The Unseen Aspect of Your Vehicle That’s Stealthily Increasing Your Insurance Costs | Carscoops

As cars become more sophisticated, insurance costs are steadily increasing.

Driver assistance systems are designed to enhance safety, yet they inadvertently contribute to rising insurance premiums.

The replacement of sensors and cameras can be expensive and requires calibration at specialized facilities.

In the U.S., insurance rates have been increasing for several years and may soon average $2,101.

While driver assistance systems aim to improve safety and convenience, they come with an unforeseen setback: higher insurance costs. It may seem illogical that features intended to prevent accidents could lead to increased expenses, but these systems are costly to repair when vehicles are involved in collisions.

A study indicates that automatic emergency braking systems in the UK have decreased the frequency of claims by 25%. While this appears to be positive, there is a paradox; over five years, the cost of claims surged by 60%.

According to the study referenced by Auto News, replacing cameras, radar, and lidar sensors is not just about swapping out damaged parts; calibration is crucial. A sensor misaligned by just one degree—approximately the thickness of a business card—can cause an error of 66 inches at a distance of 100 yards.

This level of precision means that few repair shops have the capability to perform this work, as they require a perfectly level floor, suitable lighting, and automaker-specific targets for sensor calibration. This specialized equipment can cost as much as $1 million, posing a significant financial barrier for many shops.

“It’s becoming almost too expensive to repair the car,” stated Hami Ebrahimi, chief commercial officer at Caliber Collision, in an interview with Autonews.

Additionally, some owners deactivate driver assistance features they find bothersome, leading to insurance companies covering repairs for systems that drivers do not utilize.

This situation negatively impacts everyone, as noted by a ValuePenguin study which forecasts the average insurance cost will reach a historic high of $2,101. Technology plays a significant role in this trend, with more automakers making advanced safety features standard.

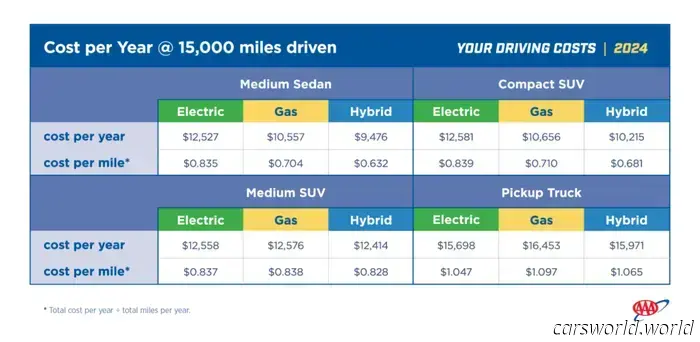

These factors contribute to the growing cost of car ownership. A study released last September by the motoring organization AAA revealed that the average annual cost of owning and operating a new vehicle has risen to $12,297, or about $1,024.71 per month, reflecting a $115 increase compared to the prior year.

Other articles

This $125 million estate features not only a large garage but also its own car museum.

The almost 24,000 sq. ft. facility is accompanied by an auto shop, gas station, car wash, and a full-time mechanic on site.

This $125 million estate features not only a large garage but also its own car museum.

The almost 24,000 sq. ft. facility is accompanied by an auto shop, gas station, car wash, and a full-time mechanic on site.

A New Model Is Set to Take the Place of Mazda's Outdated Small SUV | Carscoops

Mazda is working on a new subcompact crossover that is expected to introduce the CX-20 nameplate.

A New Model Is Set to Take the Place of Mazda's Outdated Small SUV | Carscoops

Mazda is working on a new subcompact crossover that is expected to introduce the CX-20 nameplate.

Is This the Next WRX From Subaru or Something Even More Extreme? | Carscoops

The outlook is bright for enthusiasts of the Subaru WRX and its boxer engine.

Is This the Next WRX From Subaru or Something Even More Extreme? | Carscoops

The outlook is bright for enthusiasts of the Subaru WRX and its boxer engine.

Another Mercedes-AMG One has gone up in flames.

The Mercedes-AMG One is essentially a street-legal Formula 1 vehicle. Only 275 units were manufactured, one was destroyed by fire in 2023, and now another has also gone up in flames.

Another Mercedes-AMG One has gone up in flames.

The Mercedes-AMG One is essentially a street-legal Formula 1 vehicle. Only 275 units were manufactured, one was destroyed by fire in 2023, and now another has also gone up in flames.

You Won’t Recognize AMG’s Vehicles in Two Years | Carscoops

AMG's new approach offers a more distinct visual identity and aims to enhance its appeal to enthusiasts.

You Won’t Recognize AMG’s Vehicles in Two Years | Carscoops

AMG's new approach offers a more distinct visual identity and aims to enhance its appeal to enthusiasts.

Driver's $3K Tow for Short Parking Turns into $12K Nightmare | Carscoops

The truck driver acknowledges that he parked unlawfully, but the towing company's conduct was also suspect.

Driver's $3K Tow for Short Parking Turns into $12K Nightmare | Carscoops

The truck driver acknowledges that he parked unlawfully, but the towing company's conduct was also suspect.

The Unseen Aspect of Your Vehicle That’s Stealthily Increasing Your Insurance Costs | Carscoops

As vehicles become increasingly sophisticated, the cost of insurance keeps rising.