Americans Are Struggling with Car Payments Like It’s 1992 Again | Carscoops

The number of drivers significantly behind on their payments reached an alarming record high last month, potentially signaling issues in the broader economy.

Subprime borrowers who are late on car payments have now reached the highest recorded level.

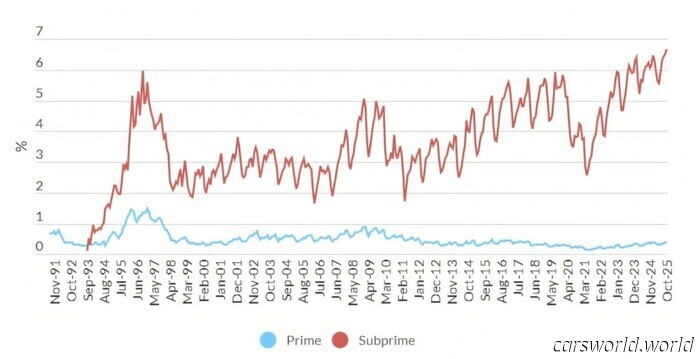

Data from Fitch reveals that 6.65 percent of subprime loans are more than 60 days overdue.

Prime borrowers remain steady, underscoring the ongoing pressure of living costs.

Purchasing a new vehicle can be thrilling, but the challenge of financing it is less so. For an increasing number of Americans, this is turning into a significant issue. Recent statistics indicate that the proportion of subprime borrowers who are at least 60 days late on their car payments has reached a new high in October.

A Negative Record Since The Early 1990s

This isn't merely a peak following the pandemic or even a high from the 2008 crisis; it is the worst since Fitch Ratings began monitoring this data in the early 1990s. The rate of 60-day defaults climbed to 6.65 percent in October, up from 6.50 percent the previous month and 6.23 percent in October of last year.

Related: Americans Trading In Cars Owe More Than Ever And It’s Only Getting Worse

This data specifically refers to subprime borrowers, those with poor credit histories who are compelled to accept higher interest rates for financing their vehicles, despite their typically lower incomes making it harder for them to afford higher payments.

The default rate for prime borrowers, those with good credit histories, has remained stable at 0.37 percent, according to Reuters.

Additionally: CEOs from Detroit's Big Three and a Tesla executive are set to appear before Congress regarding soaring car prices.

The elevated default rate among subprime borrowers, attributed to a combination of high vehicle costs and broader cost-of-living pressures, has not only resulted in people losing their cars but could also jeopardize jobs. Two US subprime lenders, Tricolor and PrimaLend, filed for bankruptcy in September and October, respectively.

Is That A Warning For The Economy?

The demise of these two lenders complicates credit access for subprime borrowers, but what’s more concerning is what the state of auto loans suggests about the overall US economy.

No one wants to miss a car payment and risk repossession, but when a family lacks sufficient funds to cover all expenses, the car loan is often a first casualty, allowing them to retain enough money for essentials like food and rent.

Also: Americans Strained By Auto Loans As Defaults And Repossessions Continue To Rise

In September, it was reported that Americans now owe a troubling $1.66 trillion in auto loans, and the Consumer Federation of America (CFA) believes that issues in the auto financing sector indicate larger economic problems that are not yet fully apparent.

However, not everyone concurs on the potential consequences. Analysts at Cox Automotive, for example, state that they detect "no signs of a domino effect set to disrupt the auto market or the economy."

Sources: Fitch, Reuters, Cox Automotive

Other articles

America's Thanksgiving Traffic Catastrophe Is Set to Shatter Records Once More | Carscoops

An estimated 73 million Americans are anticipated to travel by car, so be prepared to be patient.

America's Thanksgiving Traffic Catastrophe Is Set to Shatter Records Once More | Carscoops

An estimated 73 million Americans are anticipated to travel by car, so be prepared to be patient.

How a Basic Method Allows Thieves to Steal Your Car in Seconds | Carscoops

Thefts are increasing in Southern California as offenders capture key fob signals to steal luxury cars.

How a Basic Method Allows Thieves to Steal Your Car in Seconds | Carscoops

Thefts are increasing in Southern California as offenders capture key fob signals to steal luxury cars.

Lamborghini Believes It Can Achieve Even Greater Success With Future Off-Road Sterrato Supercars

Based on what is being said, Lamborghini's plans could make the Huracan Sterrato seem quite modest.

Lamborghini Believes It Can Achieve Even Greater Success With Future Off-Road Sterrato Supercars

Based on what is being said, Lamborghini's plans could make the Huracan Sterrato seem quite modest.

We Tested the New C5 Aircross and Found Citroen’s Comfort Superior to Our Jeep Compass | Review | Carscoops

We evaluate the latest generation of the Stellantis SUV against its predecessor to identify the changes.

We Tested the New C5 Aircross and Found Citroen’s Comfort Superior to Our Jeep Compass | Review | Carscoops

We evaluate the latest generation of the Stellantis SUV against its predecessor to identify the changes.

The 2026 Subaru Outback Is Actually Still a Wagon—But Keep It Under Wraps from the SUV Fans.

Owners requested that Subaru design the new Outback to hold more cargo without increasing its size. This is what they came up with.

The 2026 Subaru Outback Is Actually Still a Wagon—But Keep It Under Wraps from the SUV Fans.

Owners requested that Subaru design the new Outback to hold more cargo without increasing its size. This is what they came up with.

Dodge Charger Functions Flawlessly as a New Magnum Wagon | Carscoops

This is just a render, but we certainly hope Dodge is taking note.

Dodge Charger Functions Flawlessly as a New Magnum Wagon | Carscoops

This is just a render, but we certainly hope Dodge is taking note.

Americans Are Struggling with Car Payments Like It’s 1992 Again | Carscoops

The number of drivers significantly overdue on payments hit an alarming record last month, which may suggest issues within the broader economy.