Mercedes' strategy involves accumulating cars prior to the implementation of their tariff plan.

Automotive manufacturers are racing to prepare for the anticipated 25% tariffs on imported vehicles set to take effect in the United States. The deadline looms with April 2 marking the last day before the government begins collecting the tariffs on April 3. According to Reuters, Mercedes executives informed investors in a recent call that the company is accumulating inventory in the U.S. prior to the deadline to delay incurring the significant costs associated with foreign-made cars and parts for as long as possible.

While Mercedes has not commented on The Drive’s inquiry, the story will be updated if a response is received.

Many car manufacturers have remained silent about their strategies to adapt. American automakers are even expressing some resistance, as reported by Automotive News, in their efforts to campaign for the removal of tariffs on smaller components like wiring harnesses produced in Mexico. Tariffs on these parts could still rise manufacturing costs by billions, and even if the campaign is successful, tariffs will still apply to fully assembled vehicles. Hence, Mercedes appears to be preparing to stockpile products before the deadline.

The main goal of these tariffs is to motivate automakers to increase their production of vehicles in the U.S. Several international car manufacturers already have plants in the country, with Mercedes producing many SUVs in Tuscaloosa, Alabama; Volvo operating a facility in Ridgeville, South Carolina; Honda and Toyota having various manufacturing locations across the U.S.; and BMW constructing nearly all its SUVs in Spartanburg, South Carolina. In fact, BMW ranks as the largest exporter of American-made vehicles by dollar value in the nation. However, a significant portion of these brands' vehicles is still manufactured overseas, which is where the tariffs will take effect on April 3. If Mercedes can transport as many cars as possible before that date, it can lessen the tariff impact for 2025.

According to Reuters, Mercedes is already anticipating a challenging year in 2025. With first-quarter earnings of $1.57 billion, its figures are already lower than last year due to a decline in sales in China and Europe. The current profit margins are around 6.4%, but Mercedes expects that the U.S. tariffs will reduce that margin by approximately 2.5%.

Other automotive companies may also be following suit, seeking to stay ahead of these new tariffs. However, this strategy will only mitigate the impact for 2025, and if the tariffs continue beyond that, manufacturers will need to come up with more innovative solutions to cut expenses.

Have tips? Send them to [email protected]

Other articles

Acura Integra sales have decreased by 28 percent this year to date.

Sales of light trucks for Honda and Acura are currently at an all-time high.

Acura Integra sales have decreased by 28 percent this year to date.

Sales of light trucks for Honda and Acura are currently at an all-time high.

Ford Transformed This ’90s Touring Car Icon Into a Racing Simulator. It's Now Available for Purchase.

This Ford Mondeo was converted into a sim rig after its time as a test car during the 1999 British Touring Car Championship season.

Ford Transformed This ’90s Touring Car Icon Into a Racing Simulator. It's Now Available for Purchase.

This Ford Mondeo was converted into a sim rig after its time as a test car during the 1999 British Touring Car Championship season.

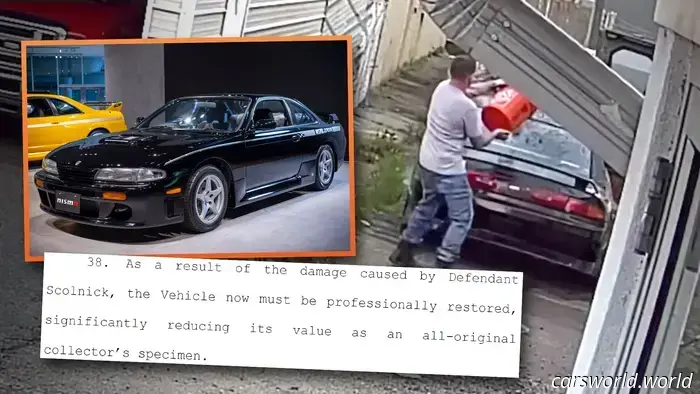

Nismo 270R Owner Files Lawsuit Against Fire Chief for Disposing of Rocks on His Vehicle

The plaintiff is seeking $500,000 as the rare coupe will lose its originality after being restored.

Nismo 270R Owner Files Lawsuit Against Fire Chief for Disposing of Rocks on His Vehicle

The plaintiff is seeking $500,000 as the rare coupe will lose its originality after being restored.

A town in Pennsylvania has painted squiggly lines on the roads to reduce speeding, and it's somewhat effective.

Some residents believed it was a joke, but the uneven lines are permanent. Additionally, drivers who aim to drive straight through them may not be able to do so for much longer.

A town in Pennsylvania has painted squiggly lines on the roads to reduce speeding, and it's somewhat effective.

Some residents believed it was a joke, but the uneven lines are permanent. Additionally, drivers who aim to drive straight through them may not be able to do so for much longer.

An individual created a 4×4 Honda Prelude by installing a second engine.

This fifth-generation Prelude, available on Cars & Bids, comes with two engines, two five-speed manual transmissions, and four-wheel drive. Who's interested?

An individual created a 4×4 Honda Prelude by installing a second engine.

This fifth-generation Prelude, available on Cars & Bids, comes with two engines, two five-speed manual transmissions, and four-wheel drive. Who's interested?

Porsche Giveaway Winner Crashes Free 911 GT3 RS While Speeding on Mountain Road

The Sheriff's Office of Storey County in Nevada apprehended the driver on grounds of suspected driving under the influence and possessing a firearm while intoxicated.

Porsche Giveaway Winner Crashes Free 911 GT3 RS While Speeding on Mountain Road

The Sheriff's Office of Storey County in Nevada apprehended the driver on grounds of suspected driving under the influence and possessing a firearm while intoxicated.

Mercedes' strategy involves accumulating cars prior to the implementation of their tariff plan.

This week marks the start of tariffs on imported cars, and according to reports, Mercedes aims to gather as much inventory as possible beforehand.