1 in 20 Americans Is Late on Car Payments | Carscoops

Inflation, elevated interest rates, and economic instability are leading to an increase in car payment delinquencies

18 hours ago

by Michael Gauthier

A growing number of Americans are falling behind on their car payments, with 5.1% reported as delinquent.

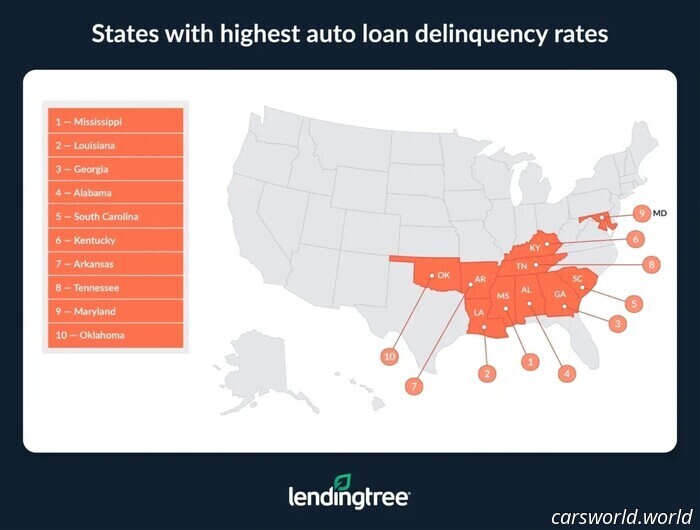

Southern states are experiencing the highest delinquency rates, with Mississippi at 9.8% leading the way.

Gen Z and Millennials are finding it challenging to manage their finances in the current economic climate.

While the economy continues to function, warning signs are becoming more evident. Job growth is slowing, tariffs are beginning to affect the market, and the Consumer Price Index has risen.

A recent alarming trend is the rise in auto loan delinquencies. A new study by LendingTree reveals that 5.1% of Americans are behind on their car payments. However, this delinquency rate varies greatly between states.

More: Car Repossessions Return To Great Recession Levels With 1.7 Million Vehicles Reclaimed

The Southern region showed poor performance, with Mississippi (9.8%), Louisiana (8.4%), and Georgia (7.8%) recording the highest delinquency rates. They were followed closely by Alabama (7.6%), South Carolina (7.3%), and Kentucky (6.8%).

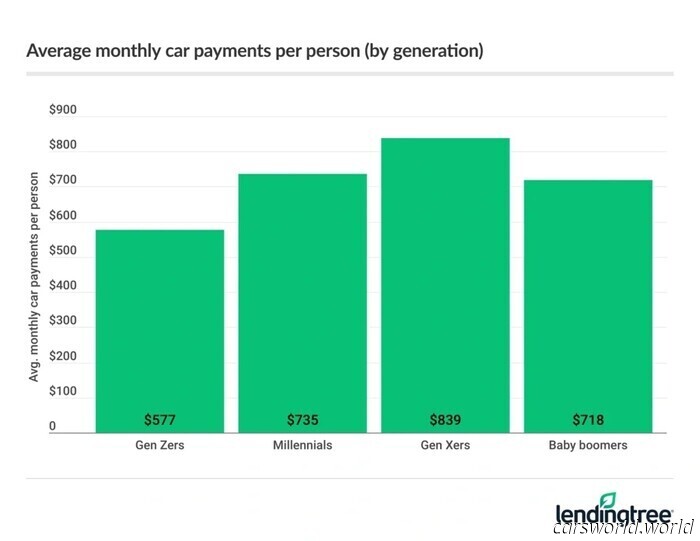

Several factors contribute to late payments, and the study indicated that “borrowers in states with higher delinquency rates often face heavier monthly car payment burdens.” For instance, while the national average car payment is $751, in Louisiana it rises to $821 and in Mississippi to $802.

LendingTree

Matt Schulz, LendingTree’s chief consumer finance analyst, emphasized that “many of the states with the highest delinquency rates are among the lowest income states in the country.” With less disposable income, consumers in these areas are increasingly pressured by rising prices, which helps explain why many are falling behind on payments.

