How a Computer Error at Carvana Resulted in a Woman Receiving a Free Car

TikToker SidneyKidneyBean (known simply as Sydney) recently purchased a car from Carvana, despite the controversies surrounding the company. Ironically, Carvana made a mistake during her buying process that benefited her. Due to the company’s new automated titling system, Sydney ended up being listed as the sole owner of the vehicle, essentially allowing her to acquire it for free.

Like many car buyers, Sydney secured a loan through a bank—specifically, Bank of America—to finance her vehicle. However, months after she brought the car home, she received a letter from the bank asking for a copy of her title application. This puzzled her, as she believed Carvana had already handled that process and she had received her title. Sydney discovered that Carvana had not listed Bank of America as the lienholder. Instead, they designated her as both the owner and lienholder on the title and bill of sale, which meant she had a completely free and clear car without any repayment obligations.

How did this happen? It appears that Carvana’s flawed new automated titling system was at fault. The process reportedly took only about a minute, and Sydney noted that Carvana staff were amazed by its speed, as she was among the first to use it.

Furthermore, she received confirmation from her state indicating that the vehicle was registered in her name and she was the lienholder. Legally, Sydney owns the car, and now Bank of America is left questioning why it sent payment to Carvana since the loan is no longer backed by the vehicle. Technically, her loan is unsecured, which means she could sell the car, keep the proceeds, and default on the loan. Normally, this wouldn’t be possible since car loans require the lender to be the lienholder, preventing the borrower from selling the car outright. However, since the title is in Sydney's name, she could sell it and disregard Bank of America's claims.

Despite this, Sydney has no intention of taking advantage of the situation. She plans to “take the boring route” by informing all relevant parties of the error and correcting it, even though many of her followers suggest otherwise. Her motivation? She considers herself not to be a “fraudster.”

In addition to Sydney’s integrity, there are many legal agreements and terms she signed before obtaining the loan and car, which are standard in any dealership transaction. Engaging in any behavior other than rectifying the situation would likely create legal complications for her. Nonetheless, it’s amusing that Carvana inadvertently provided her with a free vehicle, which they might not have been able to correct had she not brought it to their attention. One wonders how long it will take for that automated titling system to be discontinued.

Have any tips? Please send them to [email protected]

Other articles

Mitsuoka Continues to Transform Hondas into Dodge Challengers | Carscoops

You can now buy the Japanese version of the Dodge Challenger, which features a hybrid powertrain.

Mitsuoka Continues to Transform Hondas into Dodge Challengers | Carscoops

You can now buy the Japanese version of the Dodge Challenger, which features a hybrid powertrain.

Thieves Took 4 Porsches Valued at $1 Million to Sell in Mexico, But Their Plan Did Not Work Out | Carscoops

Officers apprehended four suspects and retrieved the vehicles within only six hours of the robbery.

Thieves Took 4 Porsches Valued at $1 Million to Sell in Mexico, But Their Plan Did Not Work Out | Carscoops

Officers apprehended four suspects and retrieved the vehicles within only six hours of the robbery.

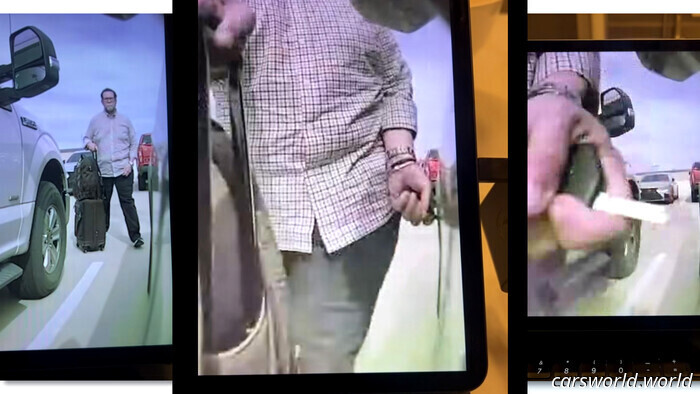

Tesla Owner Files $1 Million Lawsuit After Capturing Suspected Keying Incident on Video | Carscoops

The owner of this Model X aims to set an example of the individual he alleges vandalized his car without cause.

Tesla Owner Files $1 Million Lawsuit After Capturing Suspected Keying Incident on Video | Carscoops

The owner of this Model X aims to set an example of the individual he alleges vandalized his car without cause.

DIY Heroes Rig Ford Concept V10 to Function in a Lincoln Continental

After recreating Ford's legendary four-valve V10, which never made it to production, they installed it in a contemporary Continental equipped with a six-speed manual transmission, and it's now finally tearing up the roads.

DIY Heroes Rig Ford Concept V10 to Function in a Lincoln Continental

After recreating Ford's legendary four-valve V10, which never made it to production, they installed it in a contemporary Continental equipped with a six-speed manual transmission, and it's now finally tearing up the roads.

The 2026 GMC Sierra EV Now Begins at $27,500 Less | Carscoops

The electric truck is now available in AT4 and Elevation trims, along with a Standard Range battery option.

The 2026 GMC Sierra EV Now Begins at $27,500 Less | Carscoops

The electric truck is now available in AT4 and Elevation trims, along with a Standard Range battery option.

How a Computer Error at Carvana Resulted in a Woman Receiving a Free Car

The automated procedure allegedly took "approximately a minute." Once completed, the car was registered in her name, even though she had secured a loan from Bank of America.