It Turns Out That Electric Vehicle Sales Required the Tax Credit More than Previously Acknowledged | Carscoops

The conclusion of America’s $7,500 EV tax credit led to frantic purchasing, resulting in record sales as automakers prepare for a projected decrease.

EV sales reached unprecedented levels as consumers rushed to take advantage of the tax credit before it expired.

Ford, GM, and Tesla experienced significant increases in sales prior to the cessation of the incentive.

Leasing loopholes enabled foreign-manufactured EVs to qualify for federal benefits.

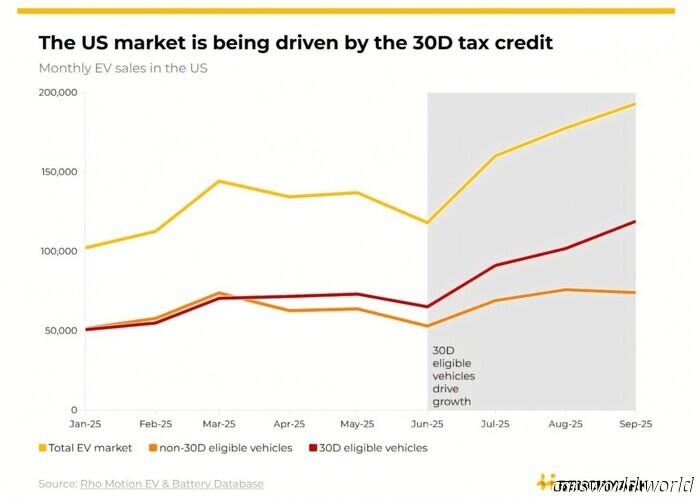

Despite the emphasis on market dynamics affecting the automotive sector, it appears that government incentives were the primary driving force behind electric vehicle sales until the end of September, when the federal tax credits came to a close.

According to market research firm Rho Motion, nearly 90 percent of all battery-electric and plug-in hybrid vehicles sold in the U.S. through the first nine months of the year are believed to have utilized some form of tax credit.

A Surge Before the Deadline

With the expiration of the federal EV tax credit on October 1, consumers rushed to secure qualifying models, resulting in record sales for multiple brands and escalating overall EV demand to new levels in August and September.

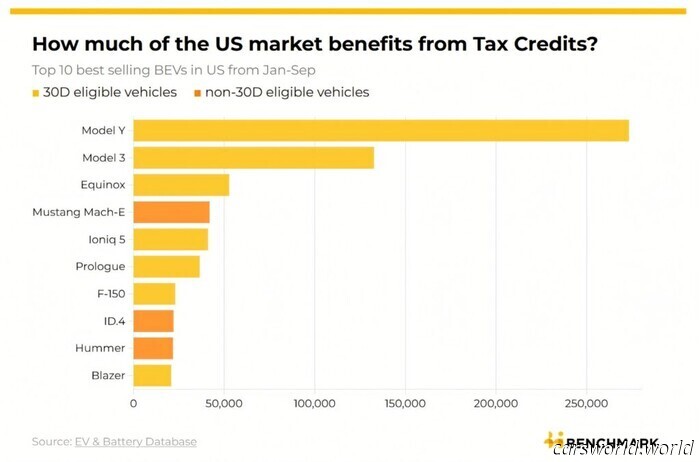

This year, the EPA identified 20 battery-electric vehicles and one plug-in hybrid as eligible for the New Clean Vehicle Credit, which offers up to $7,500. Collectively, these vehicles represented 55 percent of all EV sales from January to September.

Leasing Loopholes and Fleet Boosts

Equally vital to boosting sales was the less-publicized Qualified Commercial Clean Vehicle Credit, also valued at up to $7,500.

This credit applied to vehicles weighing under 14,000 lbs and targeted fleet and business buyers. It allowed manufacturers to claim the tax credit and lower leasing prices for new vehicles.

