China’s Automotive Brands Are Stealthily Taking Over in Europe | Carscoops

Sales of Chinese brands in Europe surged by 121 percent in August

14 hours ago

by Chris Chilton

In the previous month, Chinese brands captured 5.5 percent of the European market.

Their total sales reached 43,500 units, marking a 121 percent increase from August 2024.

In August, Audi sold 41,300 units while Renault sold 37,800 units in Europe.

Overall car sales in Europe increased by 5 percent to 790,000 units last month, supported by ongoing enthusiasm for electric vehicles across the continent. Plug-in hybrids demonstrated particularly strong growth, with registrations rising to 83,900 in August, representing a 59 percent increase from the previous year and lifting their market share to 10.6 percent.

Related: Global Electric Car Sales Increased 25 Percent While Canada Saw a Decline of a Third

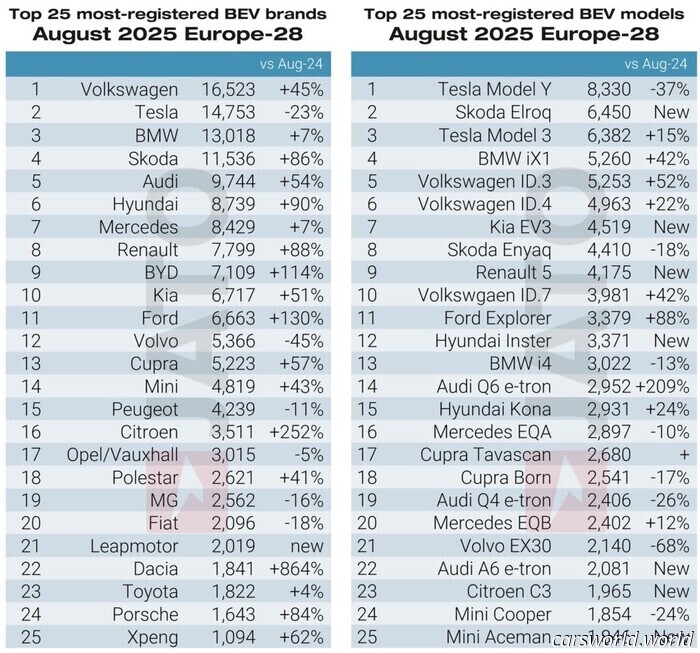

According to data from Jato Dynamics, battery-electric vehicles (BEVs) also showed an increase, up 27 percent compared to August 2024, achieving a record 20.2 percent market share, a rise of 3.6 percentage points year over year. This brings the total fully electric registrations in Europe for 2025 to 1.54 million so far. However, analysts warn that the headline growth figures for BEVs may not fully capture the situation.

Numbers With Caveats

“The data indicates strong demand for BEVs in August; however, a 27 percent increase may be less significant than it appears due to the extensive promotion of these vehicles across Europe,” said Felipe Munoz, Global Analyst at JATO Dynamics. “The new record market share for BEVs achieved last month has been somewhat skewed by the fact that Italy – usually a more reserved adopter of BEVs – tends to slow down during August,” Munoz added.

Europe Car Sales

Jato Dynamics

China’s Growing Momentum

Nevertheless, traditional European manufacturers might not find solace in these results. The challenging news for carmakers in Europe is that interest in Chinese brands is escalating even more rapidly, at the expense of some well-known names.

Audi sold 41,300 units in August, while Renault moved 37,800. Both are significant market players but were outpaced by Chinese brands that reported 43,500 sales, a staggering 121 percent increase compared to August 2024, as noted by Jato.

While the ‘Chinese brands’ figure includes 40 different automakers, Jato highlights that 84 percent of the total came from just five companies: MG, BYD, Jaecoo, Omoda, and Leapmotor. Regardless of the perspective, this is unfavorable news for Europe’s established brands and is likely to worsen, although Stellantis’s partnership with Leapmotor provides some positive news.

Even independently, the Chinese brands have made significant inroads. MG sold more cars than Tesla and Fiat, BYD outperformed Suzuki and Jeep, and Jaecoo along with Omoda surpassed Alfa Romeo and Mitsubishi.

“European consumers are responding positively to the expanding and competitive offerings from Chinese car brands,” stated Jato analyst Felipe Munoz. “It seems these brands have effectively addressed previous perception and awareness challenges.”

Hybrids, Beyond Just EVs

Chinese brands are not only excelling in the electric vehicle sector but are also performing well in the plug-in hybrid electric vehicle (PHEV) market, where they are not hindered by the same tariffs applied to their fully electric vehicles.

