Chinese Brands Have Outperformed Europe's Most Renowned Name in Its Own Market | Carscoops

The surge in electric vehicle (EV) and plug-in hybrid electric vehicle (PHEV) sales from BYD and other Chinese manufacturers has allowed them to surpass Mercedes in registration numbers for June.

Chinese automakers are increasingly challenging Western brands in the European market. BYD achieved a remarkable 311 percent increase in EV sales, while Jaecoo and Omoda also performed well.

During the first half of the year, Chinese brands captured a 5.1 percent market share, just trailing behind Mercedes.

New vehicle registrations in Europe declined by 4.4 percent in June and 0.3 percent during the first six months of 2025. However, the standout figures from the latest Jato industry report highlight the explosive growth of Chinese brands, which have already overtaken several historic Western manufacturers and aim for more in the latter half of the year.

Overall, Chinese brands experienced a 91 percent sales surge, reaching 347,100 vehicles in H1, leading to a notable 5.1 percent share of the European car market. This positions them closely behind Mercedes at 5.2 percent (where they outperformed Mercedes in June) and ahead of Ford at 3.8 percent, shocking many observers.

Additionally, European consumers continue to buy more EVs, though not necessarily from Tesla.

BYD is at the forefront of this growth, with its EV sales skyrocketing by 133 percent in June and 143 percent in H1, equating to 41,300 electric vehicles sold, which placed them 12th among the most-registered EV brands. During the same timeframe, 13th placed Cupra sold 37,400 EVs, while Ford managed to sell 35,200.

The success of Chinese brands is not solely attributed to their EV sales, as plug-in hybrids from BYD, Jaecoo, and Omoda have also gained significant traction, with BYD’s Seal U tying with the VW Tiguan for the title of Europe’s best-selling PHEV in June.

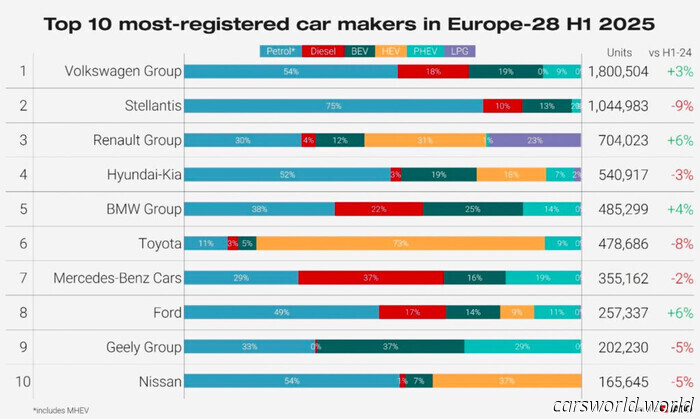

The first half of the year also saw other companies celebrating sales growth, notably VW Group (up 3 percent), Renault (up 6 percent), BMW (up 4 percent), and Ford (up 6 percent). Conversely, Tesla and Stellantis struggled, with Tesla's sales plummeting by 33 percent and Stellantis declining by 9 percent.

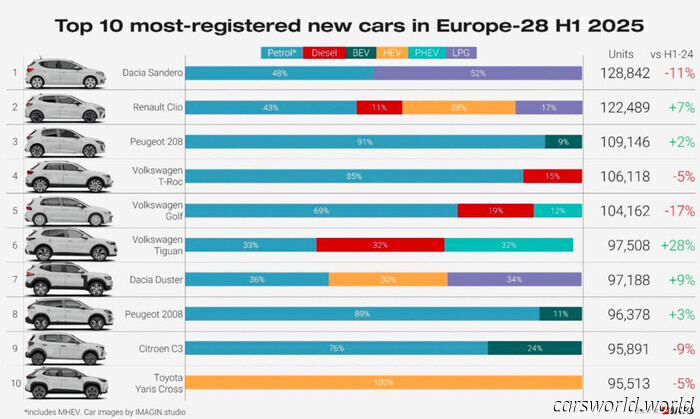

Dacia’s Sandero emerged as the best-selling car in Europe overall, registering 128,800 units despite an 11 percent drop in sales. It faces competition from the Renault Clio, which increased its sales by 7 percent to 122,500. The Peugeot 2008 took third place, followed closely by several VW models (T-Roc, Golf, and Tiguan).

The Tesla Model Y, which was once the best-selling car in Europe, saw its sales plummet by 33 percent to 68,800, preventing it from making it into the top 10. However, it experienced a slightly better performance in Q2 with a 13 percent decrease due to a spring facelift. During the same period, overall EV sales across all brands surged by 25 percent to 1.2 million, marking the first six-month interval where over 1 million EVs were registered.

BEST-SELLING EV BRANDS IN EUROPE

BEST-SELLING EV MODELS IN EUROPE

Lead image Mercedes

Chinese Brands Have Outperformed Europe's Most Renowned Name in Its Own Market | Carscoops

The surge in EV and PHEV sales from BYD and various other Chinese manufacturers enabled them to surpass Mercedes in registrations for June.