The True Victims of Trump's Tariffs Could Be American Automakers Themselves | Carscoops

New tariffs on imported vehicles are intended to create challenges for foreign brands, but the initial impact may actually be felt more by American manufacturers.

**6 hours ago**

**By Andreas Tsaousis**

Last year, Detroit’s Big Three automakers sold 1.85 million imported vehicles in the U.S.

These tariffs could be more detrimental to U.S. brands than to their foreign competitors due to their reliance on imports.

In response, automakers might relocate production to the U.S. to mitigate escalating costs and maintain profit margins.

President Trump’s recent tariffs on imported cars aim to shield domestic manufacturers and preserve American jobs. However, the situation in the automotive sector is complex, and the tariffs that took effect on April 2 could inadvertently harm the very companies they aim to support more than their international counterparts.

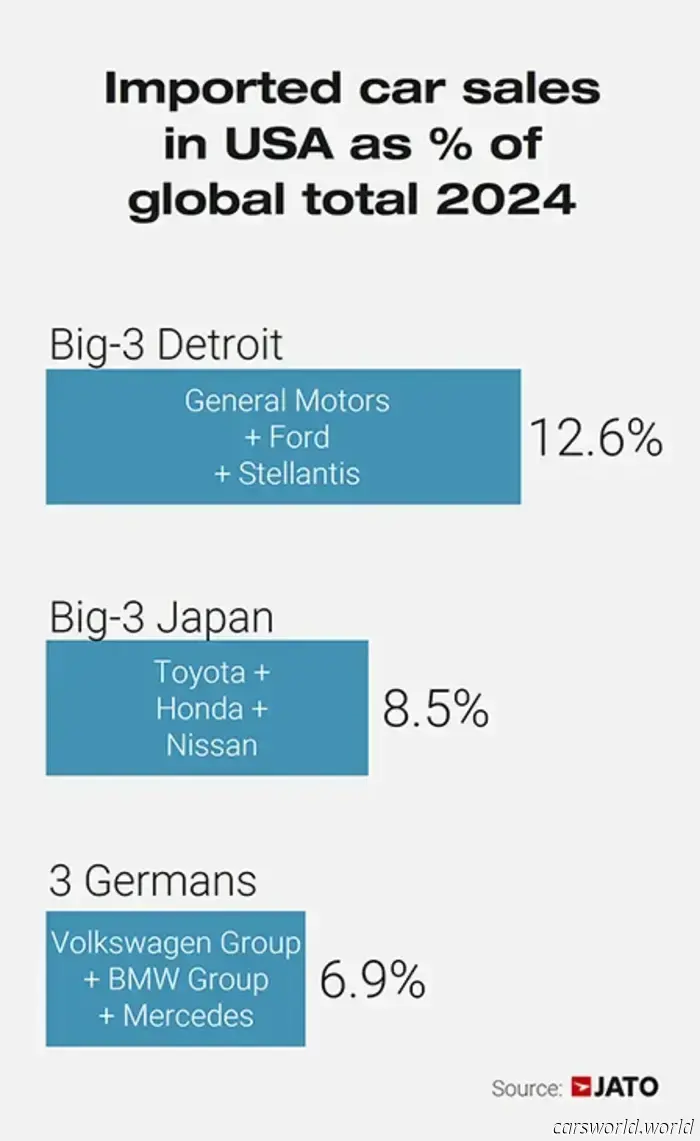

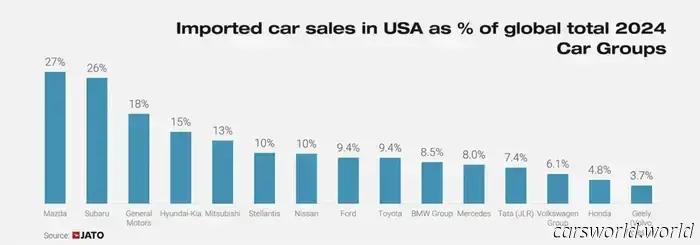

The primary reason is that American brands do not produce all their models domestically. In fact, last year, GM, Ford, and Stellantis (the Big Three) sold around 1.85 million imported light vehicles in the U.S., accounting for 13% of their overall global sales.

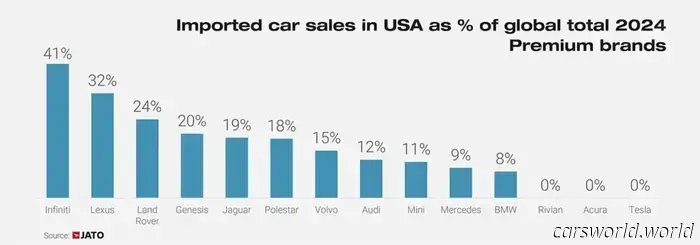

In comparison, the three largest Japanese automakers—Toyota, Honda, and Nissan—sold 1.53 million units in the U.S., representing only 9% of their global sales. For the German manufacturers, imported vehicles from VW Group, BMW Group, and Mercedes-Benz constituted 7% of their total sales, based on a JATO Dynamics report.

This indicates that domestic automakers rely more heavily on importing vehicles from their plants in regions like Canada and Mexico compared to their main foreign competitors. Furthermore, the report highlights that the Big Three are significantly more dependent on the U.S. market than European and Japanese brands, which have broader international reach.

