Is the Government Using WhistlinDiesel as a Cautionary Example?

WhistlinDiesel via Instagram, YouTube

The most significant automobile news and reviews, with no nonsense.

Our daily newsletter, free of charge, delivers the stories that truly matter to you every weekday.

Cody Detwiler, known as WhistlinDiesel on YouTube, was detained last week for alleged tax evasion. The state of Tennessee specifically took issue with a Ferrari F8 Tributo he purchased in 2023 and later registered in Montana, where he does not reside. The Ferrari was in his possession for only a brief time before its unfortunate destruction, a fate that many of his cars seem to meet. Despite this, Detwiler faced charges and was released on a $2 million bond.

The Montana registration loophole is commonly exploited by owners of luxury vehicles, as the state does not impose sales tax, does not require emissions testing, and has low registration fees. It also allows non-residents to form LLCs in the state and register their vehicles under those companies. While utilizing this loophole is technically illegal if one does not live or conduct business in Montana, a visit to any significant car meet featuring vehicles with Montana plates reveals that enforcement is largely absent.

This raises the question Detwiler posed on Instagram after his release: Is the government simply trying to make an example out of him? And for what purpose?

We won’t delve into whether Detwiler is guilty or if Tennessee has a solid case. He openly acknowledges registering the car in Montana to dodge “possibly $30,000 in sales tax” that would have benefitted Tennessee. However, there is one major distinction between him and countless others who have engaged in similar actions without repercussions—he boasts 10 million subscribers on YouTube, along with millions more across various social media platforms.

Detwiler asserts that he never received any written communication, phone call, or notification before being arrested by six officers on November 12. In the same Instagram Story, he claimed that “they targeted the worst person” to set an example, predicting that it will result in “the most enormous backfiring in history.” It’s highly probable that this scenario will generate more content for his channel, capturing the attention of millions.

Part of me believes that this might be precisely what the state, along with others losing tax revenue due to the Montana registration loophole, would desire. Regardless of whether the indictment holds in court, it serves as a warning to exotic car owners throughout the U.S. that they could face scrutiny if they register their vehicles elsewhere. Detwiler himself noted: “They believe it will create a stir within the luxury car community and generate tax revenue.”

Whether people love him or despise him, he is likely correct. This practice has already drawn criticism from other states, as Utah implemented S.B.52 earlier in 2025 to tackle out-of-state vehicle registrations for residents. Simply establishing an LLC in Montana and claiming a car as its sole asset will not be sufficient. The narrative changes if there is substantial documentation such as bank records, contracts, and business insurance. However, I can confidently say that not every supercar owner with Montana plates can provide such evidence.

Time will reveal whether this sets a significant precedent moving forward, but in any case, anticipate increased scrutiny on the Montana registration loophole.

Have a tip or question for the author? Reach out to them directly: [email protected]

Other articles

Allegedly Unlicensed Driver Wrecks Rental G-Class to the Point Where Chassis Separates from Body | Carscoops

The forces were so intense that the chassis detached from the cab of the Mercedes.

Allegedly Unlicensed Driver Wrecks Rental G-Class to the Point Where Chassis Separates from Body | Carscoops

The forces were so intense that the chassis detached from the cab of the Mercedes.

Audi Is Developing A Defender Competitor From The Scout In The U.S. | Carscoops

The large electric SUV from Germany will be manufactured at a factory owned by the new sister brand, Scout Motors.

Audi Is Developing A Defender Competitor From The Scout In The U.S. | Carscoops

The large electric SUV from Germany will be manufactured at a factory owned by the new sister brand, Scout Motors.

A discontinued camper rental business is liquidating its entire inventory of custom vans.

Hmmm.... rented vans. What could possibly go wrong?

A discontinued camper rental business is liquidating its entire inventory of custom vans.

Hmmm.... rented vans. What could possibly go wrong?

The Freelander is returning as an independent brand and will be launching shortly | Carscoops

A timeless nameplate makes a comeback as a contemporary hybrid for China, created through a domestic collaboration and targeted at a new generation of motorists.

The Freelander is returning as an independent brand and will be launching shortly | Carscoops

A timeless nameplate makes a comeback as a contemporary hybrid for China, created through a domestic collaboration and targeted at a new generation of motorists.

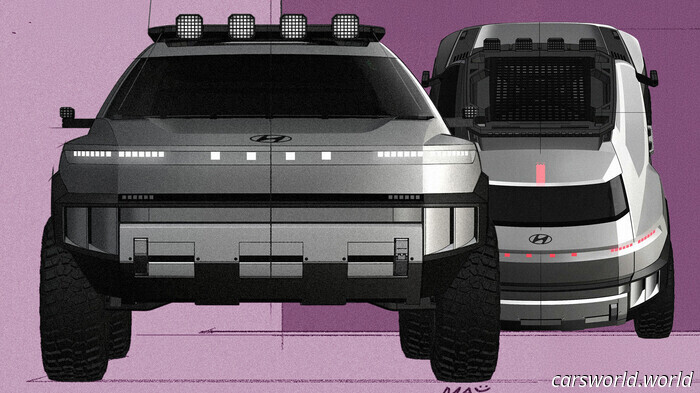

Hyundai Crater Concept Emerges as a Potential Competitor to the Bronco | Carscoops

The rugged SUV concept is making its appearance at the LA Auto Show this week.

Hyundai Crater Concept Emerges as a Potential Competitor to the Bronco | Carscoops

The rugged SUV concept is making its appearance at the LA Auto Show this week.

Mercedes-AMG's Latest GLC Targets the Macan EV with Supercar Performance | Carscoops

The AMG GLC will feature three electric motors, a simulated transmission, and an engine sound reminiscent of an internal combustion engine.

Mercedes-AMG's Latest GLC Targets the Macan EV with Supercar Performance | Carscoops

The AMG GLC will feature three electric motors, a simulated transmission, and an engine sound reminiscent of an internal combustion engine.

Is the Government Using WhistlinDiesel as a Cautionary Example?

Thousands of supercar owners have exploited the Montana registration loophole to evade sales tax on their vehicles, but they typically do not face arrest for this.