Q4 Auto Sales Figures Are Expected to Be Low

The Drive

The latest car news and reviews, no nonsense

Our complimentary daily newsletter delivers the most important stories straight to you every weekday.

As 2025 comes to a close, dealers continue to face challenges in attracting customers. Among the few automakers that still provide monthly sales updates, only a handful had favorable news to report. With increasing prices and an unpredictable economic environment, 2025 is anticipated to end quietly rather than with excitement.

Earlier this year, automakers managed to stave off the initial stages of declining sales by introducing incentive programs to mitigate tariffs and maintain low sticker prices. Both Ford and Stellantis reintroduced their employee pricing schemes to combat rising expenses, while the latter is also utilizing price reductions and additional incentives to enhance sales. However, after a surge in dealership visits to capitalize on EV and PHEV tax credits that expired in September, car buyers have significantly decreased in October and November.

Now, let’s highlight the positive news:

Toyota – Toyota and Lexus achieved a volume increase of just over 2.5% in November. The company is still nearly 8% up for the year, with any positive result being an added bonus. For Toyota to fall below its 2024 sales volume, it would practically need to shut down for the remainder of 2025, which is unlikely.

Hyundai/Kia – Hyundai and Kia experienced nearly opposite trends in November. Hyundai’s sales were slightly down compared to the previous year, while Kia saw a marginal increase. The two figures balanced each other out, leaving them flat year-over-year. However, since Kia surpassed its 2024 numbers, it marked the strongest November ever for the brand in the United States.

Ford – Similar to the Korean automakers, Ford neither gained nor lost a statistically significant number of customers in November. Although its sales showed a minor decline this year, it was just 40 units out of 156,000.

Now, onto the less favorable news.

Honda – Unfortunately, Honda reported a significant drop of 15% near the end of the year, attributing it to supply chain issues. It’s important to note that the company was not heavily invested in EVs; it only had two models—one Honda and one Acura—and neither contributed to November's decline. Sales of the HR-V, CR-V, Odyssey, Accord, Civic, Pilot, and Ridgeline fell between 5% and 27% in November. The only positive point? Passport sales rose by 50%.

Subaru – While Subaru sold a considerable number of its Solterra EVs earlier this year, it cannot blame the EV credit for its struggles. November sales were down by more than 9% (following a similarly weak October), and like Honda, the company found no easy explanations for its decline, with every model showing a decrease.

Volvo – In contrast to some other automakers, Volvo has embraced electrification more aggressively. After a 10% drop in November, Volvo described the U.S. market as “subdued.”

We don’t anticipate any further November figures at this time, as other automakers reserve their reports for quarterly updates. Check back during the first week of January for a comprehensive review of sales across the industry for 2025.

Have a news tip? Reach out to us at [email protected]!

Other articles

A video captures a driverless Waymo navigating through a Los Angeles crime scene while police shout commands.

The LAPD stated that the event concluded swiftly without interfering with the arrest. Waymo referred to it as an opportunity for learning as its testing expands across the country.

Although autonomous driving has made significant advancements in the past decade, there are still areas for improvement. Waymo, a leader in this field, needs to address some issues, including how to respond to live crime scenes.

Recently, a video surfaced showing one of the company's robotaxis calmly traversing an intersection while police were attempting a felony arrest with guns drawn.

Content creator Alex Choi shared footage of the event, where the car can be seen making a left turn at an intersection. Nearby, a parked truck with an open driver’s door is on the side of the road, and just next to it, a suspect lies face down on the ground, being held at gunpoint by officers.

Interestingly, the robotaxi slows down and seems to pause as it passes by the suspect, despite being in the line of fire at that moment. The video concludes after the vehicle departs, while the police move in to apprehend the suspect.

Police informed NBC that the incident occurred around 3:40 a.m. and that the presence of the robotaxi did not alter their tactics during the arrest.

In response, Waymo indicated that the entire encounter lasted only 15 seconds. A spokesperson emphasized the company's commitment to safety, stating, "Safety is our highest priority at Waymo, both for individuals who choose to ride with us and for those we share the streets with. When we face unusual occurrences like this, we learn from them as we continue to enhance road safety and operate in bustling cities."

As of mid-2025, the company has accumulated over 100 million miles of autonomous driving and maintains a solid safety record, though it hasn't been free from peculiar incidents and PR challenges.

Earlier this year, pranksters managed to redirect 50 Waymos to the same intersection in San Francisco, causing a traffic jam. In another event, five Waymo vehicles were set on fire during protests in Los Angeles.

The scheme involved 50 people gathering at San Francisco's longest dead-end street to simultaneously order a Waymo.

Credit: Alex Choi

Mitsubishi's North American division incurred a loss in the April-September timeframe, and a potential partnership might aid in reversing this trend.

A video captures a driverless Waymo navigating through a Los Angeles crime scene while police shout commands.

The LAPD stated that the event concluded swiftly without interfering with the arrest. Waymo referred to it as an opportunity for learning as its testing expands across the country.

Although autonomous driving has made significant advancements in the past decade, there are still areas for improvement. Waymo, a leader in this field, needs to address some issues, including how to respond to live crime scenes.

Recently, a video surfaced showing one of the company's robotaxis calmly traversing an intersection while police were attempting a felony arrest with guns drawn.

Content creator Alex Choi shared footage of the event, where the car can be seen making a left turn at an intersection. Nearby, a parked truck with an open driver’s door is on the side of the road, and just next to it, a suspect lies face down on the ground, being held at gunpoint by officers.

