Lucid Bills Customer $1,450 for Small Glass Chips on Lease—And That’s Only the Beginning

Lucid

Subscribe to Get The Drive’s daily newsletter

Stay updated on the latest car news, reviews, and features.

This year has not been particularly favorable for vehicle inspections, whether for rental returns or leases. A group of Lucid Air lessees on an owners forum claims that the EV startup has been imposing minor charges for insignificant dings and scratches that don’t even align with the manufacturer’s own criteria for excessive wear and tear. Some have faced steep charges as a result. While Lucid states it is addressing the situation, customer frustrations continue to rise.

In early June, one Air lessee initiated a thread on the Lucid Owners forum, detailing his experience of receiving a bill for $1,825 following a lease return citing alleged damage. Of that sum, $1,450 was attributed solely to the windshield, with AutoVIN, the automaker’s inspection partner, identifying three small chips—likely within the bounds of normal wear. The inspector also found an issue with one of the sun visors, but forum members could not determine what it was from the provided images. Reportedly, these marks were not disclosed to the customer when he returned the car, and although he had comprehensive glass coverage through his insurance, he was not given the opportunity to utilize it.

This lessee also received the invoice multiple times through the mail, along with prompts to pay online or by phone. He mentioned that the online payment option did not work as his account was closed after returning the vehicle, and that the phone number listed directed him to a collections agency. Nearly two months later, he stated he still had not received the promised callback from Lucid Financial Services.

Other cases followed a similar narrative. One particularly notable instance involved charges totaling $5,800 issued long after the car was returned. This customer was not given an initial explanation for the charges, which only added to his frustration, especially since he noted that the Lucid employee who accepted his Air described it as “one of the cleanest lease returns she’d seen.” The customer had opted not to request a pre-return inspection, believing that, based on Lucid’s public guidelines, his sedan's condition did not warrant any billable damage. (Even if it did, Lucid covers itself by stating that AutoVIN’s pre-inspections are merely “a helpful tool” with no impact on the conclusions drawn during the final inspection.)

Weeks later, after finally being informed about the charges, this customer shared photos on the forum. One image showed a mark on the driver’s side passenger door, described as “dirt in paint,” roughly the size of a ballpoint pen tip, which resulted in a $585 charge. Other charges included $1,200 for missing plastic on the front fender’s inner liner and $200 for worn rubber on the smartphone holder in the center console, among others.

However, when examining Lucid’s criteria for these issues, it becomes clear that they are either exceedingly vague or overly specific, yet the alleged damage doesn’t align with the guidelines. For instance, regarding the “dirt in paint” charge, Lucid states that “debris or defects of any type” on the body are chargeable only for “repainted areas.” Moreover, the body must display at least 11 chips before a charge is applicable, and any scuff must exceed “the size of a credit card.”

Concerning the interior, Lucid claims it can charge for “any tears, cuts, holes, or burns to the interior, regardless of size,” which gives inspectors broad discretion. It’s nearly impossible for anyone to interact physically with the vehicle without leaving some sort of microabrasion that another person could point out with a magnifying glass if they were intent on doing so. All the piano black trim in my vehicle would attest to this.

