Why the Mercedes-Benz G-Wagon is an Undisclosed Tax Deduction

Subscribe to The Drive’s daily newsletter

The latest updates on cars, reviews, and features.

According to the financial influencers on TikTok, there exists a hidden loophole in the U.S. tax code that enables you to purchase a Mercedes G-Wagon and write off its expense on your taxes. While they aren't entirely mistaken, let's explore Section 179, the hustle culture, and how the G-Class has transformed into a status symbol in various aspects.

Technically, it’s called the “G-Wagen,” which is German for “off-roader.” However, it’s commonly referred to as a “Wagon” in the U.S.

Not everyone driving a Merc G is engaging in tax evasion, but the vehicle’s distinct specifications and appeal can lead to questionable small business practices.

In late 2010, Congress enacted the Small Business Jobs Act to assist small businesses in recovering from the 2008 financial crisis. This legislation provided business owners with access to lending programs, increased borrowing limits, and tax cuts on necessary equipment.

A component of this act is Section 179. This part of the IRS’s Publication 946 specifically addresses large equipment required for work purposes. As our Editor-In-Chief, Kyle Cheromcha, explains in the video above, if a farmer needs a $50,000 tractor, contributes $5,000 upfront, and finances the remainder, they can deduct the total purchase on their taxes in the first year. The intent behind this provision is to facilitate the acquisition of costly, specialized equipment like construction machinery or kitchen appliances for restaurants. However, it becomes somewhat ambiguous when it pertains to road vehicles.

A vehicle can qualify for this deduction if it is utilized at least 50% for business and has a Gross Vehicle Weight Rating (GVWR) between 6,000 and 14,000 pounds. When this regulation was established, it primarily applied to heavy-duty trucks, not luxury cars. Nonetheless, the Mercedes G-Class fits both categories. With many vehicles currently being quite heavy and numerous work trucks containing luxury features, Section 179 is now more prone to exploitation than ever.

Watch the video for a detailed explanation of how we arrived at this point and whether or not claiming a $150,000 luxury SUV on your taxes is advisable.

Have you checked out our YouTube channel since it was relaunched last year? Take a look now!

Other articles

60-Year-Old Racer Passes Away While Trying to Set Land Speed Record at Bonneville Salt Flats

Chris Raschke was part of the renowned Speed Demon team, which established the current Bonneville Salt Flats record of 470 mph in 2020 alongside George Poteet.

60-Year-Old Racer Passes Away While Trying to Set Land Speed Record at Bonneville Salt Flats

Chris Raschke was part of the renowned Speed Demon team, which established the current Bonneville Salt Flats record of 470 mph in 2020 alongside George Poteet.

You can own Prodrive’s Subaru WRC Homage for a cool million dollars.

While it may resemble the legendary 22B, Prodrive's P25 is actually a contemporary rally vehicle at its core.

You can own Prodrive’s Subaru WRC Homage for a cool million dollars.

While it may resemble the legendary 22B, Prodrive's P25 is actually a contemporary rally vehicle at its core.

WRX Sales Are Plummeting, Should We Consider a Mercy Kill? | Carscoops

Sales of the rally-inspired sedan dropped by 67 percent in July, resulting in only 457 units sold.

WRX Sales Are Plummeting, Should We Consider a Mercy Kill? | Carscoops

Sales of the rally-inspired sedan dropped by 67 percent in July, resulting in only 457 units sold.

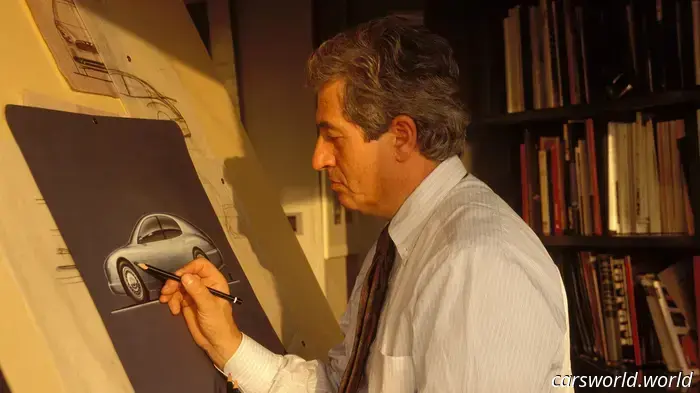

World's Most Prolific Car Designer Claims 'Safety Is a Luxury' Following Rollover Accident

Giorgetto Giugiaro, 87, emerged unscathed from a severe accident in his Land Rover. He expresses concern that a typical car likely wouldn't have held up as well.

World's Most Prolific Car Designer Claims 'Safety Is a Luxury' Following Rollover Accident

Giorgetto Giugiaro, 87, emerged unscathed from a severe accident in his Land Rover. He expresses concern that a typical car likely wouldn't have held up as well.

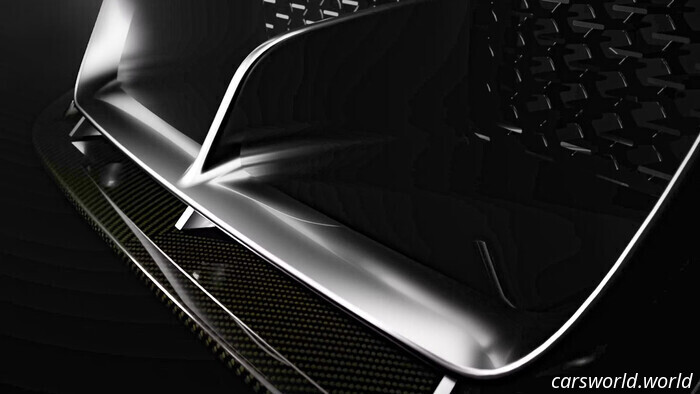

Something intriguing and enigmatic is developing within Bugatti’s hidden studio | Carscoops

Bugatti's latest one-off, the Solitaire, is set to challenge all conventions and may not even fit the definition of a hypercar.

Something intriguing and enigmatic is developing within Bugatti’s hidden studio | Carscoops

Bugatti's latest one-off, the Solitaire, is set to challenge all conventions and may not even fit the definition of a hypercar.

Kia Took 12,000 Cases to Acknowledge This Issue as a Recall-Worthy Problem | Carscoops

The three-row SUV is facing a recall due to the same issue with trim detachment that has already affected the K5.

Kia Took 12,000 Cases to Acknowledge This Issue as a Recall-Worthy Problem | Carscoops

The three-row SUV is facing a recall due to the same issue with trim detachment that has already affected the K5.

Why the Mercedes-Benz G-Wagon is an Undisclosed Tax Deduction

Section 179 of the US tax code is often referred to as "the G-Wagon loophole." Here’s what it actually signifies.