Billionaire Discreetly Invested in Hertz, Causing Its Stock to Soar | Carscoops

Pershing Square Holdings acquired 12.7 million shares of Hertz stock during 2024.

Hertz's stock value surged over 120 percent after Pershing Square disclosed its stake.

Bill Ackman's firm now holds nearly 20 percent of Hertz through both shares and swaps.

Last year, Hertz suffered a staggering loss of $2.9 billion and is working to improve its situation.

Hertz has experienced a tumultuous five years. During the peak of the Covid-19 pandemic in early 2020, the car rental giant missed lease payments on its vehicles and filed for Chapter 11 bankruptcy by May. However, it quickly emerged from bankruptcy and, in 2021, pledged to purchase over 100,000 electric vehicles from Tesla and other manufacturers. Now, Hertz has gained a significant new investor who has caused its stock to skyrocket.

Pershing Square Holdings, run by billionaire investor Bill Ackman, has revealed that it recently acquired 12.7 million shares of Hertz stock, amounting to approximately a 4.1% ownership in the company. This announcement triggered a dramatic rise in the share price, which jumped over 120% to close at $8.22.

Ackman Places a Major Bet on Recovery

“We started buying shares in Hertz late last year,” Ackman stated on X, affirming Pershing Square’s investment. He characterized Hertz as “an operational company with a highly leveraged automobile portfolio” and acknowledged previous mistakes, particularly the company’s aggressive acquisition of Teslas, which resulted in operational challenges, weaker demand, and significant depreciation after Tesla cut prices.

Ackman’s investment firm acquired its Hertz shares throughout 2024. Notably, CNBC reports that through shares and swaps, its total stake in Hertz stands at 19.8%. Hence, it’s no surprise that the market reacted favorably to Ackman’s substantial investment in the firm.

According to sources, Pershing Square received an exemption from the US Securities and Exchange Commission that permitted it to postpone disclosing its holdings until this week, despite having acquired a considerable amount of shares last year.

Ackman’s investment comes at a pivotal moment for Hertz. In February, the company announced a $2.9 billion loss for 2024, with $245 million attributed to reducing its EV fleet in the fourth quarter. While this was a setback for shareholders, it provided a unique opportunity for EV buyers, as Hertz has recently been selling electric vehicles at significant discounts.

Hertz’s eagerness to reduce its EV fleet was evident when it was reported in December that customers renting EVs were being contacted via email with offers to purchase the cars immediately. For instance, a customer renting a 2023 Tesla Model 3 was offered the opportunity to buy it for just $17,913.

A Long-Term Perspective

Despite the financial hurdles, Ackman remains optimistic about Hertz’s future. He pointed to several encouraging factors, such as “an improving industry structure and more rational competitive behavior,” as well as a new leadership team with relevant experience. He also highlighted that Hertz’s strategy for rotating its fleet is beginning to show results, asserting that the company has “already made significant headway in replacing higher-cost vehicles that had temporarily increased depreciation expenses.”

Ackman believes that these initiatives, along with pricing enhancements across the industry, could ultimately yield considerable returns. He even suggested a longer-term valuation target of around $30 per share by 2029, based on anticipated earnings and market conditions.

“We began accumulating shares in @Hertz late last year, and as of today, we have a 19.8% stake in the company made up of outright share ownership and total return swaps. Hertz can be viewed as an operational company combined with a highly leveraged portfolio of automobiles.” — Bill Ackman (@BillAckman) April 17, 2025

Other articles

VW Won't Increase Prices for Now, But Cautions That Someone Will Bear That 25% Tariff | Carscoops

VW is not the sole brand employing that strategy; several others, including Hyundai, Stellantis, and Ford, are also maintaining stable prices, at least for the time being.

VW Won't Increase Prices for Now, But Cautions That Someone Will Bear That 25% Tariff | Carscoops

VW is not the sole brand employing that strategy; several others, including Hyundai, Stellantis, and Ford, are also maintaining stable prices, at least for the time being.

The Final V8 M3 from BMW Demonstrates That They No Longer Create Them Like They Once Did | Carscoops

This Melbourne Red M3 features stylish upgrades such as an ECU tune and a performance exhaust system.

The Final V8 M3 from BMW Demonstrates That They No Longer Create Them Like They Once Did | Carscoops

This Melbourne Red M3 features stylish upgrades such as an ECU tune and a performance exhaust system.

Rivian CEO Claims Inexpensive EVs Are Generally Unsatisfactory and He is Now Taking Action | Carscoops

The company's leader stated that there are “a limited number of truly compelling” electric vehicles available for less than $50,000 at the moment.

Rivian CEO Claims Inexpensive EVs Are Generally Unsatisfactory and He is Now Taking Action | Carscoops

The company's leader stated that there are “a limited number of truly compelling” electric vehicles available for less than $50,000 at the moment.

Hyundai Aims to 'Sell Aggressively' Despite Tariffs | Carscoops

Though the brand will experience the impact of the tariffs, it is making significant investments in the US to minimize the effect as much as possible.

Hyundai Aims to 'Sell Aggressively' Despite Tariffs | Carscoops

Though the brand will experience the impact of the tariffs, it is making significant investments in the US to minimize the effect as much as possible.

Subaru Acknowledges It's Dull and Seeks to Reintroduce the STI, Though Not in the Way You Recall | Carscoops

Although STI may come back in the near future, don’t anticipate it to reach the same ICE performance value it had in the past.

Subaru Acknowledges It's Dull and Seeks to Reintroduce the STI, Though Not in the Way You Recall | Carscoops

Although STI may come back in the near future, don’t anticipate it to reach the same ICE performance value it had in the past.

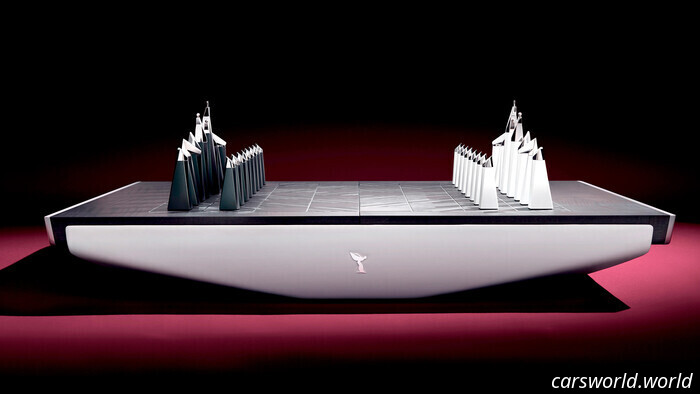

This Rolls-Royce Chess Set is Designed to Make You Feel Even More Affluent | Carscoops

Customers have the option to select from 13 various leather colors and four types of wooden veneers.

This Rolls-Royce Chess Set is Designed to Make You Feel Even More Affluent | Carscoops

Customers have the option to select from 13 various leather colors and four types of wooden veneers.

Billionaire Discreetly Invested in Hertz, Causing Its Stock to Soar | Carscoops

In 2024, Pershing Square Holdings accumulated 12.7 million shares of Hertz stock.