Porsche Has Been Removed From Germany’s DAX Due to Tariffs and Strains with China | Carscoops

The automaker's shares have declined by over 33% in the last year due to the impact of tariffs.

Porsche has been taken out of Germany’s DAX and substituted by a real estate firm.

The company’s shares are transitioning to the less esteemed MDAX, where they will join Lufthansa.

The stock has dropped 24.08% this year, weighed down by tariffs and challenges related to China.

There is notable stock market activity in Europe as Porsche AG is being excised from the DAX, which includes 40 prominent German corporations. It is being replaced by Scout24 SE, the operator of ImmoScout24, the leading online platform for residential and commercial real estate in Germany.

This shift is indeed unexpected, as Porsche is a well-known brand worldwide, whereas Scout24 SE is not as familiar. Nevertheless, the organization responsible for the index indicated that the change followed a regular assessment conducted every three months. For reference, Porsche will move to the MDAX, taking over the position vacated by Scout24 SE.

Additionally, Porsche recently experienced a loss of $462 million, which could have repercussions for consumers.

Although STOXX did not clarify their reasoning, CNBC reported that Porsche's stock has significantly dropped over the last year amid various challenges. The shares closed at €44.35 ($51.67) today, marking a 33.57% decline compared to a year ago. Thus far in the year, the situation is slightly improved, but the stock remains nearly 25% lower.

This transition seems to be a setback for Porsche, with CEO Oliver Blume expressing to FAZ his desire to rejoin the DAX “as soon as possible.” Despite this, he remarked that the index will be losing out by being “one company poorer when it comes to one of Germany’s most valuable firms.”

While Porsche is maintaining a positive outlook, they have recently admitted that “macroeconomic and geopolitical challenges” have significantly impacted their first half results. Notably, the company faced around €1.1 ($1.3) billion in special charges linked to their strategic adjustments, battery initiatives, and U.S. tariffs.

Crucially, revenue decreased from €19.46 ($22.7) billion to €18.16 ($21.2) billion, and their operating profit fell from €3.06 ($3.6) billion to €1.01 ($1.2) billion. These are considerable drops, and Blume pointed to weak demand in China and U.S. tariffs as critical factors exerting “huge pressure on our business.” He also mentioned that the shift towards electric mobility is advancing more slowly than anticipated.

Other articles

Did Tesla Unveil a Concealed CyberSUV That Was Clearly Visible? | Carscoops

Fans have noticed a potential CyberSUV in a recent Tesla video, suggesting the possibility of a future full-size electric SUV.

Did Tesla Unveil a Concealed CyberSUV That Was Clearly Visible? | Carscoops

Fans have noticed a potential CyberSUV in a recent Tesla video, suggesting the possibility of a future full-size electric SUV.

BMW's Upcoming i3 Sedan Aims to Compete with Tesla | Carscoops

The initial Neue Klasse sedan has been hinted at with a resurrected nameplate, an elegant design, and an important position in the brand's electric future.

BMW's Upcoming i3 Sedan Aims to Compete with Tesla | Carscoops

The initial Neue Klasse sedan has been hinted at with a resurrected nameplate, an elegant design, and an important position in the brand's electric future.

Rivian Cuts Jobs as Trump's Policies Create a Gap in Its Revenue Strategies | Carscoops

Employees who were laid off may be re-hired and are encouraged to seek other job openings within the company.

Rivian Cuts Jobs as Trump's Policies Create a Gap in Its Revenue Strategies | Carscoops

Employees who were laid off may be re-hired and are encouraged to seek other job openings within the company.

Time Stopped For This 2005 NSX-T, And Now It’s Ready To Astonish On Bring A Trailer | Carscoops

You would be challenged to find a better 2005 NSX available for purchase in the US than this one.

Time Stopped For This 2005 NSX-T, And Now It’s Ready To Astonish On Bring A Trailer | Carscoops

You would be challenged to find a better 2005 NSX available for purchase in the US than this one.

US Government Seeks to Revise Regulations for Self-Driving Vehicles | Carscoops

The government aims to adjust four regulations to remove the necessity for human drivers and manual controls.

US Government Seeks to Revise Regulations for Self-Driving Vehicles | Carscoops

The government aims to adjust four regulations to remove the necessity for human drivers and manual controls.

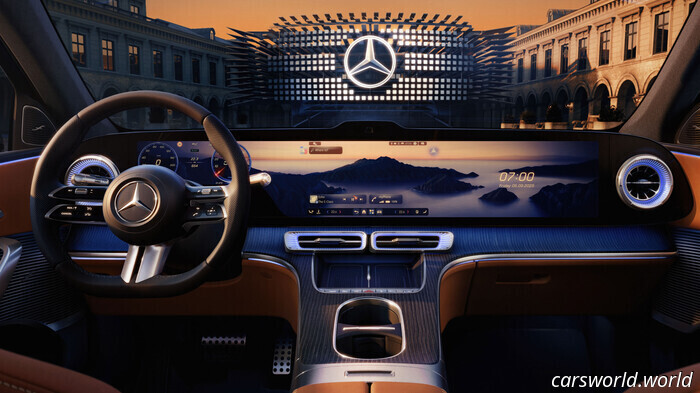

The new Mercedes GLC EV features a 39.1-inch Hyperscreen display, which resembles a stretched limousine version of an iPad | Carscoops.

The integrated digital gauge cluster and infotainment system includes a zone dimming function designed to minimize driver distraction.

The new Mercedes GLC EV features a 39.1-inch Hyperscreen display, which resembles a stretched limousine version of an iPad | Carscoops.

The integrated digital gauge cluster and infotainment system includes a zone dimming function designed to minimize driver distraction.

Porsche Has Been Removed From Germany’s DAX Due to Tariffs and Strains with China | Carscoops

The automaker's shares have fallen more than 33% in the last year due to the impact of tariffs.