Car repairs are soon going to become significantly more costly due to tariffs.

Joel Feder

The most significant news and reviews in the automotive world, no nonsense

Subscribe to our complimentary daily newsletter to receive the most important stories directly to your inbox every weekday.

The pricing challenges anticipated in the auto parts market are familiar to suppliers. Anan Bishara, founder and CEO of Premium Guard Inc. (PGI), recognized that maintaining production in China would not be viable during President Trump’s initial term. With Trump now back in office, car owners are soon to feel the repercussions.

Bishara informed The Drive that, up until now, consumers have not really experienced the effects of tariffs on automotive parts, but that is set to change just in time for the holiday season. According to him, catalytic converters that previously cost $1,200 or $1,500 will soon exceed $2,500 due to tariffs.

PGI is a major player in the North American auto parts market, holding over 30% market share in oil filters alone. These parts are distributed through various channels, including retailers, quick lube centers, and repair shops, with PGI involved in all segments from brick-and-mortar stores to e-commerce and service, although most products are sold under private labels.

Certain product categories, particularly catalytic converters that depend on rare-earth metals (92% of which are sourced from China), will face significant tariff increases. Bishara pointed out that items relying on Chinese materials might be subject to additional regulations. The overall uncertainty of the situation looms large, as Bishara constantly wonders, “What will tomorrow bring?”

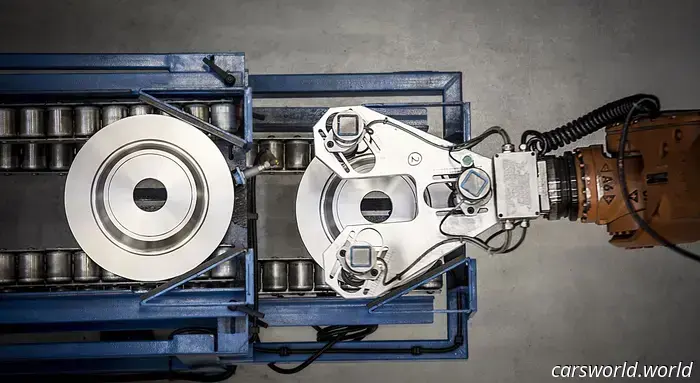

Everyday items like brake rotors, usually made from steel, are also expected to see notable price hikes due to President Trump’s tariffs, according to Bishara.

The situation is complicated. Factors such as the material type, origin, manufacturing location, and supply chain logistics all impact pricing.

Consumers haven’t yet felt the effects because altering prices isn’t as straightforward as simply flipping a switch, stated Bishara. Changing retail prices involves considerable behind-the-scenes work. So far, many resellers and certain suppliers have adopted a “wait and see” approach, particularly during the initial months of tariffs being imposed earlier this year in April and May.

When it became evident in May that tariffs were going to persist, suppliers began implementing minor price increases to establish a buffer. “For us, it was around 4-5% just to protect against significant losses,” said Bishara. Different companies took varying approaches, which depended on their respective products and supply chains.

Bishara highlighted that PGI has a diversified supply chain, operating 50 production lines in countries like Vietnam, Malaysia, Taiwan, and India, allowing it to move some production away from China more easily.

However, relocating production is far from a simple task. “For other products, it’s not as straightforward.” Factors including significant investments in robotics, safety standards, and the entire steel manufacturing ecosystem could result in costs exceeding $20-$30 million. “This is not something that can be shifted outside of China overnight.”

In PGI's case, Bishara successfully moved some production out of China and absorbed part of the initial tariff costs, though a slight price increase was enacted initially while the team awaited developments from April to August.

August 1 brought new announcements and policies. “India was a big surprise for us; we believed it had the necessary infrastructure and workforce to compete with China in terms of scale.” Discussing scale necessitates addressing the broader ecosystem, according to the executive. “Vietnam and other nations are promising, but none can match China’s scale.” India presented a viable alternative.

Bishara expressed his astonishment, along with others in the aftermarket industry, that India faced 50% tariffs. “While we understand the reasons," he emphasized that his focus remains on business.

This has led to a second wave of price increases that will be felt across the aftermarket during August and September. “I don’t believe those increases have impacted the market yet.”

Some categories will experience particularly severe effects. Bishara pointed out that hydraulic power steering pumps are declining as electric power steering systems gain popularity. “The capital investment required is substantial, so companies are hesitant to invest $30 million or $40 million in production outside of China,” he explained. In five years, he predicts this category could shrink by 30% to 40%, making it illogical to invest in relocating production. “However, there are approximately 180 million vehicles currently on the road needing those hydraulic parts,” he noted. Customers—including dealerships, aftermarket shops, and local retailers—will face skyrocketing costs for these parts.

The brake segment, in particular, is expected to “suffer significantly,” according to Bishara.

“If a vehicle requires an oil change, you might postpone it for a few weeks or even a month, but eventually, it has to be done. The same applies to brakes. If your brakes need replacing, there

Other articles

Porsche’s Most Powerful Sedan Believes It’s a GT3 RS | Carscoops

A prototype of the Panamera was captured on camera while undergoing tests at the Nurburgring, featuring saw-tooth fender vents and a stationary rear wing.

Porsche’s Most Powerful Sedan Believes It’s a GT3 RS | Carscoops

A prototype of the Panamera was captured on camera while undergoing tests at the Nurburgring, featuring saw-tooth fender vents and a stationary rear wing.

Toyota's new FJ is essentially a smaller version of the Land Cruiser.

It's not significantly larger than a UTV, but it's definitely much cooler.

Toyota's new FJ is essentially a smaller version of the Land Cruiser.

It's not significantly larger than a UTV, but it's definitely much cooler.

This individual is producing homemade 'gasoline' from recycled plastic and solar energy.

This seems like an incredibly risky method to cause harm to oneself.

This individual is producing homemade 'gasoline' from recycled plastic and solar energy.

This seems like an incredibly risky method to cause harm to oneself.

Slate Might Be On The Verge Of Pricing Itself Out Of The EV Market | Carscoops

It appears that the Slate Truck may struggle to compete against the Ford Maverick.

Slate Might Be On The Verge Of Pricing Itself Out Of The EV Market | Carscoops

It appears that the Slate Truck may struggle to compete against the Ford Maverick.

Mercedes Should Likely Proceed with the Production of This GLS | Carscoops

The upcoming GLS is still three to four years from its release, but if it resembles this, Mercedes could be onto a promising idea.

Mercedes Should Likely Proceed with the Production of This GLS | Carscoops

The upcoming GLS is still three to four years from its release, but if it resembles this, Mercedes could be onto a promising idea.

Fast and Furious Stunt Cars Head to Auction Appearing as If They've Endured a Battle | Carscoops

The trio is being sold as a single lot, which includes stunt modifications, replica weapons, and actual damage.

Fast and Furious Stunt Cars Head to Auction Appearing as If They've Endured a Battle | Carscoops

The trio is being sold as a single lot, which includes stunt modifications, replica weapons, and actual damage.

Car repairs are soon going to become significantly more costly due to tariffs.

"Stocking up wouldn't be a bad idea," said Anan Bishara, CEO of Premium Guard Inc., in an interview with The Drive.