Angry Investors Claim Geely's Acquisition Agreement Is Unfavorable | Carscoops

Other prominent investors believe that Zeekr is intentionally being undervalued.

Geely intends to acquire Zeekr completely with a $2.2 billion offer for the remaining shares.

Investors assert that Geely's proposal does not fairly reflect Zeekr's worth compared to electric vehicle competitors such as Nio.

Last year, Zeekr was valued at $13 billion, but this figure dropped to $5.5 billion at the time of its IPO.

Electric vehicle startups often experience rapid growth and significant fluctuations, yet Zeekr's recent developments are drawing attention for different reasons. Geely aims to privatize the electric car maker Zeekr just a year after its public listing in the United States. However, investors are concerned that Geely is undervaluing the company and are calling for a better offer.

Considering Zeekr is regarded as one of Geely's most valuable automotive assets, it's not surprising that the conglomerate seeks to gain complete control over it.

Currently, Geely possesses around two-thirds of Zeekr along with several other electric vehicle manufacturers that form part of the group. In 2023, a fundraising effort valued Zeekr at $13 billion, but its fully diluted valuation was lowered to $5.5 billion when it went public in the U.S. a year ago, representing less than half of the previous estimate.

Investors Stand Against Geely’s Proposal

In early May, Geely announced it intended to pay $2.2 billion to take Zeekr private, acquiring the remaining 34.3% stake. However, significant investors in Zeekr, including CATL, Intel Capital, and Boyu Capital—who participated in the company’s initial fundraising round—believe Geely’s offer does not accurately represent the company’s fair value. Other dissatisfied investors include Bilibili and Cathay Fortune Group.

As reported by Reuters, these five firms sent a letter to Geely arguing that the offer suggests Zeekr’s overall value is only $6.5 billion, which is a considerable discount compared to its rivals like Xpeng, Nio, and Li Auto, all of which have higher valuations despite similar challenges.

Geely's bid to acquire the remaining shares in Zeekr puts the value at $25.66 per share, representing a 24% premium over the average share price in the past four weeks. Following the announcement of the potential acquisition, Zeekr’s share price has risen to over $26.

Control Without Consensus?

The early investors have urged Zeekr’s special committee to carefully assess Geely’s offer. They also wish to prevent the deal from moving forward without a consensus among the majority of Zeekr’s independent minority shareholders.

Unfortunately for these shareholders, they may lack influence in this situation. Some analysts indicate that Geely’s current 65.7% stake in Zeekr could provide it enough voting power to proceed with the privatization without needing the approval of other shareholders.

Other articles

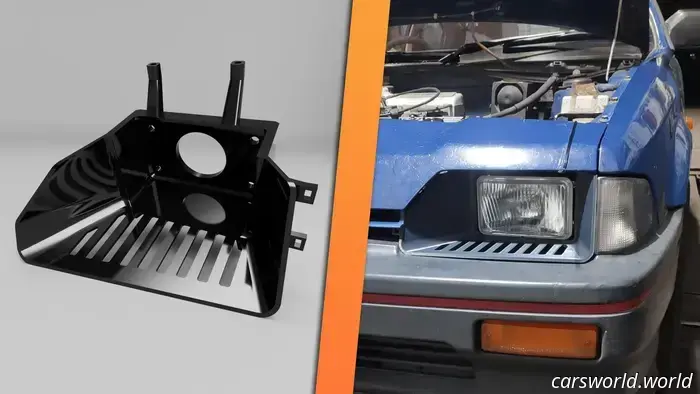

If you're in search of a car part that isn’t available, reach out to this individual.

We received some intriguing insights from an individual who 3D prints obsolete components and creates new designs from the ground up.

If you're in search of a car part that isn’t available, reach out to this individual.

We received some intriguing insights from an individual who 3D prints obsolete components and creates new designs from the ground up.

GR Badges Have Arrived in the Most Unexpected Places | Carscoops

With the introduction of the new GR Sport trim, the compact Aygo X becomes the first city car to offer a full hybrid powertrain.

GR Badges Have Arrived in the Most Unexpected Places | Carscoops

With the introduction of the new GR Sport trim, the compact Aygo X becomes the first city car to offer a full hybrid powertrain.

Mercedes' Electric G Stumbles So Severely It May Alter Future Developments | Carscoops

According to sources, even China, which has a strong preference for electric vehicles, has only acquired 58 electric G-Class SUVs since their introduction last year.

Mercedes' Electric G Stumbles So Severely It May Alter Future Developments | Carscoops

According to sources, even China, which has a strong preference for electric vehicles, has only acquired 58 electric G-Class SUVs since their introduction last year.

This Raptor Sold for $24K Above MSRP, and It's Not Even Brand New | Carscoops

Selecting the $31,925 Equipment Group 803A option converted this F-150 Raptor into a super-truck powered by a 5.2-liter, supercharged V8 engine.

This Raptor Sold for $24K Above MSRP, and It's Not Even Brand New | Carscoops

Selecting the $31,925 Equipment Group 803A option converted this F-150 Raptor into a super-truck powered by a 5.2-liter, supercharged V8 engine.

Limited Availability for This Ultimate McLaren Le Mans Tribute | Carscoops

A new ultra-rare supercar pays homage to McLaren's iconic Le Mans win, featuring aerodynamics inspired by the racetrack and motorsport elements both inside and out.

Limited Availability for This Ultimate McLaren Le Mans Tribute | Carscoops

A new ultra-rare supercar pays homage to McLaren's iconic Le Mans win, featuring aerodynamics inspired by the racetrack and motorsport elements both inside and out.

Beneath GM's Reductions in Korea is an Increasing Concern About Its Possible Withdrawal

Sales of GM's vehicles produced in Korea have fallen by 9.1% in the first four months of 2025.

Beneath GM's Reductions in Korea is an Increasing Concern About Its Possible Withdrawal

Sales of GM's vehicles produced in Korea have fallen by 9.1% in the first four months of 2025.

Angry Investors Claim Geely's Acquisition Agreement Is Unfavorable | Carscoops

Other significant investors believe that Zeekr is intentionally undervalued.