Volvo Has Temporarily Halted Its Forecast as Tariffs and Electric Vehicle Challenges Disrupted Q1 | Carscoops

Volvo will rely on its U.S. plant to navigate tariffs on imports

17 hours ago

by Michael Gauthier

Volvo has announced a notable drop in revenue and earnings for the first quarter.

The company attributed these declines to several factors and is initiating a cost-cutting initiative.

Its facility in South Carolina is poised to play a crucial role in Volvo's U.S. strategy.

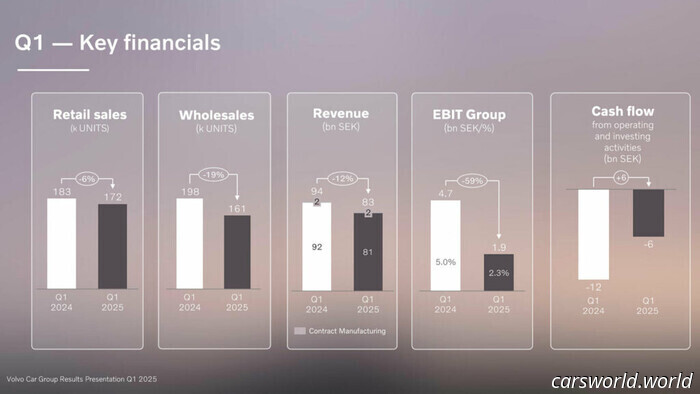

Volvo Cars has revealed disappointing results for the first quarter, with revenues decreasing by 11.7% year-over-year to 82.9 SEK ($8.62 / €7.57 / £6.43) billion. The operating income fell sharply from 4.7 SEK billion ($489 / €429 / £365 million) to 1.9 SEK billion ($198 / €173 / £147 million).

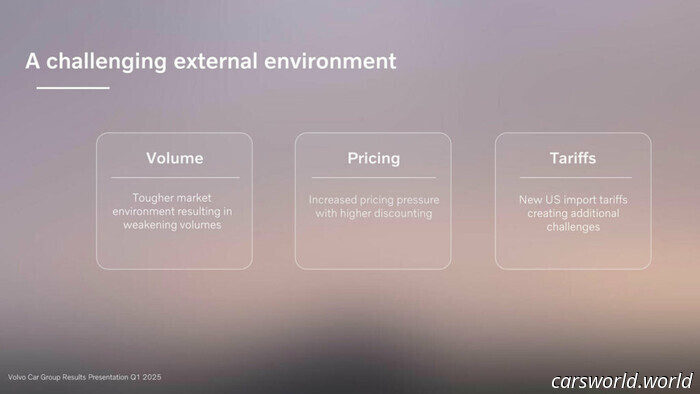

The automaker cited the "current turbulence in the world and a challenging external environment for the automotive industry." Additionally, they pointed to Trump's tariffs and heightened pricing pressures that have led to larger discounts.

More: Volvo Plans to Launch 5 Models in 2025, EX60 Arriving in 2026

In an effort to stabilize the situation, Volvo has introduced an "accelerated cost and cash action plan" worth 18 SEK ($1.87 / €1.64 / £1.40) billion. While details were sparse, the company mentioned plans to reduce investments and cut costs. Regarding the latter, Volvo will collaborate with Geely to reduce product costs.

Beyond cuts, Volvo believes a more regional approach is necessary to effectively meet the product and technology preferences of different markets. Their primary focus will be China and the United States, which are key markets for the company.

In China, they are set to launch their first range-extended model later this year, which they describe as a "good example of their ability to customize products to varying demands in different markets."

As part of their focus on the United States, Volvo is establishing a new Americas group that will also encompass Canada and Latin America. The company stated that this restructuring "further simplifies the company’s global operations into three streamlined regions: Americas, Greater China, and Europe & Rest of the World."

Given Volvo’s heavy reliance on China, Trump's tariffs pose a significant challenge. To address this, the company aims to "better utilize its existing manufacturing footprint" in the U.S. in the upcoming years, resulting in "producing more cars where they are sold."

Volvo also committed to refining its U.S. product offerings. While specific details were not revealed, the company has already announced the upcoming EX60 in 2026.

Regarding production, the EX30 has recently begun manufacturing in Ghent, Belgium, effectively resolving the crossover's "China problem." Production is expected to increase in the latter half of this year.

