UAW President Advocates for Stricter Import Tariffs, Asserts Automakers Can Handle the Costs | Carscoops

Shawn Fain asserts that President Trump should adopt even stricter measures against imports, claiming that free trade has negatively impacted American jobs.

Currently, Trump's 25% tariff on imported cars and parts is highly contentious in the US.

UAW President Shawn Fain is a strong proponent of this tariff, contending that free trade has been detrimental to American employment.

The Detroit automakers anticipate significant costs from the tariffs, although their reactions vary.

President Trump’s new 25% tariff on imported vehicles, which took effect on April 2, and on car parts starting May 3, has faced considerable backlash, even within the United States. While the Big Three automakers in Detroit fear the adverse effects this policy may bring, Trump has found a supporter in UAW President Shawn Fain.

Fain argues that the tariff is well-founded, as it will, according to Trump’s claims, enhance U.S. production, boost investment, increase government revenue, and generate better-paying jobs within the American automotive industry. He further advocates for even tougher measures, asserting that free trade has led domestic manufacturers to outsource jobs to Mexico and Canada, harming American workers in the process.

“Free trade has been the most harmful government policy throughout my working life – and for most of us,” Fain expressed to UAW members in a livestreamed speech on April 10. “We must end this free trade disaster.”

Moreover, he mentioned that despite their objections, the Detroit automakers will not suffer, despite the price hikes they claim the 25% tariff will necessitate. “In 2023, we stated that record profits should lead to record contracts,” Fain noted, as reported by the Detroit News.

“Executives claimed our demands for wage increases and the elimination of tiers would require them to raise prices. They asserted that the industry wouldn’t survive. It turns out, the companies were misleading,” he stated. “They could afford to make the right choices then, and they can do the same now.”

In stark contrast to Fain's remarks, an analysis by the Center for Automotive Research (CAR) commissioned by the American Automotive Policy Council indicated that the 25% tariff will likely lead to increased vehicle prices, reduced sales, and the shutdown of suppliers.

CAR's estimates suggest that tariffs could cost domestic automakers a total of $107.9 billion and that about 6.8 million vehicles produced by General Motors, Ford, and Stellantis could be impacted annually.

“Businesses are resilient and prepared to take risks,” remarked K. Venkatesh Prasad, CAR's senior vice president of research and chief innovation officer. “However, they tend to be cautious about unpredictability. They’re looking to allocate the burden and find strategies to manage it.” This implies that, unless automakers opt to absorb the costs (which is unlikely), the increased expenses will also affect suppliers, dealers, and ultimately, consumers.

Prasad predicts a decline in new car sales: “Many buyers are sensitive to pricing. They might decide it’s not an ideal time to purchase or may choose to buy a used vehicle instead, which will then drive up demand and prices for used cars.” Essentially, anyone looking to acquire a new vehicle will face higher costs, whether opting for new or used.

The Anderson Economic Group consulting firm corroborates these findings, forecasting that the price of a new vehicle could rise by $2,500 to $10,000 for most models, $10,000 to $12,000 for larger luxury vehicles, and as much as $20,000 for imported ultra-luxury vehicles. This shift will lead some consumers to the used car market, heightening demand and prices in that segment as well.

Fain's assertions regarding potential benefits for American workers from the tariffs are challenged by AEG's estimates. They project that GM, Ford, and Stellantis could see a reduction of about $5 billion in operating profits this year if the tariffs persist, which would likely result in a decrease in workers' annual profit-sharing payouts — typically disbursed between February and March — by $1,000 to $5,000.

Different responses to Trump’s tariffs have emerged from U.S. automakers. For example, Stellantis announced plans to pause production at its Windsor and Toluca plants for two weeks and the remainder of April, respectively. Conversely, General Motors intends to ramp up production of the Chevrolet Silverado and GMC Sierra at its Fort Wayne, Indiana facility and is hiring numerous temporary workers.

Fain recognized GM's actions: “These plants still have capacity available,” he commented. “That amounts to tens of thousands of jobs that we could reinstate immediately. Our research indicates that if the Big Three operated their existing plants at full capacity, they could generate 50,000 jobs.”

However, Michigan Governor Gretchen Whitmer, who received UAW support during her campaign, expressed concerns about the tariffs' effects on the local industry: “There are suppliers still

Other articles

Someone Scored a Deal on This 1k-Mile Porsche 911 T Coupe | Carscoops

The initial purchaser also included a carbon fiber roof and wheels sized at 20 and 21 inches.

Someone Scored a Deal on This 1k-Mile Porsche 911 T Coupe | Carscoops

The initial purchaser also included a carbon fiber roof and wheels sized at 20 and 21 inches.

GM Halting Operations at Canadian Facility, Yet Tariffs Aren't Its Main Worry | Carscoops

The production of the Chevrolet BrightDrop van will cease, resume, halt, and then commence once more in the upcoming months.

GM Halting Operations at Canadian Facility, Yet Tariffs Aren't Its Main Worry | Carscoops

The production of the Chevrolet BrightDrop van will cease, resume, halt, and then commence once more in the upcoming months.

This Aston Martin is the only one in Canada | Carscoops

The company produced only 38 Valiants, a more powerful variant of the Valour, with just one intended for Canada.

This Aston Martin is the only one in Canada | Carscoops

The company produced only 38 Valiants, a more powerful variant of the Valour, with just one intended for Canada.

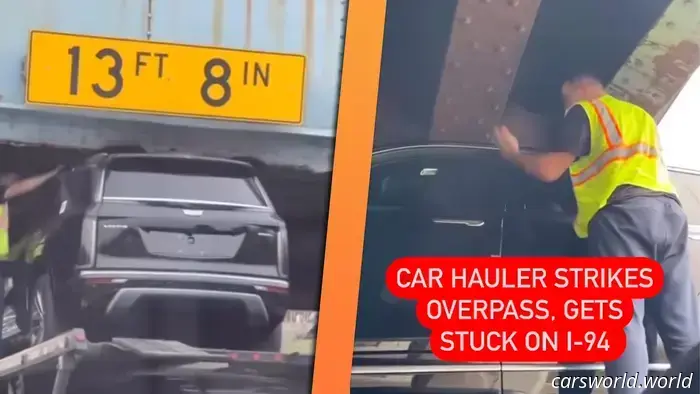

New Cadillac SUVs Receive a Trim as Hauler Gets Stuck Under Detroit Overpass

This is exactly what you don’t want while transporting a trailer loaded with expensive electric Cadillacs.

New Cadillac SUVs Receive a Trim as Hauler Gets Stuck Under Detroit Overpass

This is exactly what you don’t want while transporting a trailer loaded with expensive electric Cadillacs.

Democratic Senator Pledges To 'Stand Firm At The Border' To Prevent Chinese Car Imports | Carscoops

Democrat Elissa Slotkin has proposed a new bill that may prohibit connected vehicles from China and other countries.

Democratic Senator Pledges To 'Stand Firm At The Border' To Prevent Chinese Car Imports | Carscoops

Democrat Elissa Slotkin has proposed a new bill that may prohibit connected vehicles from China and other countries.

This custom trailer designed to transport land speed racers is nearly more impressive than the cars themselves.

The gooseneck available for purchase also holds a generator, a water tank, and a variety of other tools for race week.

This custom trailer designed to transport land speed racers is nearly more impressive than the cars themselves.

The gooseneck available for purchase also holds a generator, a water tank, and a variety of other tools for race week.

UAW President Advocates for Stricter Import Tariffs, Asserts Automakers Can Handle the Costs | Carscoops

Shawn Fain contends that President Trump should adopt stricter measures on imports, claiming that free trade has negatively affected American employment.