Europe Attempted to Restrict Chinese Cars but Ultimately Supported Them Instead | Carscoops

Chinese car manufacturers are taking advantage of a loophole in the EU regulations, shifting their focus to hybrid and internal combustion engine (ICE) vehicles while postponing the establishment of factories in Europe.

This year, sales of Chinese vehicles in Europe are projected to surpass 700,000, up notably from the 408,000 sold in 2024. This increase comes despite the introduction of additional tariffs of up to 35 percent on electric vehicles (EVs) last November, which were intended to protect local manufacturers and encourage Chinese brands to set up production in Europe. Instead, the expected shift in manufacturing has not occurred on a large scale, and sales of Chinese cars are actually on the rise.

The tariffs, designed to dissuade EV demand, have redirected it instead. While the new tariffs specifically target EVs and extended-range electric vehicles, hybrid and ICE models still only incur the original 10 percent tariff. As a result, Chinese brands are focusing on this category to avoid higher costs.

Due to much lower production costs—up to 30 percent cheaper than in Europe—it’s not financially advantageous for these brands to move production to cater to a tariff-protected market, so they are taking advantage of this loophole.

Philippe Houchois, managing director at Jeffries, noted that the EU decision created a significant opening for full hybrids and hybrids from China. This year, around two-thirds of the Chinese vehicles imported into Europe have only been subjected to the standard 10 percent duty. In early 2024, EVs represented 44 percent of Chinese car sales in Europe, but this figure has declined to 34 percent in 2025. Houchois criticized the EU's targeted approach in imposing extra tariffs on specific technologies as misguided.

Currently, local manufacturing by Chinese brands remains minimal, with fewer than 20,000 vehicles expected to be assembled in Europe this year. BYD aims to change this by establishing a plant in Hungary that could produce 150,000 units annually, although this is more of an exception than a trend.

At present, there seems to be little enthusiasm among most Chinese automakers to establish European production facilities, despite some theoretical plans. However, several companies have indicated intentions to start manufacturing in Europe, such as Leapmotor, which plans to build the B10 in Spain, and GWM, which aims to produce up to 300,000 vehicles in the region by 2029. Dongfeng and Hongqi are also exploring potential European sites, while Chery, Xpeng, and GAC have already begun assembling a limited number of vehicles locally.

Other articles

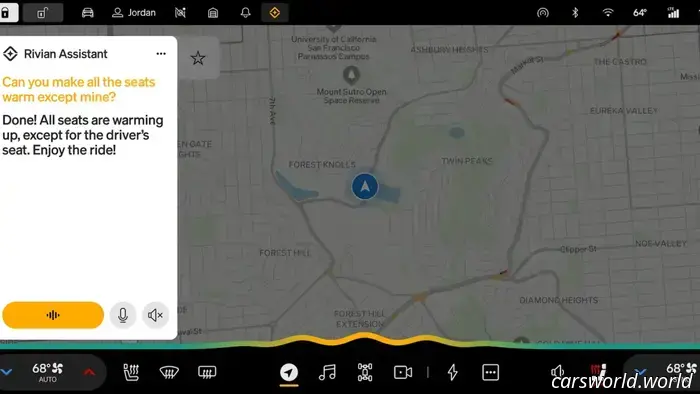

Rivian Avoids Apple CarPlay by Offering Integrated Texting Features

Rivian believes that the future will be controlled by voice.

Rivian Avoids Apple CarPlay by Offering Integrated Texting Features

Rivian believes that the future will be controlled by voice.

Rivian Plans to Introduce Lidar in 2026, Claims Tesla's Camera System Is Insufficient

"A Rivian spokesperson stated to The Drive, 'Cameras are excellent at observing the world until they're unable to do so.'"

Rivian Plans to Introduce Lidar in 2026, Claims Tesla's Camera System Is Insufficient

"A Rivian spokesperson stated to The Drive, 'Cameras are excellent at observing the world until they're unable to do so.'"

This Ultimate Track-Day Tool Kit is a collaboration between BMW Tuner Shop and Sonic Tools.

This comprehensive euro car track-day toolkit is a collaboration between Sonic Tools and the BMW shop Kies Motorsports.

This Ultimate Track-Day Tool Kit is a collaboration between BMW Tuner Shop and Sonic Tools.

This comprehensive euro car track-day toolkit is a collaboration between Sonic Tools and the BMW shop Kies Motorsports.

Brabus Didn't Simply Tune This Vehicle, They Erased Its History | Carscoops

The tuning company removed the Bentley name from the coupe, equipping it with 888 horsepower, carbon components, and a significantly higher price.

Brabus Didn't Simply Tune This Vehicle, They Erased Its History | Carscoops

The tuning company removed the Bentley name from the coupe, equipping it with 888 horsepower, carbon components, and a significantly higher price.

Caterham Refuses to Relinquish Its Electric Vehicle Ambitions, Despite Global Trends | Carscoops

An updated prototype of the Project V electric coupe will be unveiled as development progresses with assistance from Yamaha, although a specific launch date has not yet been determined.

Caterham Refuses to Relinquish Its Electric Vehicle Ambitions, Despite Global Trends | Carscoops

An updated prototype of the Project V electric coupe will be unveiled as development progresses with assistance from Yamaha, although a specific launch date has not yet been determined.

You might think this budget Chinese superbike is Italian, and you wouldn't be completely mistaken. | Carscoops

QJMotor's newest bike, designed in Italy, is expected to be priced lower than its European competitors.

You might think this budget Chinese superbike is Italian, and you wouldn't be completely mistaken. | Carscoops

QJMotor's newest bike, designed in Italy, is expected to be priced lower than its European competitors.

Europe Attempted to Restrict Chinese Cars but Ultimately Supported Them Instead | Carscoops

China's automotive manufacturers are taking advantage of a gap in EU regulations by transitioning to hybrid and internal combustion engine models while postponing their plans for factories in Europe.