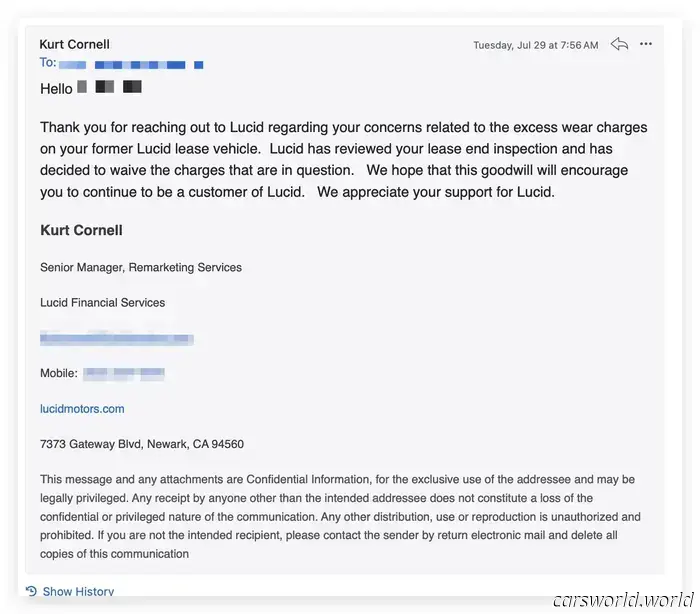

The Drive contacted Lucid regarding these reports after a lease customer and forum member informed us about the trend. Lucid replied with a statement: “We are aware of some instances where our lease turn-in standards have not been interpreted consistently. We are collaborating with our banking partner to resolve disputes and sincerely apologize to those who have been inconvenienced.”

We inquired about the actions Lucid is taking to address these systemic issues or to align the criteria it enforces with its published guidelines, but the company declined to provide further information. Nonetheless, the reference to the automaker’s “banking partner” is significant, as leases are managed by a department known as Lucid Financial Services, which essentially operates as a trade name for Bank of America. Lucid licenses its brand to Bank of America, which takes care of all servicing.

Considering that BoA is a large organization with numerous departments of its own, and that Lucid is also collaborating with an external partner for inspections, it becomes apparent how easily this can create confusion when problems arise. One customer mentioned that they “know people have been passed around between Lucid, LFS (owned by BoA),

Other articles

Heavy-duty pickups were previously utilized to tow 14,000 pounds. What has led to the need for them to now tow 35,000 pounds?

Modern dually pickups have advanced tremendously compared to their predecessors. However, what has evolved more: the technology or the demographics of the buyers?

Heavy-duty pickups were previously utilized to tow 14,000 pounds. What has led to the need for them to now tow 35,000 pounds?

Modern dually pickups have advanced tremendously compared to their predecessors. However, what has evolved more: the technology or the demographics of the buyers?

Both the Chevy Corvette ZR1X and ZR1 have outperformed the Mustang GTD's Nurburgring record.

Chevy took it to heart when the Mustang GTD became the first American vehicle to surpass the 7-minute mark at the Nurburgring.

Both the Chevy Corvette ZR1X and ZR1 have outperformed the Mustang GTD's Nurburgring record.

Chevy took it to heart when the Mustang GTD became the first American vehicle to surpass the 7-minute mark at the Nurburgring.

Harley's $6K Motorcycle Might Be The Most Affordable Entry Into The Club | Carscoops

Sales have decreased by 18 percent in 2025, but the brand is optimistic that this autumn's affordable Sprint bike will appeal to younger consumers.

Harley's $6K Motorcycle Might Be The Most Affordable Entry Into The Club | Carscoops

Sales have decreased by 18 percent in 2025, but the brand is optimistic that this autumn's affordable Sprint bike will appeal to younger consumers.

Millionaire's Unicorn Reemerges in the Spotlight Following Impressive Makeover | Carscoops

Although the powertrain of the DLS is remarkable, it is likely the cabin that stands out the most in this specific example.

Millionaire's Unicorn Reemerges in the Spotlight Following Impressive Makeover | Carscoops

Although the powertrain of the DLS is remarkable, it is likely the cabin that stands out the most in this specific example.

The Honda Prelude features a hidden design feature that simplifies parking.

The most effective solution to a problem is one that avoids screens and sensors, and Honda has embraced this philosophy with the new Prelude.

The Honda Prelude features a hidden design feature that simplifies parking.

The most effective solution to a problem is one that avoids screens and sensors, and Honda has embraced this philosophy with the new Prelude.

The Thoughtful Family Man's Golf Is Transitioning to Electric | Carscoops

Skoda is teasing the Vision O concept, which serves as a preview for the next-generation all-electric Octavia wagon.

The Thoughtful Family Man's Golf Is Transitioning to Electric | Carscoops

Skoda is teasing the Vision O concept, which serves as a preview for the next-generation all-electric Octavia wagon.

Lucid Bills Customer $1,450 for Small Glass Chips on Lease—And That’s Only the Beginning

Lucid acknowledges that it has "not been consistent" in its approach to charging for wear and tear on lease returns, resulting in unexpectedly large bills. Customers are fed up.