Jato

Over 11,000 Chinese-brand plug-in hybrids were sold this August compared to just 779 in the same month last year. BYD is now the eighth most popular PHEV brand overall, and models like the BYD Seal U, Jaecoo J7, and MG HS occupy three spots in the top 10 best-selling models list.

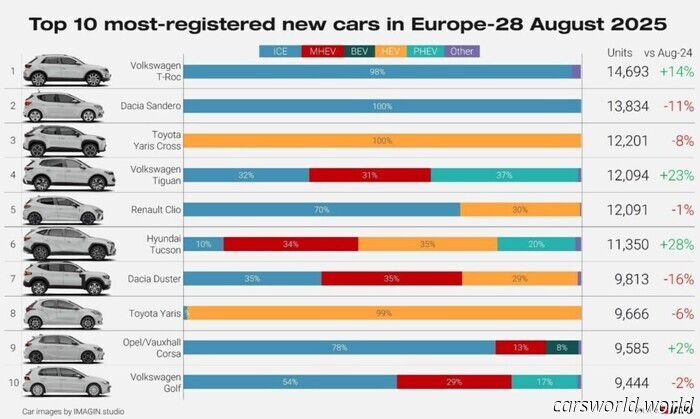

However, if one were to only look at the list of the 10 most-registered models, they might not realize how quickly China is advancing. No brands from the People’s Republic appear on this list, which remains dominated by Volkswagen and Renault.

The VW T-Roc (which has since been updated) was the top seller in the region, followed by the Dacia Sandero in second place and Toyota’s Yaris Cross in third. Tesla’s revamped Model Y was the best-selling electric vehicle, but its sales fell by 37 percent and it did not rank in the overall top 10 cars list.

Jato

Other articles

Subaru Dealerships Will Soon Resemble Community Centers Instead of Car Showrooms | Carscoops

A trip to a Subaru dealership might soon resemble a visit to a coffee shop.

Subaru Dealerships Will Soon Resemble Community Centers Instead of Car Showrooms | Carscoops

A trip to a Subaru dealership might soon resemble a visit to a coffee shop.

The standard Subaru BRZ didn't sell, so it's no longer available.

Subaru reports that only 1 out of 10 buyers have chosen the base trim of the BRZ this year, leading them to eliminate it. Is that a valid reason?

The standard Subaru BRZ didn't sell, so it's no longer available.

Subaru reports that only 1 out of 10 buyers have chosen the base trim of the BRZ this year, leading them to eliminate it. Is that a valid reason?

Urus Catches Fire, Leading to Immediate Recalls for Lamborghini, Audi, and Porsche | Carscoops

A fire involving a Lamborghini SUV caused a brief but pressing recall, prompting automakers to quickly check and replace faulty fuel pump parts.

Urus Catches Fire, Leading to Immediate Recalls for Lamborghini, Audi, and Porsche | Carscoops

A fire involving a Lamborghini SUV caused a brief but pressing recall, prompting automakers to quickly check and replace faulty fuel pump parts.

Tesla Discreetly Resolves Deadly Autopilot Accident Right Before Jury Evaluation | Carscoops

The car manufacturer avoids a jury trial related to a fatal 2019 Model 3 Autopilot accident by reaching a settlement with the family of the victim.

Tesla Discreetly Resolves Deadly Autopilot Accident Right Before Jury Evaluation | Carscoops

The car manufacturer avoids a jury trial related to a fatal 2019 Model 3 Autopilot accident by reaching a settlement with the family of the victim.

Road rage is increasing, and instances of drivers cutting one another off are skyrocketing | Carscoops

Recent information indicates that road rage is rising, with 96% of drivers acknowledging aggressive behaviors, and AAA proposing a straightforward solution.

Road rage is increasing, and instances of drivers cutting one another off are skyrocketing | Carscoops

Recent information indicates that road rage is rising, with 96% of drivers acknowledging aggressive behaviors, and AAA proposing a straightforward solution.

Ohio Police Confiscated a 797 HP Hellcat and Assigned It a Completely New Purpose | Carscoops

The high-performance Dodge muscle car has been customized with police stickers and blinking red and blue lights.

Ohio Police Confiscated a 797 HP Hellcat and Assigned It a Completely New Purpose | Carscoops

The high-performance Dodge muscle car has been customized with police stickers and blinking red and blue lights.

China’s Automotive Brands Are Stealthily Taking Over in Europe | Carscoops

Chinese brand sales in Europe surged by 121 percent in August.