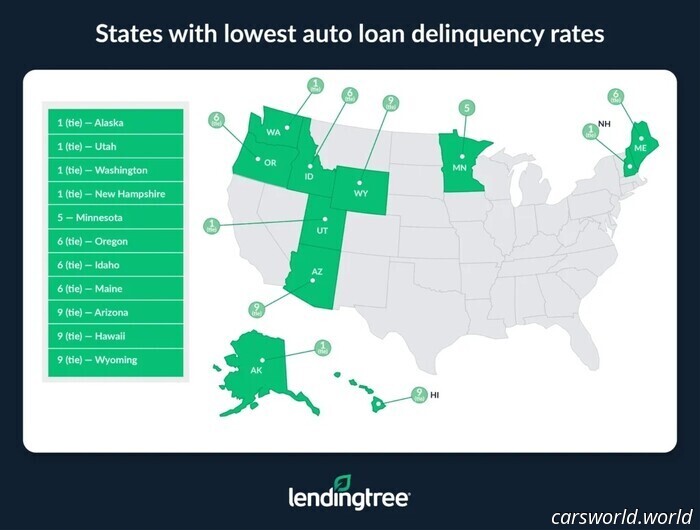

Conversely, states with the lowest delinquency rates include Alaska, Utah, Washington, and New Hampshire, all standing at 3.2%. The report also indicated that 28 states fell below the 5.0% mark.

In the first quarter, 2% of borrowers were 30 days late, while 0.9% were 60 days overdue. Another 0.9% were 90 to 120 days behind schedule.

LendingTree

Gen Zers have the highest delinquency rate at 7.5%, though their average monthly payment is the lowest at $577. Millennials follow with a delinquency rate of 6.9% and an average payment of $735. Delinquency among Gen Xers stands at 4.3%, while Baby Boomers have the lowest rate at 1.9%.

These delinquency rates may signal impending difficulties, and Schulz remarked, “Auto loan payments are almost always a high priority for Americans because most of us rely on our vehicles for transportation to work.”

Considering this, auto loan delinquencies typically indicate that individuals are facing challenges. Nonetheless, Schulz stated that this is not a “great surprise, given persistent inflation, high interest rates, and overall economic uncertainty.”

LendingTree

Other articles

Trump May Ultimately Push Audi to Act in America | Carscoops

A decision regarding Audi's factory in the U.S. may be reached later this year due to pressures from the trade war.

Trump May Ultimately Push Audi to Act in America | Carscoops

A decision regarding Audi's factory in the U.S. may be reached later this year due to pressures from the trade war.

Stellantis May Divest Maserati, But Who Would Be Interested in Purchasing It and Why? | Carscoops

The board of the parent company is said to be divided on the decision to either abandon its sole genuine luxury brand or make another attempt to rejuvenate it.

Stellantis May Divest Maserati, But Who Would Be Interested in Purchasing It and Why? | Carscoops

The board of the parent company is said to be divided on the decision to either abandon its sole genuine luxury brand or make another attempt to rejuvenate it.

A person invested $1.2 million to create the most bizarre Pontiac GTO you have ever witnessed | Carscoops

It will be intriguing to find out if the car's final auction price comes close to its construction cost.

A person invested $1.2 million to create the most bizarre Pontiac GTO you have ever witnessed | Carscoops

It will be intriguing to find out if the car's final auction price comes close to its construction cost.

Fake Ferrari F40 Damages a German Sports Car and Our Vision | Carscoops

You could own this one-of-a-kind build for just a small percentage of the price of an authentic F40, but is it something you would truly desire?

Fake Ferrari F40 Damages a German Sports Car and Our Vision | Carscoops

You could own this one-of-a-kind build for just a small percentage of the price of an authentic F40, but is it something you would truly desire?

Dodge Changes Production Focus to Gas Chargers After Electric Vehicles Underperform | Carscoops

Stellantis is redirecting its attention to gas-powered Chargers due to unfavorable responses to electric models and changes in regulations.

Dodge Changes Production Focus to Gas Chargers After Electric Vehicles Underperform | Carscoops

Stellantis is redirecting its attention to gas-powered Chargers due to unfavorable responses to electric models and changes in regulations.

Nissan's Significant Investment in the Murano May Be Evolving Into a Substantial Failure | Carscoops

After a tepid response, the plans for an updated Murano have been postponed.

Nissan's Significant Investment in the Murano May Be Evolving Into a Substantial Failure | Carscoops

After a tepid response, the plans for an updated Murano have been postponed.

1 in 20 Americans Is Late on Car Payments | Carscoops

Inflation, elevated interest rates, and economic instability are leading to an increase in car payment delinquencies.