Ford and GM Will Bear the Impact of Trump's China Tariffs, but They Aren't the Only Ones | Carscoops

The President has not mentioned that the tariffs imposed on China could be suspended, unlike those against Canada and Mexico.

Both the Lincoln Nautilus and Buick Envision are manufactured in China and exported to the United States.

Around $15-20 billion worth of car parts made in China are sent to America.

China holds a significant position in the electric vehicle battery market.

Tariffs have recently been in the news, with President Donald Trump initially implementing, then putting on hold, duties on imports from Mexico and Canada. However, the newly introduced 10% tariff on Chinese imports is also set to disrupt the U.S. auto industry.

While there are relatively few new vehicles shipped directly from China to American dealerships, the primary concern lies in the influx of Chinese-made auto parts essential for the industry's operation.

The two automakers that will face immediate negative consequences from these 10% tariffs are General Motors and Ford, two of the most vital companies in America. Lincoln manufactures the Nautilus in China, and GM produces the Buick Envision there as well. Last year, 83,884 Nautilus and Envision models were sold in the U.S., accounting for 95% of all Chinese-built cars sold in the country.

Volvo and Polestar are also affected.

Both Volvo and Polestar, owned by China’s Geely, produce vehicles in China for the U.S. market. As of now, none of these brands have confirmed whether the new tariffs will force them to change prices or alter production, but it is likely they won't absorb the costs entirely without passing some onto consumers.

“It’s primarily GM and Ford that are significantly impacted in terms of volume,” said Jeff Schuster, GlobalData's vice president of automotive research, to CNBC. “Our domestic manufacturers are bearing the brunt, at least for complete vehicles… but the effects could be somewhat mitigated.”

America Relies on Chinese Auto Parts

Beyond whole vehicles, the real economic impact arises from tariffs on Chinese-made auto parts. According to CNBC, Goldman Sachs analyst Mark Delaney cautions that these tariffs could have much wider repercussions.

“Although vehicle imports from China are minimal, auto parts imports amount to approximately $15-20 billion annually, according to the U.S. International Trade Commission, and China plays a crucial role in the battery/storage supply chain, particularly for LFP batteries used in large-scale energy storage,” he stated.

A considerable number of electrified vehicles sold in the U.S. depend heavily on components sourced from China. Data from the National Highway Traffic Safety Administration underscore the extent to which certain models rely on Chinese-made parts.

The Hyundai Kona EV tops the list, with 50% of its components coming from China, followed by the Nissan Ariya at 40%, Hyundai Ioniq 5 N at 30%, Kia EV9 at 35%, and Kia Niro Electric at 25%. Other models significantly reliant on Chinese parts include the Genesis G80 EV (25%), Volkswagen ID Buzz EV (25%), and both the Toyota bZ4X EV and RAV4 PHEV, each at 20%.

With so many critical components linked to Chinese supply chains, these tariffs could trigger ripple effects throughout the auto industry, impacting prices, production, and supply chains in ways that will be noticeable to both consumers and automakers.

Other articles

Frustrated Man Who Rammed His Newly Purchased Subaru Into Dealer Showroom Faces Felony Charges

The long arm of the law is closing in on the suddenly-famous driver who furiously brought back his used Subaru Outback through the dealer's front entrance.

Frustrated Man Who Rammed His Newly Purchased Subaru Into Dealer Showroom Faces Felony Charges

The long arm of the law is closing in on the suddenly-famous driver who furiously brought back his used Subaru Outback through the dealer's front entrance.

5 Minutes After Taking Ownership, This C6 Corvette’s Initial Drive Concludes in Calamity | Carscoops

The seller and buyer were said to be going to a nearby bank to cash the check from the sale.

5 Minutes After Taking Ownership, This C6 Corvette’s Initial Drive Concludes in Calamity | Carscoops

The seller and buyer were said to be going to a nearby bank to cash the check from the sale.

Chevy Blazer to Become Electric-Only as GM Phases Out Gasoline Version: Report

The end of production for the gas-powered Chevy Blazer is also expected to impact its Cadillac counterparts, the XT5 and XT6.

Chevy Blazer to Become Electric-Only as GM Phases Out Gasoline Version: Report

The end of production for the gas-powered Chevy Blazer is also expected to impact its Cadillac counterparts, the XT5 and XT6.

Police Break Up Ford Super Duty Taillight Theft Operation Linked to $92,000 in Damages.

Premium trucks frequently feature LED lights equipped with built-in sensors that can be very costly to replace, and criminals have taken notice.

Police Break Up Ford Super Duty Taillight Theft Operation Linked to $92,000 in Damages.

Premium trucks frequently feature LED lights equipped with built-in sensors that can be very costly to replace, and criminals have taken notice.

Ford Must Address Display Problems in Over 72,000 Vehicles | Carscoops

Affected owners of certain Ford and Lincoln vehicles will be notified by mail this month.

Ford Must Address Display Problems in Over 72,000 Vehicles | Carscoops

Affected owners of certain Ford and Lincoln vehicles will be notified by mail this month.

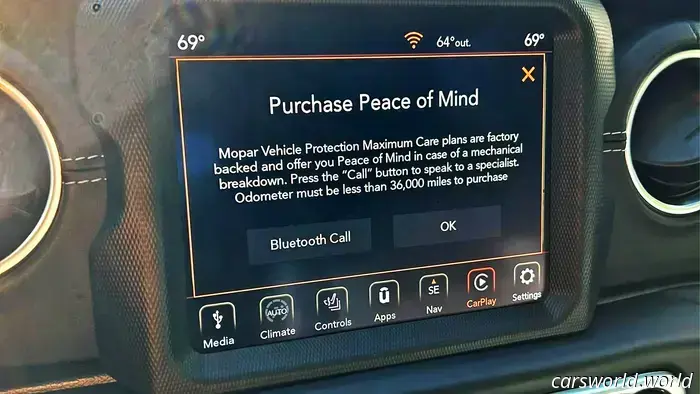

Les propriétaires de Jeep affirment que les publicités contextuelles pour des garanties prolongées bloquent constamment leurs écrans tactiles.

To make matters worse, one owner mentions that their vehicle surpasses the mileage limit, meaning they are not eligible for the advertised coverage.

Les propriétaires de Jeep affirment que les publicités contextuelles pour des garanties prolongées bloquent constamment leurs écrans tactiles.

To make matters worse, one owner mentions that their vehicle surpasses the mileage limit, meaning they are not eligible for the advertised coverage.

Ford and GM Will Bear the Impact of Trump's China Tariffs, but They Aren't the Only Ones | Carscoops

The President has not suggested that the tariffs imposed on China could be suspended in the same way as those applied to Canada and Mexico.