General Motors is likely to be the most affected by Trump’s tariffs, ranking just behind Hyundai-Kia and Toyota in U.S. vehicle imports in 2024. Imported models comprised 18% of its global sales, the largest percentage among the world’s top five automakers.

Compounding the issue is GM's primary focus on North and South America and China for vehicle deliveries, while it has limited presence in Europe and elsewhere. The increasing shift of Chinese consumers towards domestic brands adds pressure, making the U.S. its main market—yet the new tariffs pose a significant threat to its operations.

Felipe Munoz, Global Analyst at JATO Dynamics, noted, “The implementation of these tariffs presents another challenge for the industry. The U.S. is the second-largest vehicle market globally, and it has become increasingly difficult for most non-Chinese automakers worldwide to operate.”

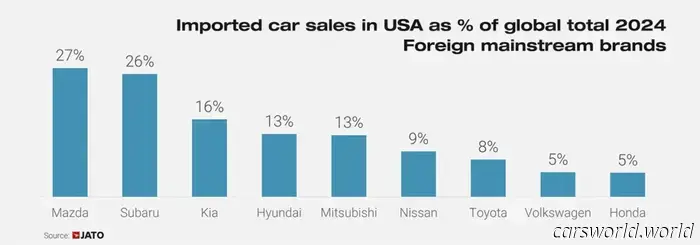

Other brands will also face repercussions; for example, out of 1.28 million new cars Mazda sold in 2024, 343,000 were imported into the U.S. Subaru is particularly vulnerable in the American market, where it generated an impressive 71% of its total sales last year.

As Munoz emphasized, “The U.S. is a crucial market for 14 of the 18 non-Chinese global automakers. For brands like Volkswagen, while the U.S. contributes a smaller portion of overall revenue, maintaining a presence is vital for their status as global players.”

“Brands including Volkswagen, Volvo, Hyundai-Kia, Mercedes, BMW, Stellantis, Toyota, Nissan, Subaru, and General Motors will likely have to expand their production capabilities in the U.S. soon. They cannot afford to exit this market.”

Despite these challenges, Trump’s assertion may hold some validity. His intent is for automakers to manufacture the vehicles they sell to American consumers domestically. It appears that if these tariffs persist, many manufacturers will have no choice but to comply or face declining sales as their imported models become less competitive compared to locally produced options.

There may indeed be logic behind this approach, even if it means that, in the interim, domestic brands must also endure hardships.

Other articles

New Kia Pickup Arriving in America, Unlike the Tasman | Carscoops

The upcoming Kia electric pickup is anticipated to be a mid-size truck and will have a counterpart from Hyundai.

New Kia Pickup Arriving in America, Unlike the Tasman | Carscoops

The upcoming Kia electric pickup is anticipated to be a mid-size truck and will have a counterpart from Hyundai.

Nissan's Electric Vehicle Return Might Feature an Unexpected Compact Pickup | Carscoops

One of the new electric models is set to be introduced in 2028, but whether it will be a Nissan or an Infiniti will depend on demand.

Nissan's Electric Vehicle Return Might Feature an Unexpected Compact Pickup | Carscoops

One of the new electric models is set to be introduced in 2028, but whether it will be a Nissan or an Infiniti will depend on demand.

Tesla Discreetly Removes $16K Range Extender for Cybertruck After Collecting $2,000 Deposits | Carscoops

The additional battery option for the Cybertruck is no longer listed on Tesla's configurator.

Tesla Discreetly Removes $16K Range Extender for Cybertruck After Collecting $2,000 Deposits | Carscoops

The additional battery option for the Cybertruck is no longer listed on Tesla's configurator.

Bentley’s More Affordable Continental GT Hybrids Are Still Entry-Level Exclusively For Millionaires | Carscoops

The latest "entry-level" Bentley models still deliver impressive performance and offer a commendable electric vehicle range.

Bentley’s More Affordable Continental GT Hybrids Are Still Entry-Level Exclusively For Millionaires | Carscoops

The latest "entry-level" Bentley models still deliver impressive performance and offer a commendable electric vehicle range.

Tesla’s Q1 Decline Boosted VW’s Surprising Surge in the EV Competition | Carscoops

Worldwide sales skyrocketed, and electric vehicle deliveries in Europe surged, with registrations more than doubling in the area.

Tesla’s Q1 Decline Boosted VW’s Surprising Surge in the EV Competition | Carscoops

Worldwide sales skyrocketed, and electric vehicle deliveries in Europe surged, with registrations more than doubling in the area.

Porsche's Decline in China is Severe, Yet US Sales Have Reached an Astonishing New Peak | Carscoops

Global sales in Q1 decreased by 8 percent overall, even with increases seen in North America and emerging markets.

Porsche's Decline in China is Severe, Yet US Sales Have Reached an Astonishing New Peak | Carscoops

Global sales in Q1 decreased by 8 percent overall, even with increases seen in North America and emerging markets.

The True Victims of Trump's Tariffs Could Be American Automakers Themselves | Carscoops

The recently introduced tariffs on imports are intended to pose challenges for foreign companies, but American brands will experience the impact first.