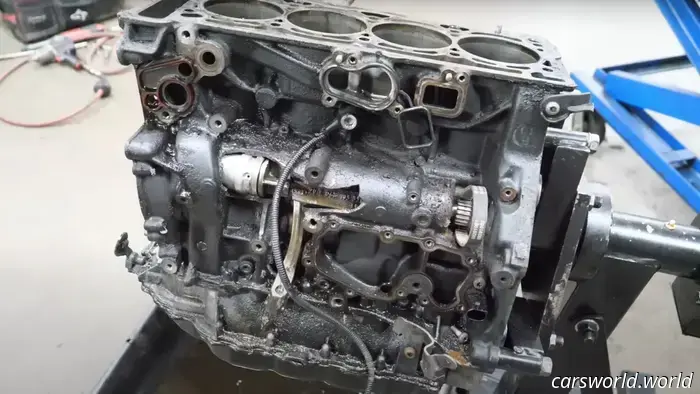

Whoever destroyed this VW GTI engine did a great job because it's completely ruined.

Neglect, careless repairs, and foolish errors all came together to send the connecting rods of this VW engine crashing through its block like the Kool-Aid Man.

Whoever destroyed this VW GTI engine did a great job because it's completely ruined.

Neglect, careless repairs, and foolish errors all came together to send the connecting rods of this VW engine crashing through its block like the Kool-Aid Man.

The new Audi A5 E-Hybrid PHEV surpasses the BMW 330e in electric range but falls short of the Mercedes C300e. | Carscoops

The 68-mile range of the plug-in compact sedan appears impressive until you begin to compare it with other PHEV alternatives.

The new Audi A5 E-Hybrid PHEV surpasses the BMW 330e in electric range but falls short of the Mercedes C300e. | Carscoops

The 68-mile range of the plug-in compact sedan appears impressive until you begin to compare it with other PHEV alternatives.

This is the fastest and most powerful front-engine convertible in the world | Carscoops

The Aston Martin Vanquish Volante, equipped with a V12 engine, directly competes with the Ferrari 12Cilindri Spider.

This is the fastest and most powerful front-engine convertible in the world | Carscoops

The Aston Martin Vanquish Volante, equipped with a V12 engine, directly competes with the Ferrari 12Cilindri Spider.

Consider Tesla's 43% decline to be severe? Just wait until you observe this Stellantis brand's sales in Europe. | Carscoops

Even with the release of its first completely new model in 13 years and efforts to grow beyond Italy, Lancia is having difficulty attracting customers.