2025 Will Experience the Lowest Number of New Car Model Launches in Several Decades.

Ford

Get The Drive's daily newsletter

The latest car news, reviews, and features.

"This year is remarkable as we anticipate 159 [car] models to be introduced in the next four years," said Bank of America senior auto analyst John Murphy during an event in Detroit this week. "Last year, the number was over 200. Historically, it’s more than 200," (within a four-year timeframe). If you've noticed a slowdown in automotive product news, you're not mistaken. Amid the current upheaval in the global economy, a significant decline in the rollout of new cars is a tangible reality.

Bank of America produces an annual automotive industry forecast report called "Car Wars," which will be unveiled on June 21. However, Murphy, who is essentially the face of the program, hinted at the aforementioned quote along with several other insights during a smaller presentation on Wednesday.

He also mentioned that 2025 will see 29 new car models launched, "the lowest number we’ve seen in decades," according to Automotive News. He linked this slowdown to the industry's rapid retrenchment on electric vehicles (EVs). "This clearly indicates that much of what's happening with EV investment and other distractions has significantly affected product planning across the board. What you're witnessing is the postponement and cancellation of several models, mainly in the EV sector."

The term "distractions" is intriguing. Just a year ago, I constantly heard that electric vehicles were the future. However, by 2025, regulations are shifting back to favor more traditional gas vehicles, and previously lauded innovations, such as the electric Mercedes G, are now facing criticism from their own companies. So, it seems that the research and development that produced features like the tank turn now appears to be a distracting sidetrack.

Clearly, Murphy does not appear to believe electric vehicles will be a growth sector in the near future, given the changing regulations and sluggish sales. "I think 8 percent might be the peak for EVs in the U.S. for the next four or five years... It may indeed turn out to be the highest total."

The Detroit News indicated that Bank of America foresees 71 EV models being released in the next four years, "about half of what was projected two years ago."

There has been further empirical context shared in mainstream media and industry publications this week, but it essentially concludes that significantly fewer new cars are being launched, which will impact everybody from automakers to suppliers, marketers, dealers, and everyone else whose income relies on vehicle updates.

I’d like to believe that longer intervals between model updates will result in more substantial advances in technology and performance when changes do occur. However, to be frank, I think automotive technology peaked around the early 2000s, and now we're simply observing car companies trying to reduce costs.

I don't mean to inject a controversial opinion here, but from my perspective, the only category of vehicles that has achieved genuine, practical advancements since around 2015 is electric vehicles. Yet, I recognize why consumers are hesitant to purchase them—they are costly, and without home charging, they can be quite inconvenient for their price.

We'll need to wait until June 21 for the complete overview of Bank of America’s forecast for the automotive industry, but Automotive News did reveal one more intriguing insight from this week’s "Car Wars" teaser. Murphy believes the crossover market has reached its saturation point. He suggested that other light truck and small car segments are poised for growth in the near future. Perhaps the struggling economy has a silver lining: a potential resurgence of smaller vehicles.

Have a tip? Send us a note at [email protected]

Other articles

A Genuine Mitsubishi Ralliart SUV Might Be Nearer Than You Anticipate | Carscoops

Mitsubishi indicates that a sporty SUV is being contemplated, inspired by motorsport and customized for various markets.

A Genuine Mitsubishi Ralliart SUV Might Be Nearer Than You Anticipate | Carscoops

Mitsubishi indicates that a sporty SUV is being contemplated, inspired by motorsport and customized for various markets.

Here’s the Reason GM Created a Gas Exhaust for Electric Vehicles

Electric cars can indeed gain from having an exhaust system, but not in the way you might expect.

Here’s the Reason GM Created a Gas Exhaust for Electric Vehicles

Electric cars can indeed gain from having an exhaust system, but not in the way you might expect.

The Future of Maserati Uncertain as Stellantis Rushes to Develop a New Strategy | Carscoops

The head of Maserati has refuted claims that Stellantis might be putting the brand up for sale.

The Future of Maserati Uncertain as Stellantis Rushes to Develop a New Strategy | Carscoops

The head of Maserati has refuted claims that Stellantis might be putting the brand up for sale.

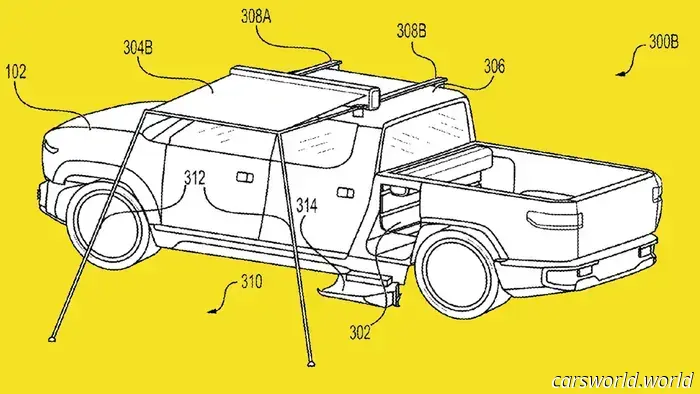

Rivian’s concept for a Tonneau cover awning is a fantastic example of simple yet effective innovation.

A tonneau cover for a truck that can also function as a camping awning is an excellent concept. There's no need to transport two tarp-like items when one can serve a dual purpose.

Rivian’s concept for a Tonneau cover awning is a fantastic example of simple yet effective innovation.

A tonneau cover for a truck that can also function as a camping awning is an excellent concept. There's no need to transport two tarp-like items when one can serve a dual purpose.

You Continue Purchasing Manual Z4s, Which May Mean the GR Supra Sticks Around a While Longer Too | Carscoops

The automaker does not intend to introduce a successor to the Z4 but may continue its production until May 2026.

You Continue Purchasing Manual Z4s, Which May Mean the GR Supra Sticks Around a While Longer Too | Carscoops

The automaker does not intend to introduce a successor to the Z4 but may continue its production until May 2026.

2025 Will Experience the Lowest Number of New Car Model Launches in Several Decades.

Typically, over 200 new car models are launched every four years. The upcoming forecast has decreased to 159, raising concerns among analysts.