A Chinese Brand Achieved the Unimaginable Against Tesla in Europe | Carscoops

Sales for the Chinese brand surged by 169 percent in April, while Tesla saw a decline of 49 percent.

BYD's sales soared last month, surpassing Tesla for the first time.

In April, the Chinese brand sold 7,231 cars in Europe, compared to Tesla's 7,165.

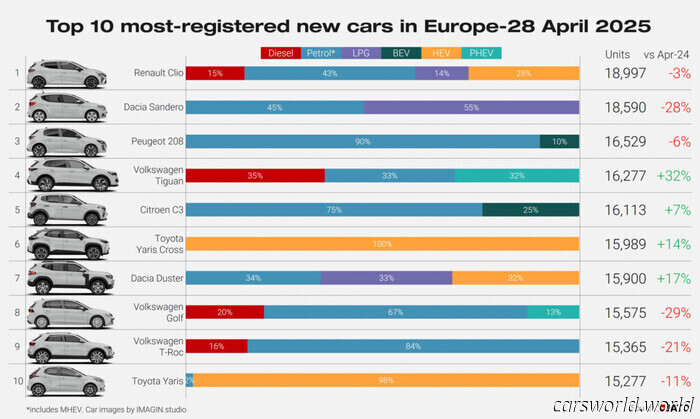

The Renault Clio emerged as the top-selling vehicle overall with nearly 19,000 sales.

Fourteen years after Elon Musk ridiculed BYD and doubted its ability to outpace Tesla, the Chinese brand has now surpassed its American competitor in the European electric vehicle market. At first glance, the sales figures seem close: BYD sold 7,231 cars in Europe while Tesla sold 7,165, based on data from Jato. However, considering the trend in these sales figures, the outlook appears grim for Tesla.

BYD's sales skyrocketed by 169 percent compared to April 2024, reaching 7,231 units, indicating significant potential for further growth. This week, the company introduced its sub-€23,000 ($26,000) Dolphin Surf in Europe, a model likely to make a considerable impact as it undercuts almost all Western competitors, except for the basic and slow Dacia Spring 45.

The sales trajectory for Tesla, however, is more concerning. The company experienced a 49 percent drop in sales last month in Europe, despite the rollout of the updated Model Y earlier this year. What may appear to be a closely contested battle between BYD and Tesla based on these figures could quickly turn into a lopsided contest if the trends continue. Musk has stated that he plans to remain in his position as CEO indefinitely, but one must wonder if Tesla's downward trajectory will make investors reconsider his leadership.

Tesla's sales challenges come at a time when BYD is gaining traction, and the entire electric vehicle sector is on the rise. Overall car sales, regardless of type, saw a slight increase of 0.1 percent to 1,078,500, while battery electric vehicle sales jumped by 28 percent to 184,300, increasing their market share from 13 to 17 percent.

Plug-in hybrids performed even better, with sales climbing 31 percent to 97,700, raising their share from 7 to 9 percent. Naturally, BYD’s success played a significant role in the substantial growth of Chinese brands in the overall market, with their sales rising by 121 percent to 53,300 units, more than doubling their market share to 4.9 percent. However, while Chinese brands flourished, Western brands owned by Chinese companies—such as Volvo, Polestar, and MG—experienced a 15 percent decline in sales.

Despite this surge in EV sales, it didn't affect the competition for the best-selling overall vehicle, as none of the top contenders were electric (the Model Y's impressive performance in 2023 now seeming more like a memory). All of the top three models experienced sales drops, but Renault’s Clio (18,997 units) saw only a 3 percent decrease, while the Dacia Sandero fell by 28 percent (18,590 units), allowing the Clio to surpass its more budget-friendly sibling and claim the top position for the first time since 2020.

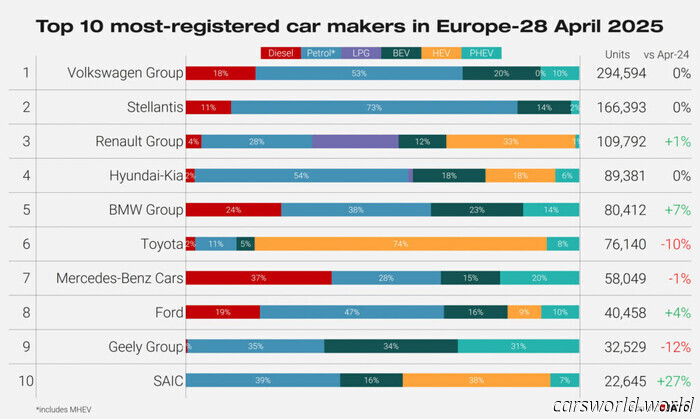

VW’s Golf struggled as well, with sales falling 29 percent, dropping it from fifth place in March's sales to eighth. Nonetheless, the VW Group can take solace in being the best-selling car manufacturer, achieving 294,600 deliveries.

Best-selling EV brands in Europe, April 2025 (Jato)

Altri articoli

BMW trascorre 20 ore ossessionata dalla vernice della M4 CS VR46 / Carscoops

M4 CS Edition VR46 celebra il 46 ° compleanno del campione motociclistico e pilota ufficiale BMW M Valentino Rossi

BMW trascorre 20 ore ossessionata dalla vernice della M4 CS VR46 / Carscoops

M4 CS Edition VR46 celebra il 46 ° compleanno del campione motociclistico e pilota ufficiale BMW M Valentino Rossi

Non chiedere cosa è successo a questo VW Basta guardarlo / Carscoops

Se ti è mai piaciuta l'idea di una VW a prova di zombie, pronta a respingere alcune orde, questa potrebbe essere la tua prossima corsa

Non chiedere cosa è successo a questo VW Basta guardarlo / Carscoops

Se ti è mai piaciuta l'idea di una VW a prova di zombie, pronta a respingere alcune orde, questa potrebbe essere la tua prossima corsa

L'Alfa Romeo più bella che non dovresti mai comprare / Carscoops

Se il V6 twin-turbo da 2,9 litri funziona ancora, questo Guilia QV potrebbe essere un buon affare

L'Alfa Romeo più bella che non dovresti mai comprare / Carscoops

Se il V6 twin-turbo da 2,9 litri funziona ancora, questo Guilia QV potrebbe essere un buon affare

Un marchio cinese ha fatto l'impensabile per Tesla in Europa / Carscoops

Le vendite del marchio cinese sono aumentate del 169 ad aprile mentre Tesla è scesa del 49

Un marchio cinese ha fatto l'impensabile per Tesla in Europa / Carscoops

Le vendite del marchio cinese sono aumentate del 169 ad aprile mentre Tesla è scesa del 49

VW ci lascia tranquillamente dal piano DEI per placare Trump / Carscoops

La mossa arriva dopo che Trump ha firmato un ordine esecutivo contro I DEI a gennaio

VW ci lascia tranquillamente dal piano DEI per placare Trump / Carscoops

La mossa arriva dopo che Trump ha firmato un ordine esecutivo contro I DEI a gennaio

EV sconti Hit Record in Cina e che è una cattiva notizia / Carscoops

Diversi produttori di auto elettriche saranno costretti ad uscire dal mercato o ad essere acquisiti da rivali più grandi

EV sconti Hit Record in Cina e che è una cattiva notizia / Carscoops

Diversi produttori di auto elettriche saranno costretti ad uscire dal mercato o ad essere acquisiti da rivali più grandi

A Chinese Brand Achieved the Unimaginable Against Tesla in Europe | Carscoops

In April, sales of the Chinese brand soared by 169 percent, while Tesla's sales fell by 49 percent.