In terms of electric vehicles, Volvo highlighted that nearly 20% of sales in the first quarter were from electric models, with 43% of total sales coming from electrified vehicles.

Although there are some positive signs ahead, Volvo noted that "2025 will be a challenging and transition year due to uncertainties surrounding macroeconomic, geopolitical, and market developments." The company expects "tougher market conditions and lower volumes combined with increased price pressure and tariff effects" to affect profitability.

In light of these developments and "increased uncertainties," Volvo has suspended its financial forecast for 2025 and 2026.

Other articles

They Rejected $103K for This 25-Year-Old Acura Integra Type R | Carscoops

Despite significant bidding activity, the owner concluded that the offers were insufficient to let go of their low-mileage Type R.

They Rejected $103K for This 25-Year-Old Acura Integra Type R | Carscoops

Despite significant bidding activity, the owner concluded that the offers were insufficient to let go of their low-mileage Type R.

Audi Q4 E-Tron Shines in Competition Against Tesla's Model Y | Carscoops

The mid-life visual updates for the upscale variant of the VW ID.4 are restricted to a refreshed grille, daytime running lights (DRLs), and new bumpers.

Audi Q4 E-Tron Shines in Competition Against Tesla's Model Y | Carscoops

The mid-life visual updates for the upscale variant of the VW ID.4 are restricted to a refreshed grille, daytime running lights (DRLs), and new bumpers.

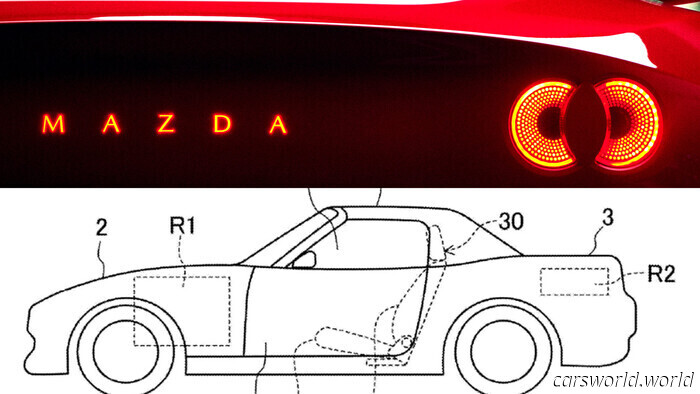

Mazda's EV Patent Might Be Crucial for the Future of Sports Cars | Carscoops

Mazda's innovative electric vehicle design positions the batteries in unexpected locations to maintain the driving experience.

Mazda's EV Patent Might Be Crucial for the Future of Sports Cars | Carscoops

Mazda's innovative electric vehicle design positions the batteries in unexpected locations to maintain the driving experience.

Aston Martin DBX S Employs Valhalla Techniques to Offer 717 Justifications for Choosing It Over Ferrari's SUV | Carscoops

The inaugural S-badged SUV offers an additional 20 horsepower compared to the DBX 707 and sheds 100 pounds of curb weight.

Aston Martin DBX S Employs Valhalla Techniques to Offer 717 Justifications for Choosing It Over Ferrari's SUV | Carscoops

The inaugural S-badged SUV offers an additional 20 horsepower compared to the DBX 707 and sheds 100 pounds of curb weight.

2025 Volkswagen Golf GTI Initial Driving Review: Improved, But at a Price

The updated Mk 8 GTI is more lovable due to its enhanced interior. However, Volkswagen decided to tweak something that was already working well.

2025 Volkswagen Golf GTI Initial Driving Review: Improved, But at a Price

The updated Mk 8 GTI is more lovable due to its enhanced interior. However, Volkswagen decided to tweak something that was already working well.

New U-Haul Car Trailers Begin Joining Fleets with a Maximum Capacity of 6,800 Pounds

U-Haul has disclosed additional specifications for the Toy Hauler and confirmed that production has officially started, with 5,000 units anticipated to arrive at dealerships by the end of the year.

New U-Haul Car Trailers Begin Joining Fleets with a Maximum Capacity of 6,800 Pounds

U-Haul has disclosed additional specifications for the Toy Hauler and confirmed that production has officially started, with 5,000 units anticipated to arrive at dealerships by the end of the year.

Volvo Has Temporarily Halted Its Forecast as Tariffs and Electric Vehicle Challenges Disrupted Q1 | Carscoops

Volvo will rely on their U.S. facility to manage tariffs on imported goods.