New Transportation Legislation to Provide Auto Workers with 200% Tax Deduction | Carscoops

The Transportation Freedom Act intends to "revitalize auto manufacturing" in America. It proposes a 200% tax deduction for auto workers, subject to certain conditions. The act also aims to roll back regulations and create national standards.

Congress is actively introducing automotive-related legislation, with the Transportation Freedom Act being one of the most recent initiatives that has garnered support from various automakers. Its goal is to reduce regulations while providing attractive benefits to auto workers.

According to a document released by Ohio Senator Bernie Moreno, his office describes the bill as a "pro-America, pro-worker solution to revitalize auto manufacturing and ensure fairness in emissions regulations." Although it predominantly focuses on emissions, the 200% tax deduction for American auto workers is among the key aspects of the legislation.

Upon closer examination of the bill, it proposes modifying the Internal Revenue Code of 1986 by adding a provision for wages paid to automobile manufacturing employees. It aims to allow those involved in producing automobiles or automotive parts to claim a deduction equal to 200% of the total eligible wages paid during the taxable year.

However, there are various stipulations, including a requirement that 75% of total production must occur within the United States, along with an individual wage cap of $150,000 per taxable year.

Shifting focus to the regulatory aspect, the act seeks to repeal the EPA's Tailpipe Rule, which Moreno’s office claims would "require that 67% of all new vehicles be electric by 2032, irrespective of consumer demand or affordability."

Additionally, the act intends to remove "burdensome emissions regulations for heavy-duty trucks" and eliminate "arbitrary CAFE fuel economy standards." These would be replaced with stringent yet achievable standards based on market-ready technology and input from the industry.

Moreover, it proposes to revoke California's special status that allows the state to set its own standards. Instead, a unified national standard would be established, preventing one state from exerting influence over the entire country.

In the long term, the act plans to establish "stable emissions and fuel economy standards from 2027 to 2035," which are expected to be affordable and practical, aiming to avoid government mandates that are disconnected from consumer demand.

Other articles

Stellantis Leader Rejects Trump's Tariffs and Proposes an Alternative Approach | Carscoops

John Elkann mentioned that eliminating a loophole permitting 4 million foreign-made cars to enter the US could enhance jobs and investments in the country.

Stellantis Leader Rejects Trump's Tariffs and Proposes an Alternative Approach | Carscoops

John Elkann mentioned that eliminating a loophole permitting 4 million foreign-made cars to enter the US could enhance jobs and investments in the country.

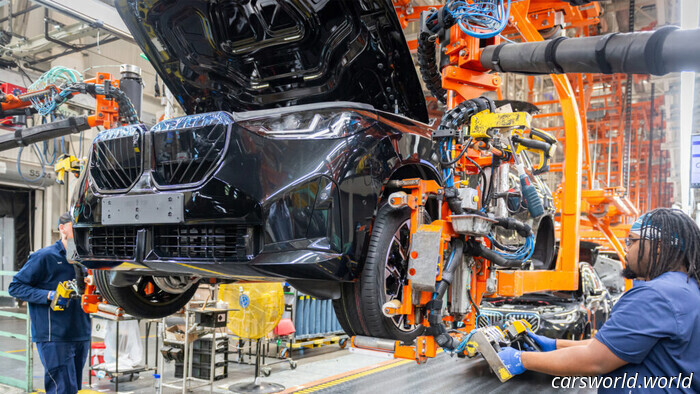

BMW is the leading vehicle exporter in the U.S. by value | Carscoops

The extensive production facility has manufactured over 2.7 million vehicles in the last ten years.

BMW is the leading vehicle exporter in the U.S. by value | Carscoops

The extensive production facility has manufactured over 2.7 million vehicles in the last ten years.

The PV5 Represents Kia's Concept for an Electric Minivan | Carscoops

The PV5 can be viewed as an ID.Buzz tailored for Uber drivers and businesses.

The PV5 Represents Kia's Concept for an Electric Minivan | Carscoops

The PV5 can be viewed as an ID.Buzz tailored for Uber drivers and businesses.

New Transportation Legislation to Provide Auto Workers with 200% Tax Deduction | Carscoops

It would also reverse regulations and establish attainable fuel efficiency standards.