Ford's Dangerous Strategy to Increase Truck Sales Echoes the 2008 Situation | Carscoops

Buyers with poor credit scores are being presented with low-interest financing options, but this choice could turn out to be a risky move.

Ford aims to boost F-150 sales by reaching out to customers with subpar credit ratings. From now until the end of September, sub-prime borrowers will receive interest rates comparable to those offered to prime borrowers. Although F-150 sales have increased in 2025 overall, August figures have declined compared to last year.

The F-150 is crucial to Ford’s operations, representing about 40 percent of its yearly production and consistently ranking high in national sales. However, F-Series sales saw a 3.4 percent drop in August, prompting Ford to adopt a strategy that may cause concern among those who recall the financial crisis of the late 2000s, which stemmed from lax lending practices.

Ford is shifting its focus towards American consumers with less-than-ideal credit ratings to boost sales, as reported by the WSJ. Throughout September, customers with lower credit scores can take advantage of interest rates that are typically reserved for safer borrowers. These customers are also offered extended loan terms of up to 72 or even 84 months to make monthly payments more manageable.

The timing is significant: sub-prime borrowers in the US faced average APRs around 16 percent in Q2, according to Experian data cited by the WSJ, while low-risk borrowers gained access to financing at only 5 percent. Ford’s limited-time program considerably narrows this gap, potentially enabling new truck ownership for those who thought it was out of reach.

An increase in sales during September, driven by more affordable financing, could positively affect Ford’s third-quarter results. The starting price for the truck lineup is just under $39,000, but fully equipped models like the Raptor R can exceed $115,000.

Additionally, Ford’s move to facilitate financing for high-risk drivers coincides with a report from the Consumer Federation of America (CFA), which highlighted a rise in auto loan delinquencies. Notably, the report revealed that not just sub-prime borrowers are struggling, but those with average credit scores are also having trouble keeping up with payments.

A Ford Credit representative told the WSJ that the company stays selective in its lending practices. “We only finance customers we consider creditworthy and who have the ability to repay,” stated a Ford finance spokesperson. “We have previously initiated similar national programs, offering promotional rates to customers who satisfy our credit standards.”

Other articles

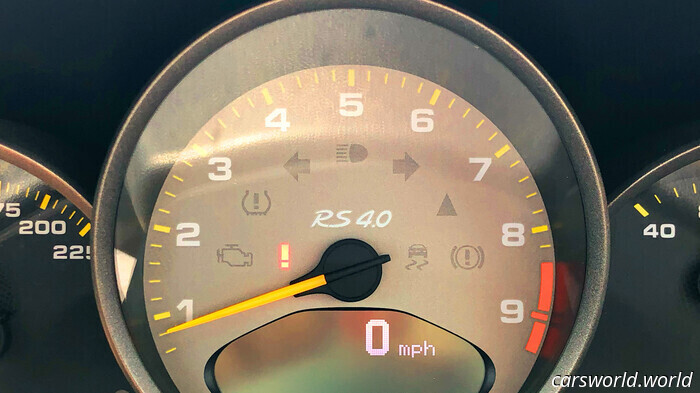

Porsche's Gentrification of Internal Combustion Engines Is Just the Beginning of Exclusively Premium Features | Carscoops

The 718 Boxster and Cayman were initially designed as electric vehicles but will now offer an internal combustion engine option for high-end customers.

Porsche's Gentrification of Internal Combustion Engines Is Just the Beginning of Exclusively Premium Features | Carscoops

The 718 Boxster and Cayman were initially designed as electric vehicles but will now offer an internal combustion engine option for high-end customers.

Mercedes' Smallest SUV Unveils New Lighting Signature | Carscoops

The new hybrid GLA has been spotted featuring an LED loop that encircles its star-shaped taillights.

Mercedes' Smallest SUV Unveils New Lighting Signature | Carscoops

The new hybrid GLA has been spotted featuring an LED loop that encircles its star-shaped taillights.

The Case for Triple-Axle Trailers Is a Fallacy

If you believe that having three axles is consistently superior to two, let a towing specialist clarify that for you.

The Case for Triple-Axle Trailers Is a Fallacy

If you believe that having three axles is consistently superior to two, let a towing specialist clarify that for you.

Marvel Comics will launch Star Wars #6 on Wednesday, and you can catch a glimpse of the issue below…

The New Republic teeters on the edge of war! LUKE, HAN, and VALANCE confront a host of threats from the Clone Wars era! PRINCESS LEIA plays her last card against the escalating danger! RYNN ZENAT uncovers a clue that illuminates the challenges faced by the enigmatic NAGAI!

Star Wars #6 is set to be released on Wednesday, October 1st, 2025.

Originally published on September 27, 2025. Updated on September 28, 2025. About Gary Collinson: Gary Collinson is a producer and writer in film, TV, and digital content, who founded the pop culture site Flickering Myth and is the producer of the gothic horror film 'The Baby in the Basket' as well as the upcoming thriller 'Death Among the Pines'.

If you're looking for an SUV that grabs attention, you need to get a Lamborghini LM002.

Marvel Comics will launch Star Wars #6 on Wednesday, and you can catch a glimpse of the issue below…

The New Republic teeters on the edge of war! LUKE, HAN, and VALANCE confront a host of threats from the Clone Wars era! PRINCESS LEIA plays her last card against the escalating danger! RYNN ZENAT uncovers a clue that illuminates the challenges faced by the enigmatic NAGAI!

Star Wars #6 is set to be released on Wednesday, October 1st, 2025.

Originally published on September 27, 2025. Updated on September 28, 2025. About Gary Collinson: Gary Collinson is a producer and writer in film, TV, and digital content, who founded the pop culture site Flickering Myth and is the producer of the gothic horror film 'The Baby in the Basket' as well as the upcoming thriller 'Death Among the Pines'.

If you're looking for an SUV that grabs attention, you need to get a Lamborghini LM002.

So You Aspired to Be Top Gun But Didn't Clear the Medical Exam? | Carscoops

The Pulse autocycle listed on Bring a Trailer is one of approximately 326 units produced and features a tandem two-seat configuration.

So You Aspired to Be Top Gun But Didn't Clear the Medical Exam? | Carscoops

The Pulse autocycle listed on Bring a Trailer is one of approximately 326 units produced and features a tandem two-seat configuration.

Sierra Grille Trim Detaches Even After GM Recall Solution | Carscoops

Months following a grille recall, a GMC Sierra owner reports that the dealer's repair did not hold up while driving at speed.

Sierra Grille Trim Detaches Even After GM Recall Solution | Carscoops

Months following a grille recall, a GMC Sierra owner reports that the dealer's repair did not hold up while driving at speed.

Ford's Dangerous Strategy to Increase Truck Sales Echoes the 2008 Situation | Carscoops

Consumers with poor credit scores are being presented with low-interest financing options, but this choice could turn out to be a significant risk.