This Eye-Opening Chart Uncovers the True Players in China's Automotive Market | Carscoops

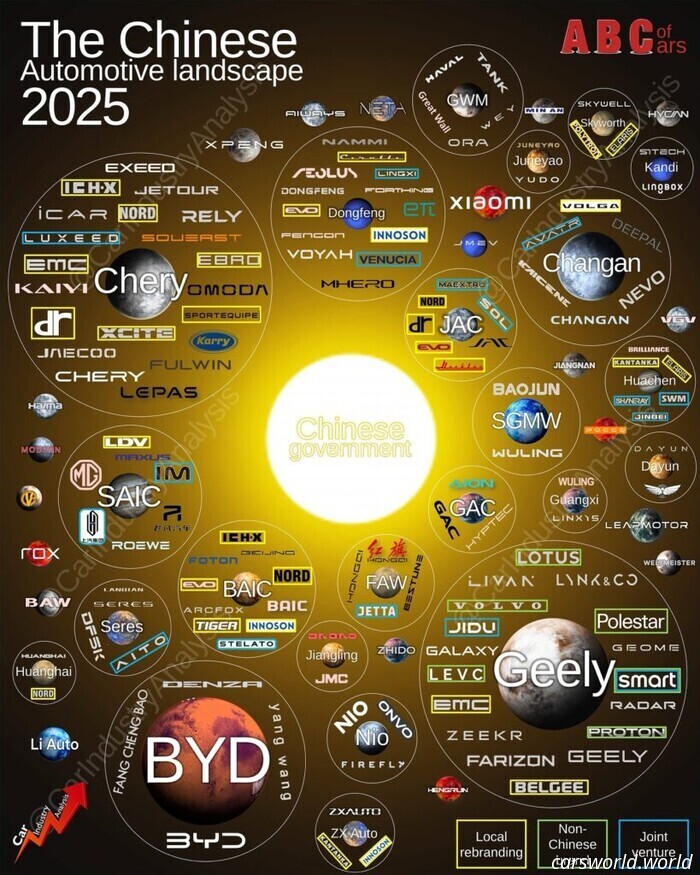

China's auto industry is depicted in a single chart, highlighting key players, hidden ownerships, and brands that might not endure.

BYD, Changan, Chery, and Geely collectively generate more than half of China's car sales.

Independent startups such as Nio, Xpeng, and Xiaomi are facing increasing pressures while remaining autonomous.

Several Chinese car brands are unlikely to last another decade.

Do you find it challenging to comprehend China's automobile market and the overwhelming variety of brands it encompasses? If that’s the case, this comprehensive infographic aims to clarify the nation's automotive sector. However, be prepared that examining it may raise as many questions as it provides answers.

This chart, created by industry analyst Felipe Munoz, details every car manufacturer that is fully or partially owned by Chinese entities. In terms of sales, the country's four leading groups are Geely, BYD, Chery, and Changan, with the last two notably being state-owned.

Who Owns What?

The Chery group includes brands such as Fulwin, Omoda, Jetour, Exeed, iCar, Luxeed, Jaecoo, Rely, and of course, the Chery brand itself. Changan encompasses brands like Avatr, Deepal, Nevo, Volga, and Kaicheng.

Geely, on the other hand, has a diverse portfolio that includes brands like Zeekr, Proton, Farizon, LEVC, Galaxy, Volvo, Lotus, Lynk & Co, Polestar, Smart, Geome, Belgee, and Radar. BYD's range is relatively simpler, consisting of its namesake along with Denza, YangWang, and Fan Cheng Bao.

As noted by Munoz, these four groups account for 56% of total car sales in China. All of them benefit from local government subsidies, and in the chart, the companies with the most state involvement are depicted closer to the sun.

The Wider Circle

Apart from China's Big Four, other significant conglomerates include SAIC, which owns the MG, LDV, Maxus, IM, and Roewe brands; JAC, which includes Maextro, JAC, Evo, and Nord; and BAIC, which comprises Arcfox, Foton, Tiger, and Stelato. Dongfeng also contributes, owning brands such as MHero, Voyah, Lingxi, Nammi, and Venucia.

Several noteworthy startups have managed to remain independent from these larger groups, including Nio, which has introduced the Onvo and Firefly brands, as well as Leapmotor, Xpeng, Aiways, Neta, Xiaomi, Li Auto, and Rox.

Stacking China’s Car Brands By Status

Furthermore, Munoz has shared a second chart featuring a pyramid that categorizes 109 brands by market position. At the top are ultra-premium names like Hongqi, YangWang, and Maextro. The next tier consists of high-tech challengers like Xiaomi, Nio, and Li Auto.

Below these are the premium and semi-premium categories, populated by names such as Stelato, Denza, Zeekr, and Xpeng, all targeting buyers mindful of status. The base contains older, budget-friendly brands that remain relatively unknown in the West, such as Sinogold, Hima, Pocco, among others. These brands could fade into obscurity as consumers increasingly prefer more advanced, connected vehicles.

Survival Of The Fittest

Despite these details, it is improbable that all these brands will survive the next decade. While the major groups are likely to persist, they may opt to merge or discontinue some of their sub-brands, reminiscent of the trends in the West where brands like Pontiac, Oldsmobile, NSU, Autobianchi, and Sunbeam have vanished from dealership floors over the years.

It is evident that Chinese car manufacturers are not going anywhere and will maintain a significant presence in the global auto industry for the foreseeable future.

This Eye-Opening Chart Uncovers the True Players in China's Automotive Market | Carscoops

A single chart illustrates China's auto industry, highlighting major participants, concealed shareholders, and brands that could potentially fail.