Oversight Following '23 Strikes Resulted in $80 Million Loss for UAW | Carscoops

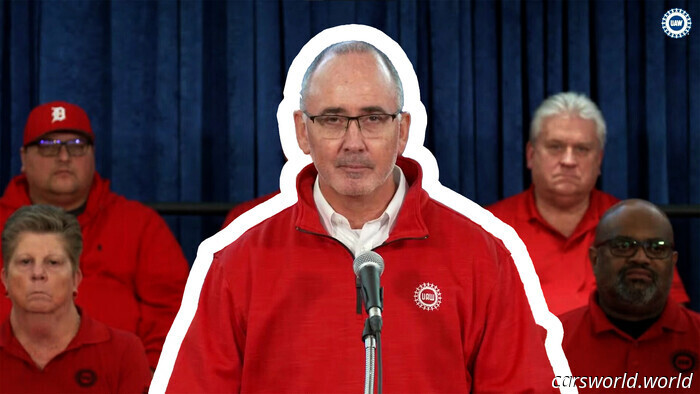

UAW president Shawn Fain expressed concern over the portfolio's returns being less favorable than those from a standard cash bank account, and the response was discouraging.

The UAW sold off $340 million in stock investments to support large-scale strikes in 2023.

Union regulations dictate that 30% of funds should be allocated to stocks and 53% to fixed income.

The leadership of the union, including the president and vice presidents, oversees the union’s investments.

The extensive strikes launched by the United Auto Workers (UAW) in 2023 not only imposed a heavy financial burden on the union but also led to a significant loss of over $80 million in unrealized investment gains due to poor management following the strikes. This news is likely to cast a shadow over the UAW, which has already faced its share of controversies.

Before the strikes began in the third quarter of 2023, the UAW board decided to liquidate approximately $340 million in stock investments to cover the costs of the strikes. Each UAW-represented employee who went on strike for six weeks received $500 weekly from this fund.

Following the conclusion of the strikes and the ratification of new labor contracts, the money that had been liquidated was expected to be reinvested in accordance with the union’s guidelines. As it stands, the UAW has about 30% of its assets in stocks, 53% in fixed income, and 17% in alternative investments. However, internal sources and documents indicate that virtually none of the portfolio was reinvested in stocks during the twelve months following the strikes.

Instead, the funds were allocated to fixed-income, cash, and alternative assets until September 2024. Reports from Reuters highlighted that the union conducted an analysis, revealing it could have potentially earned up to $80 million had the funds been invested appropriately. Staff members reportedly made this assessment by comparing the portfolio’s actual performance with what it could have achieved through standard investment strategies, which involve a 30% allocation mirroring the Russell 3000 index.

The investigation was prompted after UAW president Shawn Fain inquired why the portfolio’s returns were falling short compared to a cash bank account.

A federal monitor is currently looking into why the union failed to reinvest the funds correctly. This monitor was appointed following the UAW's settlement with the US Department of Justice concerning a corruption scandal.

According to the attorney for UAW Secretary-Treasurer Margaret Mock, the oversight of the UAW’s investments is the responsibility of the president, three vice presidents, and the secretary-treasurer.

Other articles

PHEVs Serve as a Bridge to EVs, Manufacturers Work Towards Balancing Cost and Range | Carscoops

Companies such as Toyota and Hyundai see PHEVs as a temporary step towards complete electrification and aim to manage costs while still satisfying customers.

PHEVs Serve as a Bridge to EVs, Manufacturers Work Towards Balancing Cost and Range | Carscoops

Companies such as Toyota and Hyundai see PHEVs as a temporary step towards complete electrification and aim to manage costs while still satisfying customers.

A Topless Demon 170 is Simply Inviting Trouble | Carscoops

One of the most unique Demon 170s is now available for auction, and this particular model has lost its roof and acquired a bit of an edge.

A Topless Demon 170 is Simply Inviting Trouble | Carscoops

One of the most unique Demon 170s is now available for auction, and this particular model has lost its roof and acquired a bit of an edge.

Is Bentley Compromising Its Values by Producing Models Like This? | Carscoops

At the request of an American client, the Mulliner personalization team painted this Bentayga in a strikingly un-Bentley color - Candy Pink.

Is Bentley Compromising Its Values by Producing Models Like This? | Carscoops

At the request of an American client, the Mulliner personalization team painted this Bentayga in a strikingly un-Bentley color - Candy Pink.

Introducing Physical Controls! Updated VW Electric Vehicles to Feature Actual Buttons | Carscoops

The refreshed ID.3 and ID.4 are set to be launched next year, featuring updated designs, new interiors, and an abundance of buttons.

Introducing Physical Controls! Updated VW Electric Vehicles to Feature Actual Buttons | Carscoops

The refreshed ID.3 and ID.4 are set to be launched next year, featuring updated designs, new interiors, and an abundance of buttons.

Oversight Following '23 Strikes Resulted in $80 Million Loss for UAW | Carscoops

UAW president Shawn Fain raised concerns about why the portfolio's returns were less than what one would receive from a bank account, and the response was discouraging.