Analysts Predict Cars Will Become Heavier Due to Increased Tariffs and Deregulation.

Cadilla

The latest car news and reviews, no nonsense

Subscribe to our free daily newsletter for the important stories delivered to you every weekday.

Electric vehicle incentives and emissions regulations might not be the sole automotive impacts of the current U.S. administration. With the reduction of EPA fines for emissions violations and the additional burden of tariffs, car manufacturers are under pressure to remove expensive lightweight materials from their vehicles to manage price increases. This means the curb weight of your next car may rise along with its starting price.

As reported by Automotive News, the Center for Automotive Research predicts that manufacturers will need to absorb an average of $4,600 in extra costs per vehicle by 2027. Facing criticism for post-COVID price hikes, automakers are searching for solutions to prevent sticker shock, likely resulting in the use of less expensive, heavier materials. This may lead to increased usage of budget steel and a decline in the use of aluminum alloys and advanced composites, especially for cars aimed primarily at the U.S. market.

While it would be nice to think that lightweight sports cars are leading automotive innovation, efficiency has been the main reason for the greater usage of high-tech materials. Both combustion engine and electric vehicles have significantly benefited from “lightweighting,” with electric vehicles promoting it to extend their range. Now that U.S.-bound vehicles are free from fines for fuel consumption and with government-backed EV tax incentives soon ending, the incentive to invest in lighter components has diminished.

So, what about that promised zero-feature, low-cost manual sports car with a V8 that was supposed to appear once government regulations were relaxed? Don’t expect to see it anytime soon. As demonstrated by Dodge and Ram, merely easing EPA restrictions is not sufficient, and the administration will need time to refocus on CARB and the 16 other states (along with D.C.) that adhere to its emissions guidelines.

Additionally, because automotive development cycles typically last three to five years, a governmental administration can change before a single model progresses from concept to production. The possibility of another significant political shift will restrict the already cautious industry from taking bold steps to cater to an audience that may constitute only 2% of car buyers. Even if an automaker had a design ready to launch, the risk of failure is a considerable concern.

Have a news tip? Reach out to us at [email protected].

Other articles

Florida Teen Discovers Consequences of Pointing a Laser at a Helicopter | Carscoops

Helicopter cameras directed ground units directly to suspects in Tampa and Bradenton, who are now facing felony charges.

Florida Teen Discovers Consequences of Pointing a Laser at a Helicopter | Carscoops

Helicopter cameras directed ground units directly to suspects in Tampa and Bradenton, who are now facing felony charges.

This Stellantis SUV Allows You to Brew Your Own Coffee On-Site | Carscoops

Opel's electric SUV sacrifices cargo capacity to include a complete coffee station, featuring grinders, machines, and a steamer integrated into the trunk.

This Stellantis SUV Allows You to Brew Your Own Coffee On-Site | Carscoops

Opel's electric SUV sacrifices cargo capacity to include a complete coffee station, featuring grinders, machines, and a steamer integrated into the trunk.

Europe Finally Receives the BMW Straight-Six Performance That Americans Already Experience | Carscoops

Various additional updates have been implemented throughout the BMW lineup in Europe, including the introduction of new headlights and taillights.

Europe Finally Receives the BMW Straight-Six Performance That Americans Already Experience | Carscoops

Various additional updates have been implemented throughout the BMW lineup in Europe, including the introduction of new headlights and taillights.

Wait a Moment, Ford Could Be Developing a Hybrid Pony Car | Carscoops

Speculation arises as Mustang Hybrid prototypes are said to be undergoing testing, sparking discussions about Ford's manufacturing intentions.

Wait a Moment, Ford Could Be Developing a Hybrid Pony Car | Carscoops

Speculation arises as Mustang Hybrid prototypes are said to be undergoing testing, sparking discussions about Ford's manufacturing intentions.

The Unique Diablo That Lamborghini Never Manufactured Is Now Available for Purchase | Carscoops

This 1993 Lamborghini Diablo Evolution GTR, modified in Switzerland, combines dealer style with an exhilarating 5.7L V12 engine.

The Unique Diablo That Lamborghini Never Manufactured Is Now Available for Purchase | Carscoops

This 1993 Lamborghini Diablo Evolution GTR, modified in Switzerland, combines dealer style with an exhilarating 5.7L V12 engine.

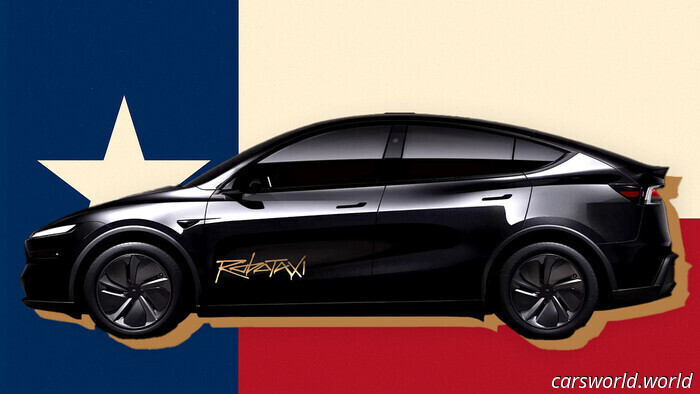

Tesla Robotaxis Have Already Been Involved in Crashes in Austin | Carscoops

By July, Tesla's robotaxis in Texas had accumulated about 7,000 miles during testing.

Tesla Robotaxis Have Already Been Involved in Crashes in Austin | Carscoops

By July, Tesla's robotaxis in Texas had accumulated about 7,000 miles during testing.

Analysts Predict Cars Will Become Heavier Due to Increased Tariffs and Deregulation.

Tariffs are compelling automakers to reduce expenses; the absence of efficiency penalties allows them to do so without restrictions.