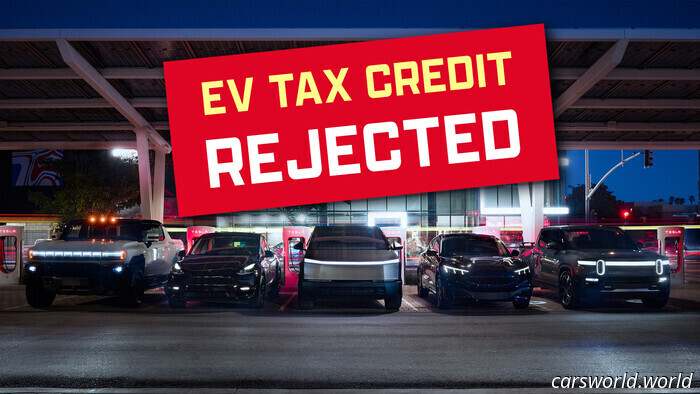

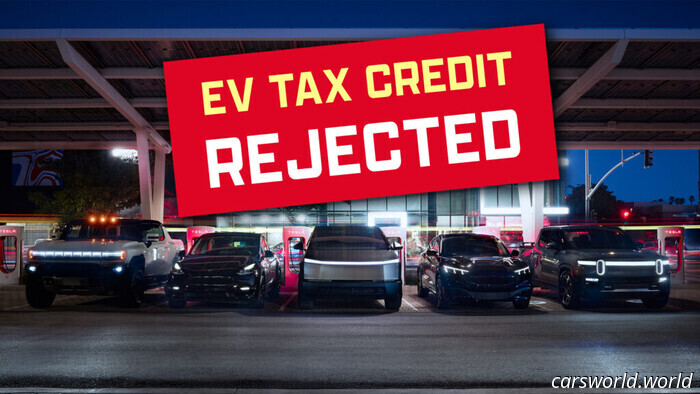

Errors in Dealers' Paperwork Are Causing Buyers to Lose Their EV Tax Credits with the IRS | Carscoops

Some dealerships failed to complete the necessary paperwork properly, which has left owners, who were relying on tax rebates, to face the consequences.

Buyers throughout the United States are experiencing tax return rejections due to errors in paperwork.

While the vehicles qualify for rebates, mistakes were made by dealers in the documentation process.

It remains uncertain how many buyers are missing out on their tax rebates, although the IRS might provide a resolution.

Electric vehicles and plug-in hybrids are expected to deliver savings on energy expenses and sometimes even at the point of sale. However, while federal incentives have facilitated broader adoption, their continuation is not guaranteed and they could potentially vanish soon. In 2024, many purchasers considered these rebates when making their buying decisions, only to later discover that errors in dealership paperwork left them without their benefits.

It appears that tax regulations related to electric vehicles undergo changes nearly every year, which was certainly true for 2024. One significant alteration allowed buyers to access their rebate at the time of purchase. For this process to function smoothly, dealers needed to participate in the program and utilize a specific portal to report when buyers availed themselves of the rebate during the sale.

However, according to NPR, thousands of dealers did not comply with these requirements. Those who failed to enroll were still obligated to provide buyers with the necessary documentation to claim their tax rebate at year-end. Unfortunately, in many instances, the forms provided were outdated and, thus, ineffective.

Kristina Meier, who purchased a PHEV minivan last September, stated that her dealer supplied forms that were valid in 2023 but not in 2024. If the dealer does not submit the paperwork accurately and on schedule, customers, despite adhering to all other requirements, are ineligible for the tax rebate.

A Slim Chance for Resolution

Dealers are required to submit paperwork to the IRS within three days after the sale, making it currently impossible for Meier and others in her situation to claim their tax rebates. Nonetheless, there is still a slight possibility for resolution: the IRS has permitted retroactive submissions in the past.

If the agency allows this again, it may enable buyers like Meier to receive their tax rebate despite the dealer's initial errors. However, whether this will actually occur is still uncertain. Currently, it is unknown how many buyers are impacted by this issue, but increased vocalization from those affected may improve the likelihood that the IRS will take action.

Other articles

Lanzante Project 95-59 Seeks to Become the Definitive Modified McLaren | Carscoops

The three-seater honors the McLaren F1 GTR that triumphed at Le Mans in 1995.

Lanzante Project 95-59 Seeks to Become the Definitive Modified McLaren | Carscoops

The three-seater honors the McLaren F1 GTR that triumphed at Le Mans in 1995.

Incorporating a white interior into a Tesla Cybertruck is an $11,000 error.

Choosing even the most affordable option may render the Cybertruck ineligible for the federal tax credit—however, there's a loophole.

Incorporating a white interior into a Tesla Cybertruck is an $11,000 error.

Choosing even the most affordable option may render the Cybertruck ineligible for the federal tax credit—however, there's a loophole.

2025 Hyundai Elantra Hybrid Review: Budget-Friendly Fuel Saver

The sedan market is declining, yet the Elantra Hybrid maintains its position with a fuel efficiency of 50 mpg that doesn't require plugging in.

2025 Hyundai Elantra Hybrid Review: Budget-Friendly Fuel Saver

The sedan market is declining, yet the Elantra Hybrid maintains its position with a fuel efficiency of 50 mpg that doesn't require plugging in.

1 in 4 Stolen Vehicles in Japan Is a Land Cruiser | Carscoops

In Japan, car thieves evidently favor practicality over performance, as reflected in the nation's ranking of the most stolen cars, trucks, and SUVs.

1 in 4 Stolen Vehicles in Japan Is a Land Cruiser | Carscoops

In Japan, car thieves evidently favor practicality over performance, as reflected in the nation's ranking of the most stolen cars, trucks, and SUVs.

Car Prices May Increase by $12,000 Due to New Tariffs, With EVs Facing the Largest Impact | Carscoops

Cross-border production is expected to decline rapidly, and a recent study indicates that this will lead to increased prices in the new car market.

Car Prices May Increase by $12,000 Due to New Tariffs, With EVs Facing the Largest Impact | Carscoops

Cross-border production is expected to decline rapidly, and a recent study indicates that this will lead to increased prices in the new car market.

Errors in Dealers' Paperwork Are Causing Buyers to Lose Their EV Tax Credits with the IRS | Carscoops

Some dealers failed to complete the paperwork correctly, and now the owners, who were relying on tax rebates, are facing the consequences.