Classic Car Prices Drop Back to Pre-Pandemic Levels, But Is This a Deal or a Dilemma? | Carscoops

The spending surge during the pandemic caused an increase in car values, but due to ongoing global instability, prices are now reverting to their 'normal' levels.

Throughout the COVID pandemic, the costs of luxury items, including classic vehicles, soared.

Nonetheless, the current geopolitical and economic situation has introduced greater uncertainty.

As a result, classic car prices have returned to their pre-pandemic levels.

Since 2020, the world appeared to lose its grip, with the COVID pandemic leading many individuals to accumulate disposable income they couldn't spend, and while most were working remotely, it felt akin to being under house arrest to prevent virus transmission.

Nevertheless, where there's a will, there's a way, and people found a means to indulge: through online shopping. Luxury goods that provided pleasure, fulfilled childhood dreams, or were perceived as investments, surged in value due to the competition among various buyers for the same item.

Take, for instance, anyone who has attempted to purchase a Rolex (or other luxury watches like Audemars Piguet or Patek Philippe): acquiring any model necessitates being placed on a waiting list that could extend for years. Resellers thrived, as buyers turned to the grey market and willingly paid three to ten times the manufacturer's suggested retail price for a stainless steel watch that was less accurate than a smartphone. It’s quite astonishing, isn’t it?

Similar trends were observed in the classic car market. The prices for sought-after classics skyrocketed, as collectors were more than willing to pay millions beyond what they would have before 2020 to acquire that rare and highly coveted Ferrari for their collections. The brand choice was no accident.

Industry expert and auction analyst Rick Carey illustrated this to Hagerty with an example: a 1959 Ferrari 250 GT LWB California Spider Competizione, one of only eight in existence with an aluminum body, sold for $4.95 million at the RM Sotheby’s Monterey auction in 2007. After restoration, its new owner sold it for a remarkable $17,990,000 at the same auction house's New York event in 2017. While that was also prior to the pandemic, extremely rare classic Ferraris consistently increase in value regardless. No matter the restoration costs, turning a $12 million profit in ten years from a single car was quite an exceptional investment, wouldn’t you agree?

However, this year at Amelia, the same Ferrari changed ownership for a “mere” $9,465,000, including buyer's premium, indicating a staggering 47 percent drop in value, even falling short of the lowest initial estimate. We suspect that what Broad Arrow Auctions describes as “arguably the most significant 250 GT California Spider in existence” would have commanded a considerably higher price during the pandemic. However, it appears the owner waited, and now prices have decreased – or at least have returned to levels accessible to those willing to spend $10 million on a classic Ferrari.

“This is a beautiful car with a notable racing history, impeccable provenance, and no issues. It’s worth top dollar, but in 2025 ‘top dollar’ apparently means 60 percent of its 2017 value,” Carey observed.

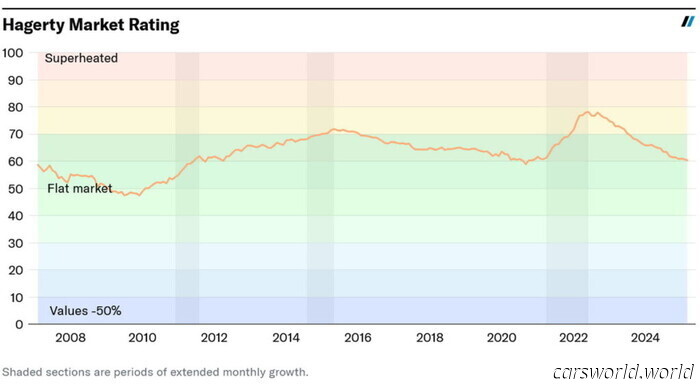

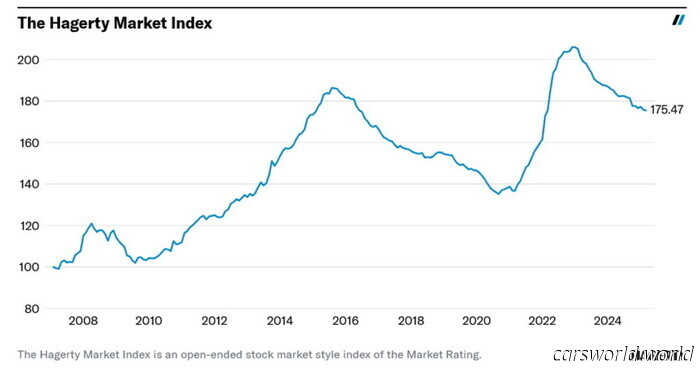

While one might consider this particular Ferrari a singular case, it's indicative of a larger trend. Hagerty's current Market Rating of 60.39 is the lowest since November 2020, marking the beginning of the classic car market's pandemic-driven boom. They suggest, “It’s fair to say that the market has returned to a pre-pandemic normal.” While rare Ferraris still go for millions, even mid-range vehicles are impacted.

Hagerty points out that “vehicles sold privately are increasingly trading at lower prices.” This is evidenced by the declining percentage of cars selling above their insured value, which has dropped to 38.9 percent, the lowest in over three years. At its peak in summer 2022, more than half of private sales surpassed their insured value. Now, for cars valued under $250,000, the ratio of insured value increases to decreases has reached its lowest mark since December 2021.

The reasoning is straightforward. First, buyers are reluctant to pay the inflated prices seen in the last three years. Second, due to an “unsteady” global market, prices are unlikely to see significant increases in the near future, and the economic policies put forth by US President Donald Trump, essentially targeting everything not American, won't improve the situation anytime soon.

Other articles

This Is Maserati’s Interpretation of Minimalism | Carscoops

The matte Blu Corse finish adorns the bodywork of this extensively customized MC20 Cielo.

This Is Maserati’s Interpretation of Minimalism | Carscoops

The matte Blu Corse finish adorns the bodywork of this extensively customized MC20 Cielo.

If you liked Snowrunner, Over the Hill seems like a game you have to try.

The developer of Art of Rally has released gameplay footage of their upcoming title, showcasing a serene haven for off-road enthusiasts.

If you liked Snowrunner, Over the Hill seems like a game you have to try.

The developer of Art of Rally has released gameplay footage of their upcoming title, showcasing a serene haven for off-road enthusiasts.

BYD CEO Claims Z9 GT Is 'Ten Times Superior' to Luxury Competitors | Carscoops

A brand that was initially established by BYD and Daimler is making its debut in Europe with the 952 hp Z9 GT, a sporty wagon reminiscent of a Porsche Panamera.

BYD CEO Claims Z9 GT Is 'Ten Times Superior' to Luxury Competitors | Carscoops

A brand that was initially established by BYD and Daimler is making its debut in Europe with the 952 hp Z9 GT, a sporty wagon reminiscent of a Porsche Panamera.

Classic Car Prices Drop Back to Pre-Pandemic Levels, But Is This a Deal or a Dilemma? | Carscoops

The surge in spending during the pandemic led to an increase in car values, but due to global instability, prices are trending back towards 'normal' levels.