Interestingly, the robotaxi slows down and seems to pause as it passes by the suspect, despite being in the line of fire at that moment. The video concludes after the vehicle departs, while the police move in to apprehend the suspect.

Police informed NBC that the incident occurred around 3:40 a.m. and that the presence of the robotaxi did not alter their tactics during the arrest.

In response, Waymo indicated that the entire encounter lasted only 15 seconds. A spokesperson emphasized the company's commitment to safety, stating, "Safety is our highest priority at Waymo, both for individuals who choose to ride with us and for those we share the streets with. When we face unusual occurrences like this, we learn from them as we continue to enhance road safety and operate in bustling cities."

As of mid-2025, the company has accumulated over 100 million miles of autonomous driving and maintains a solid safety record, though it hasn't been free from peculiar incidents and PR challenges.

Earlier this year, pranksters managed to redirect 50 Waymos to the same intersection in San Francisco, causing a traffic jam. In another event, five Waymo vehicles were set on fire during protests in Los Angeles.

The scheme involved 50 people gathering at San Francisco's longest dead-end street to simultaneously order a Waymo.

Credit: Alex Choi

Mitsubishi's North American division incurred a loss in the April-September timeframe, and a potential partnership might aid in reversing this trend.

Remove the snow from your wheels as soon as possible.

Snow and ice can become lodged in your wheels, disrupting your tire balance. Even a small amount, like a quarter ounce of snow, can cause the car to feel unbalanced.

Remove the snow from your wheels as soon as possible.

Snow and ice can become lodged in your wheels, disrupting your tire balance. Even a small amount, like a quarter ounce of snow, can cause the car to feel unbalanced.

Robotaxi Drives Through LAPD Crime Scene While Suspect Is Held at Gunpoint | Carscoops

A video captures a Waymo vehicle without a driver maneuvering through a crime scene in Los Angeles while police issue verbal instructions.

Robotaxi Drives Through LAPD Crime Scene While Suspect Is Held at Gunpoint | Carscoops

A video captures a Waymo vehicle without a driver maneuvering through a crime scene in Los Angeles while police issue verbal instructions.

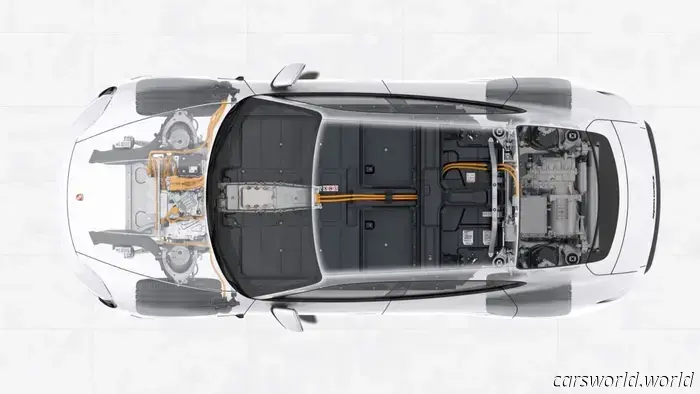

Porsche is introducing artificial gear shifts in its electric vehicles, with the 2027 Taycan being the first model to feature them: Exclusive.

Porsche plans to adopt a "virtual transmission" for its electric vehicles to enhance driver engagement, following Hyundai's example.

Porsche is introducing artificial gear shifts in its electric vehicles, with the 2027 Taycan being the first model to feature them: Exclusive.

Porsche plans to adopt a "virtual transmission" for its electric vehicles to enhance driver engagement, following Hyundai's example.

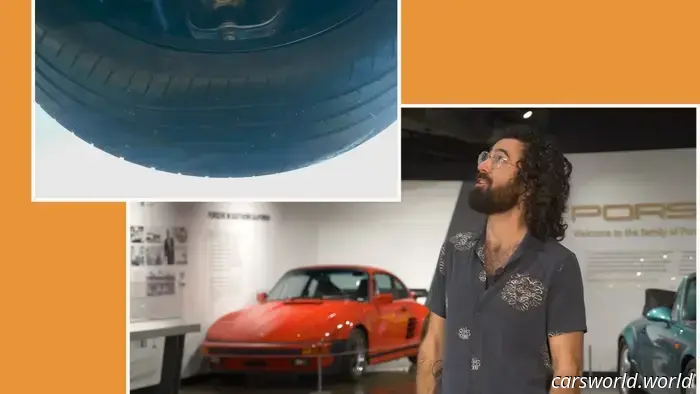

What Actually Occurs with Your Tires When You Drive at High Speeds

We drove a Porsche on a glass surface so you can observe how your tires react while cornering.

What Actually Occurs with Your Tires When You Drive at High Speeds

We drove a Porsche on a glass surface so you can observe how your tires react while cornering.

The Artificial Noises in Scout’s Electric Vehicles Are Derived Directly from Authentic American Engines | Carscoops

From the sounds of door slams to the echoes of grain silos, Scout deployed its sound engineers to create a distinctive soundscape.

The Artificial Noises in Scout’s Electric Vehicles Are Derived Directly from Authentic American Engines | Carscoops

From the sounds of door slams to the echoes of grain silos, Scout deployed its sound engineers to create a distinctive soundscape.

Q4 Auto Sales Figures Are Expected to Be Low

October and November have brought us two back-to-back months of mediocrity. Our expectations for December aren’t very optimistic.