Dealer Lots Are Dwindling, Yet Two German Brands Continue to Restock | Carscoops

The average supply of new vehicles has decreased to 70 days.

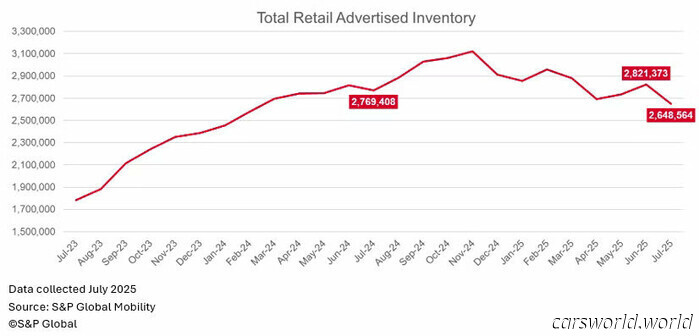

Overall, the inventory of new vehicles in the US fell by 6.1 percent in July, reaching approximately 2.65 million units.

Currently, the average availability of hybrid vehicles is just 58 days, with some regions reporting as low as 46 days.

The supply of electric vehicles (EVs) saw an 11.6 percent decline in a single month, partly due to the expiration of tax credits.

Recent data indicates that new car availability in the United States is dwindling, while consumer preferences are evolving. In July, the nationwide inventory decreased 6.1 percent from the previous month to about 2.65 million units, signaling a constriction in the US auto market that has been emerging since November 2024.

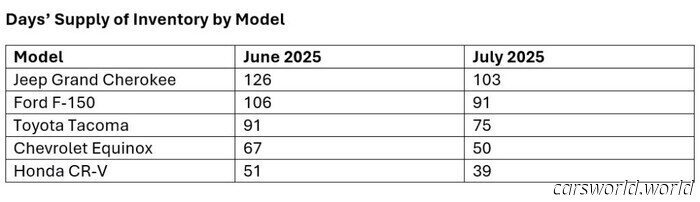

Reports indicate that the average supply of new vehicles has fallen to 70 days, a notable decrease from 97 days earlier this year. This latest figure utilizes dealer-reported inventory instead of manufacturer sales data, providing a more immediate overview of current availability.

Several brands have reported significant inventory losses since June. Nissan saw a 15 percent drop, Mercedes-Benz fell by 14 percent, Chevrolet's inventory reduced by 9.6 percent, and Honda's decreased by 9.3 percent. In contrast, Volkswagen's inventories increased by 9.5 percent, and BMW saw a 5.4 percent rise.

Price Trends

As supply tightens, prices are showing slight changes. The average manufacturer’s suggested retail price (MSRP) fell to $50,772 in July, down $385 from June. Additionally, discounts have narrowed, decreasing from $3,405 to $3,226. Although these shifts are not dramatic, they indicate a market where limited supply is putting downward pressure on incentives.

Electric vehicles are also feeling the pinch. As of July, S&P Global indicates there were about 188,000 EVs in stock, a year-over-year decrease of 4.9 percent and an 11.6 percent drop from the previous month. This decline is largely attributed to the approaching expiration of federal EV tax incentives.

Key electric vehicles that have seen inventory decreases include the Hyundai Ioniq 5 (-1.9 percent), Chevrolet Equinox (-16 percent), and Honda Prologue (-25 percent). In contrast, the inventory of the Ford Mustang Mach-E has risen by 10.4 percent since June.

Hybrid vehicles are experiencing inventory reductions as well, with supply dropping from 67 days in June to 58 days in July. In some markets, the situation is even more critical, with supply falling to 47 days in Dallas and 46 days in Houston.

Trucks and Tariff Impact

There are notable inventory declines in the full-size half-ton pickup segment, which has dropped 13.4 percent year-over-year and 9.7 percent month-over-month. Notably, the inventory of the Toyota Tundra has tightened significantly, plummeting 37 percent since June, equating to about 11,000 units.

Tariff policies continue to be a significant factor, with around 884,000 vehicles still marked as “pre-tariff” in July, down from 948,000 in the previous month. This ongoing decline illustrates how trade measures are gradually affecting supply chains.

Other articles

BMW's Smallest SUV Is Receiving A Neue Klasse Design | Carscoops

Spy photographers have captured images of the refreshed X1, which takes design elements from the latest X3 and iX3 models.

BMW's Smallest SUV Is Receiving A Neue Klasse Design | Carscoops

Spy photographers have captured images of the refreshed X1, which takes design elements from the latest X3 and iX3 models.

Skoda's Concealed Fabia Prototypes Could Be Concealing More Than Just a Refresh | Carscoops

Spy photos have captured Fabia prototypes at the Nurburgring, suggesting a facelift and the possibility of a performance-oriented version.

Skoda's Concealed Fabia Prototypes Could Be Concealing More Than Just a Refresh | Carscoops

Spy photos have captured Fabia prototypes at the Nurburgring, suggesting a facelift and the possibility of a performance-oriented version.

Waymo Steadily Advances Past Tesla in the Competition for Robotaxis | Carscoops

This fall, Waymo vehicles will be operating in Denver and Seattle, starting with human pilots before transitioning to fully autonomous service.

Waymo Steadily Advances Past Tesla in the Competition for Robotaxis | Carscoops

This fall, Waymo vehicles will be operating in Denver and Seattle, starting with human pilots before transitioning to fully autonomous service.

Why GM Is Reducing EV Production Right After Its Strongest Month of Electric Vehicle Sales | Carscoops

The company will temporarily halt EV production in Tennessee and postpone its plans in Kansas due to shifts in demand forecasts caused by policy changes.

Why GM Is Reducing EV Production Right After Its Strongest Month of Electric Vehicle Sales | Carscoops

The company will temporarily halt EV production in Tennessee and postpone its plans in Kansas due to shifts in demand forecasts caused by policy changes.

Dealer Lots Are Dwindling, Yet Two German Brands Continue to Restock | Carscoops

The typical supply of new vehicles has decreased to 70 days.