Federal EV Tax Credits Might Conclude Earlier Than Anticipated | Carscoops

The proposal aims to eliminate the credit for leased electric vehicles (EVs) not manufactured in the United States.

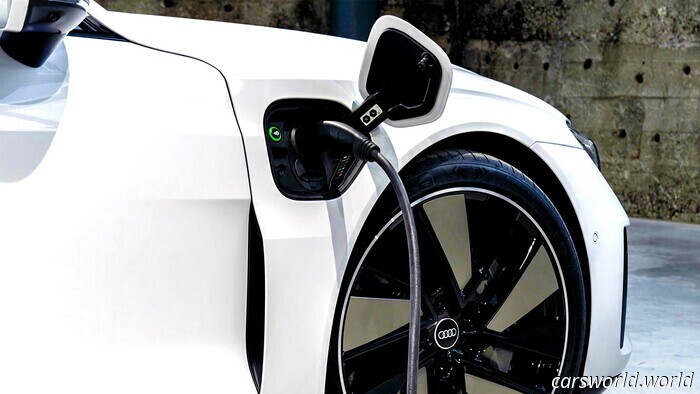

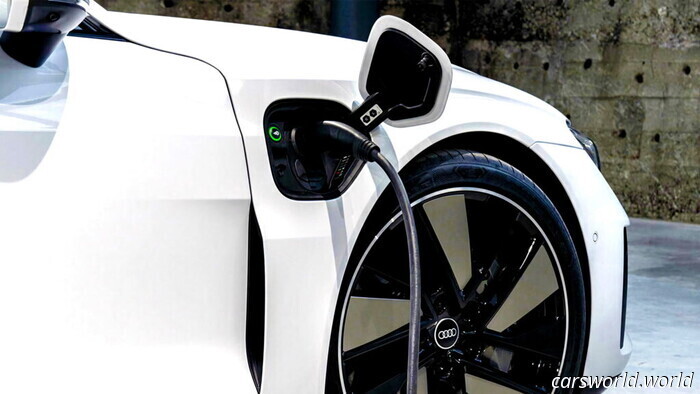

Buying a new or used EV could become significantly more costly in just a few months.

The National Automobile Dealers Association is seeking advance notice regarding cuts to tax credits.

President Donald Trump’s "One Big Beautiful Bill Act" suggested removing the credit by 2026.

The time for substantial federal tax credits for electric vehicles may be running out, and the timeline is accelerating quicker than anticipated. Senate lawmakers are now advocating for the termination of the $7,500 tax credit for new EV purchases even sooner than previously anticipated, potentially discontinuing it by September 30, 2025.

If this bill is approved, the expense of purchasing a new EV could rise markedly once the credit is removed. Moreover, changes are also on the horizon for used vehicles; the same Senate budget proposal seeks to eliminate the $4,000 tax credit for used EVs as part of this legislation.

An Expedited Timeline

As covered in mid-June, President Trump's “One Big Beautiful Bill Act” initially proposed the reduction of the EV tax credit. More recently, Republican Senators have aimed to eliminate the EV credit within 180 days of the legislation being enacted. They also suggested that the used EV credit could be removed within 90 days and called for an immediate cancellation of the credit for leased vehicles not made in the U.S. This timeline appears subject to acceleration.

Currently, with the latest updates, both credits could potentially disappear as soon as late September, which is less than three months away. Lawmakers aim to finalize the legislation by July 4, indicating that a decision may arrive sooner than expected.

A Complex Bill for Automakers

Should the credits be removed, it may influence demand, at least temporarily. With fewer incentives, buyer interest often wanes, which could impact many automakers negatively regarding EV sales. Conversely, the same bill proposes to eliminate penalties for manufacturers not meeting federal fuel economy standards, which may reduce regulatory pressures on these automakers and possibly mitigate the financial consequences of declining EV sales.

Dealers Request a Transition Period

Auto retailers are preparing for potential disruption. In discussions with Auto News, the National Automobile Dealers Association (NADA) has called on lawmakers to ensure a smoother transition.

“NADA stated, “Dealers currently have a substantial EV inventory, with about 140,000 EVs on dealer lots. If EV tax credits are to be eliminated, NADA urges Congress to provide a reasonable transition period.”

Even if the final cutoff date adjusts slightly, it’s becoming increasingly evident that the credits for both new and used EVs may vanish before the end of 2025. Therefore, if you are considering the purchase or lease of an electric vehicle, it may be wise to act sooner rather than later.

Other articles

This Iconic Off-Roader Has Been Fitted With An American Engine And A Fresh Appreciation For Pavement | Carscoops

Enhancing the updated powertrain are new driveshafts and improved brakes.

This Iconic Off-Roader Has Been Fitted With An American Engine And A Fresh Appreciation For Pavement | Carscoops

Enhancing the updated powertrain are new driveshafts and improved brakes.

Exceeding the speed limit by three times was just the beginning of this Mustang driver's issues | Carscoops

On top of everything, the Michigan driver possessed a stolen gun in the vehicle.

Exceeding the speed limit by three times was just the beginning of this Mustang driver's issues | Carscoops

On top of everything, the Michigan driver possessed a stolen gun in the vehicle.

Clownfish's Bright Orange Color Could Be a Criminal's Biggest Mistake | Carscoops

Officials report that the BMW M5 driver fled at speeds exceeding 100 mph but was subsequently easy to track down.

Clownfish's Bright Orange Color Could Be a Criminal's Biggest Mistake | Carscoops

Officials report that the BMW M5 driver fled at speeds exceeding 100 mph but was subsequently easy to track down.

A Model Y Made a 30-Minute Journey to Reach Its New Owner | Carscoops

Tesla is commemorating the inaugural autonomous delivery of a vehicle in the world.

A Model Y Made a 30-Minute Journey to Reach Its New Owner | Carscoops

Tesla is commemorating the inaugural autonomous delivery of a vehicle in the world.

Feds Probe Concealed Hazard Present in Numerous Range Rovers | Carscoops

The NHTSA, currently investigating the matter, reports that it is not aware of any accidents or injuries related to the front suspension issue.

Feds Probe Concealed Hazard Present in Numerous Range Rovers | Carscoops

The NHTSA, currently investigating the matter, reports that it is not aware of any accidents or injuries related to the front suspension issue.

Toyota's Even More Powerful GR Yaris Suggests What's Ahead for the GR Corolla

The GR Yaris Aero Performance includes an adjustable rear wing and various enhancements to Europe's most exciting small hatch, providing hints about potential updates for our GR Corolla.

Toyota's Even More Powerful GR Yaris Suggests What's Ahead for the GR Corolla

The GR Yaris Aero Performance includes an adjustable rear wing and various enhancements to Europe's most exciting small hatch, providing hints about potential updates for our GR Corolla.

Federal EV Tax Credits Might Conclude Earlier Than Anticipated | Carscoops

The proposal will also eliminate the credit for leased electric vehicles not manufactured in the U.S.