The upcoming car manufacturing crisis might be triggered by a shortage of magnets.

Bert van Dijk/Getty Images

Subscribe to The Drive’s daily newsletter for the latest updates on car news, reviews, and features.

Our dependency on rare-earth minerals is leading to shortages of materials. Currently, the essential resource in question is magnets, which are facing export restrictions from China. An alliance of automobile manufacturers and suppliers warns that without a resolution to trade issues (reducing paperwork would be beneficial), production interruptions are likely.

In a recent Reuters report, the Alliance for Automotive Innovation (AAI) and the Motor & Equipment Manufacturers Association (MEMA) jointly addressed their concerns about the availability of rare-earth magnets in a letter sent to the Trump administration on May 9. A major point of concern was China's delays in issuing export licenses. Without these elements, assembly lines that are already facing disruptions could encounter even greater challenges.

“Without dependable access to these elements and magnets, automotive suppliers will be incapable of producing critical components,” the organizations stated. “In extreme cases, this could lead to reduced production volumes or even the closure of vehicle assembly lines.”

These components range from windshield wiper motors, lights, and automatic transmissions to seatbelts, cameras, and anti-lock braking sensors. Essentially, this impacts nearly everything. However, three weeks later, the situation remains unresolved, according to Alliance CEO John Bozzella and MEMA CEO Bill Long speaking to Reuters.

The AAI includes major automotive manufacturers like BMW Group, Ford, General Motors, Honda, Hyundai, Stellantis, Toyota, and Volkswagen. Meanwhile, MEMA comprises over 1,000 members, consisting of both original equipment (OE) and aftermarket parts suppliers.

Finding a supplier outside of China would be a considerable challenge since over 90% of the world’s rare-earth production capacity, encompassing a group of 17 elements, is located in China. There is one mine in the U.S. situated in Oklahoma, but it depends on China for processing. E-waste recyclers are attempting to boost production, but any significant increase will take years, not days or weeks.

Regarding magnets specifically, Reuters reports that China's exports fell by half in April, mainly due to a complex permit application process that often requires "hundreds of pages of documents," which is quite cumbersome.

Additionally, the U.S. has accused China of breaching an agreement that temporarily eases certain tariffs and trade restrictions. In response, China claims that the U.S. is misusing its export controls in the semiconductor area.

A U.S. official indicated to Reuters that Beijing had pledged to issue the rare-earth export licenses but is “moving slowly” in executing this. There is also the possibility of Washington taking retaliatory measures if automotive production were to be forced to cease, adding to existing disruptions.

As the saying goes, “When elephants fight, it is the grass that suffers.” So here we are, left in a difficult position, with builders and buyers both affected.

Have a tip? Contact us at [email protected]

Other articles

Driver's $3K Tow for Short Parking Turns into $12K Nightmare | Carscoops

The truck driver acknowledges that he parked unlawfully, but the towing company's conduct was also suspect.

Driver's $3K Tow for Short Parking Turns into $12K Nightmare | Carscoops

The truck driver acknowledges that he parked unlawfully, but the towing company's conduct was also suspect.

This $125 million estate features not only a large garage but also its own car museum.

The almost 24,000 sq. ft. facility is accompanied by an auto shop, gas station, car wash, and a full-time mechanic on site.

This $125 million estate features not only a large garage but also its own car museum.

The almost 24,000 sq. ft. facility is accompanied by an auto shop, gas station, car wash, and a full-time mechanic on site.

The Unseen Aspect of Your Vehicle That’s Stealthily Increasing Your Insurance Costs | Carscoops

As vehicles become increasingly sophisticated, the cost of insurance keeps rising.

The Unseen Aspect of Your Vehicle That’s Stealthily Increasing Your Insurance Costs | Carscoops

As vehicles become increasingly sophisticated, the cost of insurance keeps rising.

A Surprising Sale Finally Brought Attention to Acura’s Overlooked Supercar | Carscoops

A pre-owned second-generation Acura NSX Type S recently sold for an astonishing price, indicating that it might be more sought after than its reputation implies.

A Surprising Sale Finally Brought Attention to Acura’s Overlooked Supercar | Carscoops

A pre-owned second-generation Acura NSX Type S recently sold for an astonishing price, indicating that it might be more sought after than its reputation implies.

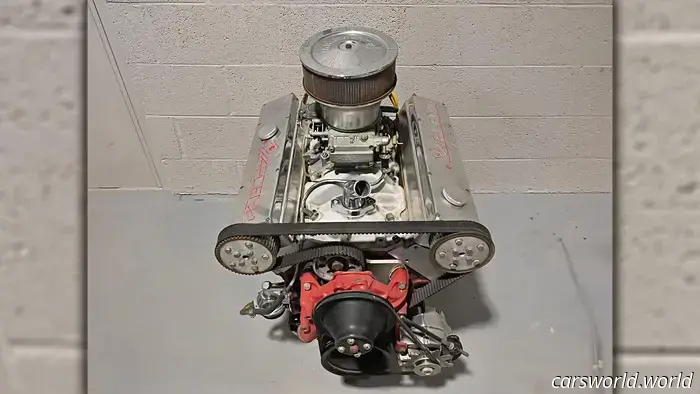

Take a look at this unusual Chevy small block that has been converted to SOHC for sale.

This unusual franken-motor was designed for hot rodding, but you can purchase it for any project you choose.

Take a look at this unusual Chevy small block that has been converted to SOHC for sale.

This unusual franken-motor was designed for hot rodding, but you can purchase it for any project you choose.

Another Mercedes-AMG One has gone up in flames.

The Mercedes-AMG One is essentially a street-legal Formula 1 vehicle. Only 275 units were manufactured, one was destroyed by fire in 2023, and now another has also gone up in flames.

Another Mercedes-AMG One has gone up in flames.

The Mercedes-AMG One is essentially a street-legal Formula 1 vehicle. Only 275 units were manufactured, one was destroyed by fire in 2023, and now another has also gone up in flames.

The upcoming car manufacturing crisis might be triggered by a shortage of magnets.

As China oversees over 90% of global rare-earth minerals production, issues arising there can affect everyone.