Americans Burdened by Auto Loans as Defaults and Repossessions Increase | Carscoops

Consumer group urges Congress to take action as drivers struggle with car ownership costs

21 hours ago

by Chris Chilton

Auto loan debt in the United States has reached an alarming $1.66 trillion.

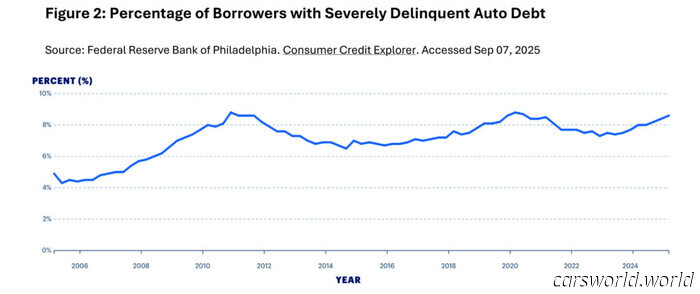

Delinquency, default, and repossession rates are on the rise.

Subprime delinquency issues are now more severe than during the 2008 financial crisis.

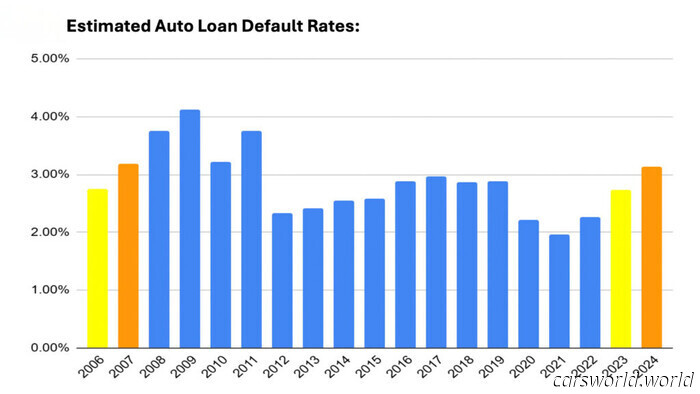

Many Americans enjoy the experience of driving a new vehicle, but the cost of that enjoyment is straining household budgets. Auto loan delinquencies are increasing, the country owes an astonishing $1.66 trillion in auto loans, and certain statistics reveal disturbing parallels to the time just before the 2008 financial collapse.

Also: One in Four Trade-Ins Are Currently Underwater, and the Situation is Deteriorating

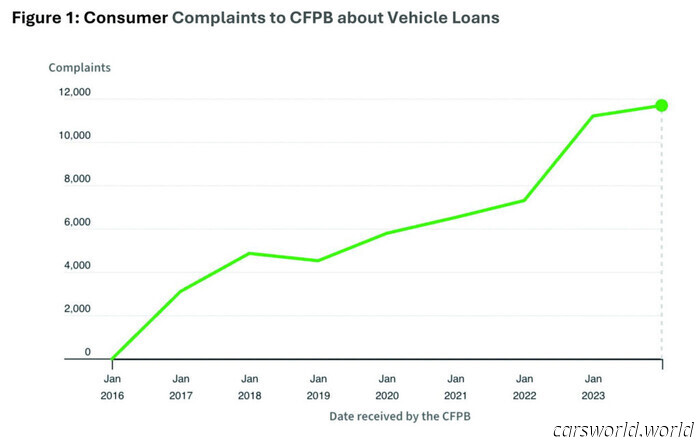

According to a new report titled “Driven to Default: The Economy-Wide Risks of Rising Auto Loan Delinquencies” from the Consumer Federation of America (CFA), the current state of auto financing in the US is “at breaking point.” The report criticizes Congress and federal regulators for stepping back, despite clear evidence that their oversight is more critical than ever to guard consumers against unscrupulous dealers.

Burdening Monthly Expenses

One factor contributing to the struggles of car owners is the high cost of monthly payments, exacerbated by elevated interest rates. Data indicates that the average monthly payment is $745, with 20 percent of buyers facing payments of at least $1,000. Conditions might worsen rapidly, as the $7,500 EV tax credit is expected to vanish soon.

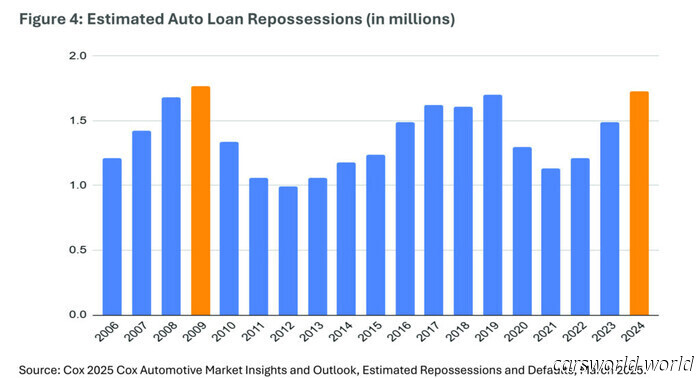

This issue is not limited to subprime borrowers; buyers with above-average credit scores are now twice as likely to fall behind on payments compared to the pre-pandemic era. Younger buyers are experiencing payment difficulties at significant rates, and the repossession rate across all age demographics surged by 43 percent from 2022 to 2024, according to Cox data.

Cox/CFA

A Broader Warning Signal

Additionally, the CFA cautions that we should be wary of more than just a few vehicles being repossessed due to missed payments. It notes that Americans often prioritize car-related expenses over other household and living costs, indicating that rising delinquency rates could signal deeper and more widespread issues within the US economy.

“Policymakers should carefully examine the auto lending market to identify exploitative practices that inflate prices and require our federal regulators to stop ignoring this crisis while Americans struggle,” the organization asserts.

Individual Choices, Societal Impacts

Nevertheless, one question remains: do drivers genuinely require legislative intervention, or is part of the solution simply about making better choices? In our view, the obvious way to navigate this dilemma is to be realistic about your financial situation and consider purchasing a well-maintained used car. I ended my lease car habit five years ago and have no regrets. But hey, whatever suits you, right?

Other articles

Americans Burdened by Auto Loans as Defaults and Repossessions Increase | Carscoops

A consumer group is urging Congress to take action as drivers struggle to manage the expenses associated with owning a car.