Importantly, leased passenger cars and trucks were not bound by the same sourcing and assembly requirements as those purchased outright. They were also not required to be manufactured in North America, which made leasing particularly appealing for both manufacturers and consumers.

As the September 30 deadline loomed, sales of electric vehicles surged throughout the U.S. Rho Motion reported that Ford sold 30,612 battery-electric vehicles in the third quarter, marking an impressive 86 percent rise from Q2.

GM's BEV sales also increased by 44 percent to 66,501 units. Tesla recorded a 27 percent rise in sales, while Hyundai saw significant growth driven by more than a doubling of demand for the Ioniq 5.

What Comes After the Incentives?

It is unclear how drastically BEV and PHEV sales will decline in the fourth quarter following the end of the tax credit. Rho Motion anticipates a "sharp decline" in demand.

The research firm further highlights that tariffs, elevated local manufacturing costs, and lenient fuel efficiency standards may dissuade investment in domestic EV production, exerting additional pressure on demand in the forthcoming months.

Other articles

Is BMW's Most Disliked Model Truly the Best-Selling Super SUV in the World? | Carscoops

The XM is surpassing the exotics in sales, but one could certainly contend that this attention-grabbing achievement may not be as impressive as it seems.

Is BMW's Most Disliked Model Truly the Best-Selling Super SUV in the World? | Carscoops

The XM is surpassing the exotics in sales, but one could certainly contend that this attention-grabbing achievement may not be as impressive as it seems.

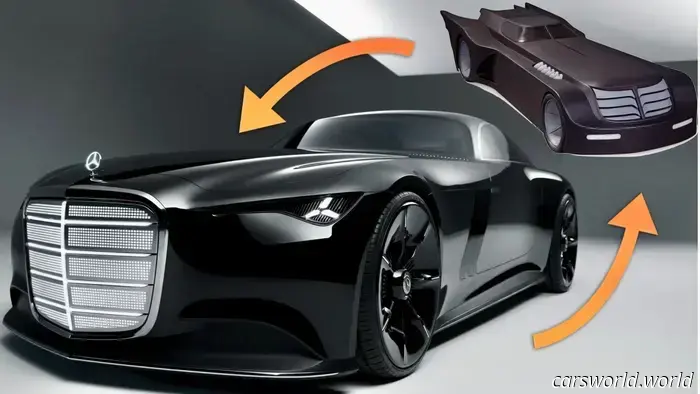

Mercedes' Latest Concept Vehicle Appears as If It's Taken Directly from '90s Batman Cartoons.

Mercedes' latest concept vehicle features self-driving capabilities and even incorporates solar paint, but the most exciting aspect is its resemblance to a classic Batmobile.

Mercedes' Latest Concept Vehicle Appears as If It's Taken Directly from '90s Batman Cartoons.

Mercedes' latest concept vehicle features self-driving capabilities and even incorporates solar paint, but the most exciting aspect is its resemblance to a classic Batmobile.

GM Discreetly Abandons Its Hydrogen Ambitions to Pursue Electric Vehicles | Carscoops

Although it was an early supporter of hydrogen, the company has now redirected its attention to electric vehicles (EVs).

GM Discreetly Abandons Its Hydrogen Ambitions to Pursue Electric Vehicles | Carscoops

Although it was an early supporter of hydrogen, the company has now redirected its attention to electric vehicles (EVs).

The typical price of a new car has surpassed $50,000.

According to one analyst, the $20K new car is now "largely extinct," and we shouldn't expect it to return.

The typical price of a new car has surpassed $50,000.

According to one analyst, the $20K new car is now "largely extinct," and we shouldn't expect it to return.

It Turns Out That Electric Vehicle Sales Required the Tax Credit More than Previously Acknowledged | Carscoops

The conclusion of America's $7,500 EV tax credit caused buyers to rush, leading to record sales as automakers prepare for an anticipated decline.